ActionAid Ghana (AAG) has called on the government to revise the nation’s tax incentives regime and strengthen the tax system so as to increase domestic revenues for the country’s development, especially its investment in education.

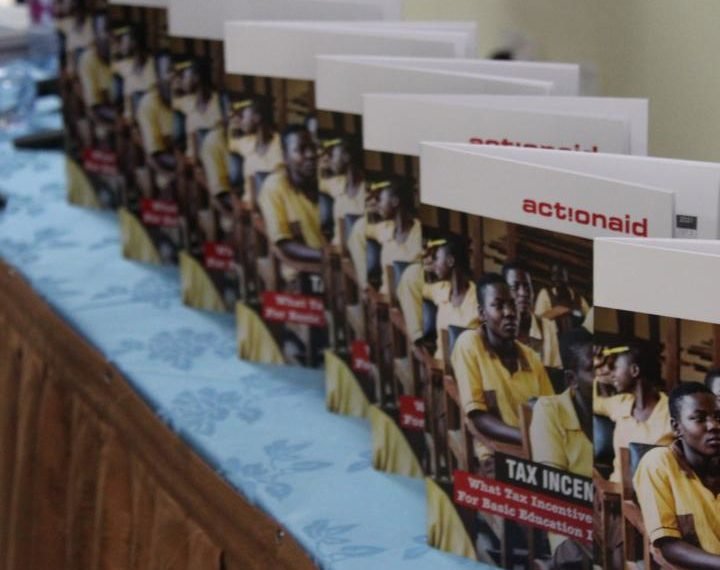

The AAG made this call during the launch of its recent report entitled “Tax incentives; What tax incentives can do for basic education in Ghana”. The report indicated that the continuous allocation of huge tax exemptions to companies which are already well established is depriving basic education the needed resources.

ActionAid Ghana’s study on financing education in Ghana revealed that between 2018 and 2020, Ghana lost a whopping $901.1million as tax incentives through Parliamentary tax waivers alone to corporations and $657million through the Ghana Investment Promotion Centre (GIPC) in 2018. The report noted that government expenditure allocation to the education sector is increasingly looking bleak, shifting away from the Global Partnership for Education (GPE) target of 20%.

“With an annual average of GHC 4.198 million funding gap, according to the GPE benchmark, the measure of underperformance and delivery in the education sector is adequately measured. It showed a fluctuating trend between 13 percent and 16 percent (2016 – 2021), with its highest peak at 16 percent in 2019,” the report said.

“20 percent of the $901 million potential revenues lost to tax incentives could provide extra 950, 527 places for pupils in schools or more school infrastructure with the potential of 10,376 classrooms for pupils in Ghana” the report added.

Speaking at the launch event in Accra, Ms Maria Ron Balsera, the coordinator for ActionAid International, said Ghana needed extra resources to ensure safe schools and reach a growing number of disadvantaged children. She urged government to pay attention to education inequalities and increase remote learning, as well as technology in deprived communities.

“We need to increase the 4Ss of the education budgets, which are share, size, sensitivity and scrutiny. Increasing the above will help to ensure that money arrives in practice and also help to know the allocations within education,” she stressed.

The Policy Analyst at Integrated Social Development Centre (ISODEC), Bernard Anaba, said although tax incentives are good considering their expected benefits, Ghana has over the period struggled to point out these so-called benefits.

“Over the years, I think we have not seen those benefits. We have not seen them; government has not been able to communicate those benefits to us. In fact, government itself laments to the fact that we have not benefited from the incentives that we give. So, government has contemplated the idea that, maybe you come and invest then you show us your outputs, what you said you are going to do before you come and claim your incentives. I am not so sure government has been able to implement that policy”. he said

Mr. Anaba then urged government to finance public sector education through taxation, adding that domestic resource was the best sustainable way of financing rather than external conditional sources. He indicated that the gap in the resource potential and resource loss through taxes had been established and there was a need for government to do more to access such resources.

“Education is the fulcrum of investment in people; hence we must prioritize education for extra budget funding,” he said.

The Country Director for Actionaid Ghana, Sumaila Abdul-Rahanan, said education is a basic right, but due to the challenges associated with resources, this right is not enjoyed by many children of school going age.

The report, said by the Country Director, follows series of research conducted by ActionAid Ghana, focusing on how to leverage domestic taxation for sustainable financing of the education sector, how progressive taxation can increase government’s spending on public basic schools and reverse education privatization and what tax incentives can do in the sector. He decried the current expenditure on basic education is woefully inadequate and asked that government shifts attention to the sector to better the situation.

“The cost of education financing is a national issue that requires attention. Government’s expenditure allocation to the education sector falls shy of the Global Partnership for Education (GPE) target of 20%. Considering the fact that, Ghana lost $901million to tax incentives through parliamentary tax waivers and the fact that 20% of that amount could have provided more school infrastructure to pupils, raises a crucial point that should put things in perspective for all of us”, he said.

ActionAid Ghana recommended in the report that Government must first improve domestic resource mobilization by curbing tax leakages (tax incentives and illicit-flows) and then allocating 20% of such savings to education following equity criteria.

ActionAid Ghana concluded that “the government’s elaborate VAT exemptions are depriving the state of needed revenues, VAT exemptions should be more effectively targeted to lower-income households or to sectors that generate positive social or economic externalities.