Pension contributions made towards retirement are still safe in the midst of the pandemic and as such all persons eligible to be paid will receive their benefits, according to the Chief Executive Officer (CEO) of the National Pensions Regulatory Authority (NPRA), in an interview to discuss the effects of the COVID-19 pandemic on the pensions industry.

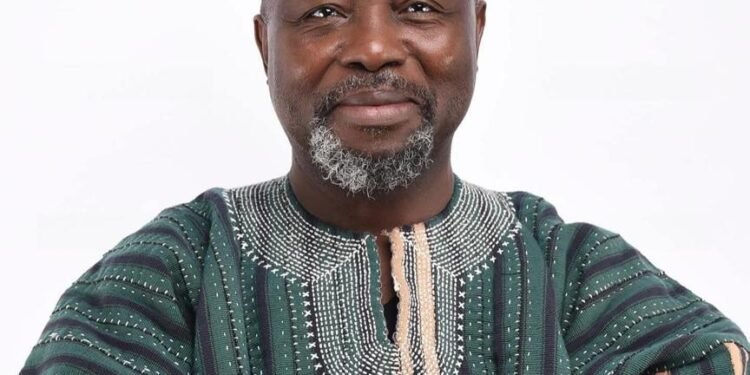

The CEO, Mr. Hayford Attah Krufi on Thursday, October 1, 2020 on PM express reassured Ghanaians that all benefits would be paid in a timely manner to retirees as the widespread economic turmoil of the COVID-19 pandemic had not had an effect on pension funds and investments.

“COVID or no COVID when a person reaches their retirement age, they will have to be paid”

He asserted that the only effect that the pandemic had had on the operations of the pensions industry was in terms of reporting deadlines, explaining that situations which arose as a result of the pandemic had forced the NPRA to extend timelines for the submission of reports by pension institutions. However, he was insistent that these delays will in no way affect the payment of benefits to retirees and Ghanaians can rest assured that their contributions are safe.

“There have been a few delays but under no circumstance will a worker who has worked for all his entire life will be made to suffer simply because of COVID so payments are being made all be it with a few delays here and there but what needs to be done is being done”.

In response to concerns that layoffs which had occurred during the pandemic had had significant impact on pension funds, Mr. Krufi denied that this was the case, holding that the stimulus packages provided by the government had been able to cater adequately for any deficits caused by the layoffs.

“Stimulus packages have been given to employers and these stimulus packages are being used to hedge up some of the payments that they couldn’t have made during the time of COVID.”

With the recent clean-up of the financial sector resulting in many Ghanaians’ investments being locked up in collapsed financial institutions, questions arose over the effect this could have had on the pensions sector, considering the close link between the two, but Mr. Krufi guaranteed that the clean-up had also had no effect on the pensions industry, stating that the government had intervened and ensured that all pension investments were salvaged from the collapsed financial institutions.

“Even if a trustee goes down, or a fund manager goes down, or a bank goes down, the pension funds are safe, and if you look at Section 207 of our act, it clearly states that even if a bank goes down and the bank is a custodian, pension funds are the first to come up.”

He however admitted that the sector was faced with certain challenges, most notably the disproportionate nature of the ratio of contributions to the number of pay-outs. According to the CEO of the NPRA, an actuarial assessment of the pensions sector conducted in 2014 revealed that there was a need for increased contributions to be made to the pension fund to enable it to pay benefits with ease. He blamed this state of affairs on the unemployment situation at the time, claiming that the reduced number of new employments along with the higher number of retirees had led to a significant decline in contributions being made to the fund. He also brought up the issues of government indebtedness to the pension fund and non-compliance of pension institutions with the regulations of the NPRA.

“We all know as a country it got to a point, if you look at the statistics, the contribution was less than the pay-out. So, there was a bit of a difficulty for SSNIT.”

With regards to the decline in contributions, he said that certain reforms were being considered in the sector, such as increasing the retirement age and making amendments to the National Pensions Act to broaden the base from which contributions can be drawn. He also addressed the problem of government indebtedness to the pension fund, revealing that bonds had been taken out by the government to cover these debts. He added that the imposition of punitive fines by the NPRA, as well as the recent authorisation of the Authority to prosecute offenders had greatly improved compliance levels from pension institutions.

“Now that they know that the prosecutor has a whip in their hand, suddenly the level of compliance has raised.”

The NPRA CEO was generally hopeful in his outlook for the pension industry in the midst of the COVID-19 pandemic, calming fears that the pandemic had had a negative impact on the sector. He was additionally hopeful that with reforms being implemented coupled with increased digitisation in the sector, Ghanaians had nothing to fear in terms of the ability of pension institutions to pay benefits on time amid the pandemic.