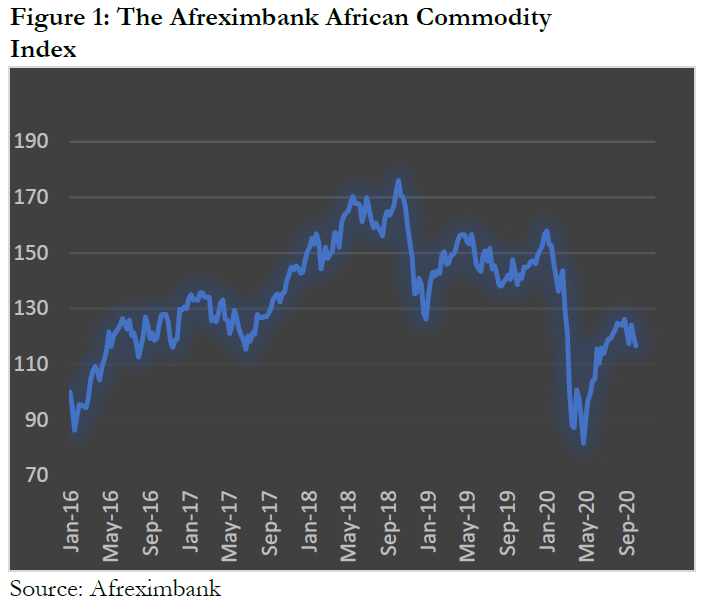

The African Export-Import Bank (Afreximbank) has released the Afreximbank African Commodity Index (AACI) for the third quarter of 2020 on Wednesday, 18th November, 2020.

The AACI is a trade-weighted index designed to track the price performance of 13 different commodities of interest to Africa and the Bank on a quarterly basis. The composite index constitutes four sub-indices; energy sub-index; agriculture commodities sub-index (sugar, cocoa, cotton, coffee); base metals sub-index; precious metals sub-index.

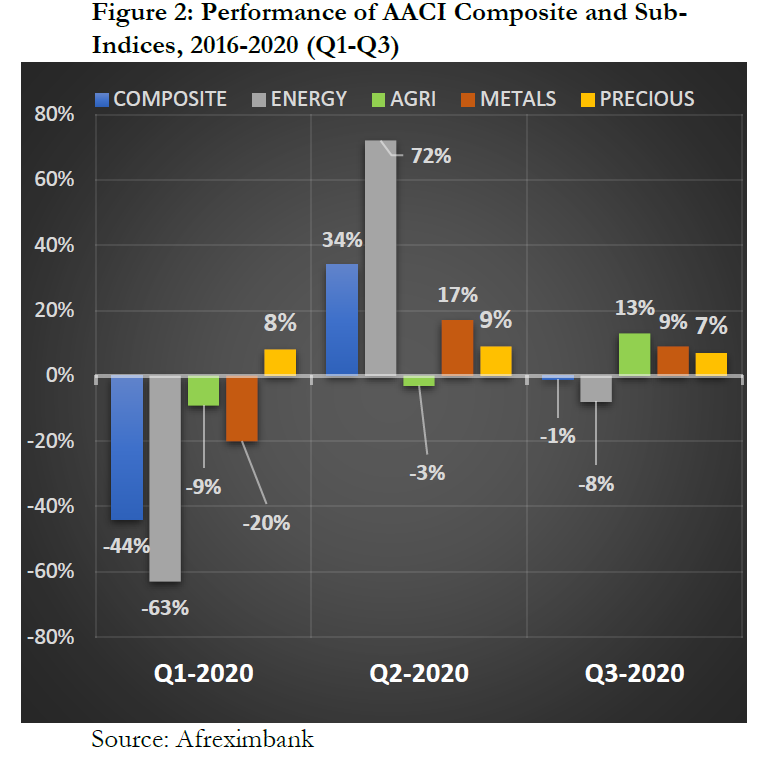

Per the third quarter reading of the bank, the composite index slumped marginally by 1 percent on a quarter-on-quarter basis, chiefly on account of a drop-down in the energy sub-index. In comparison, the agricultural commodities sub-index peaked in the quarter, outstripping the gains in all the other sub-indices, especially gains in base and precious metals.

Consequently, the energy sub-index experienced a trough of 8 percent, due largely to a sharp decline in oil prices in the latter part of the quarter, after markets had been inching higher for most parts of the third quarter.

Oil prices experienced a global growth in July and August from an increasingly positive global growth outlook, as economies started to reopen, following the COVID-19 lockdown among other positive oil market outcomes. However, this was short-lived as the oil market stumbled in September following a wane in Chinese demand due to a build-up in domestic inventories, price cuts by Saudi-Arabia and backdropped by fears of a second wave of the coronavirus pandemic in Europe and other parts of the world.

According to the report, the agricultural commodities index rose by 13 percent due in part to suboptimal weather conditions in major producing countries. Within this sub-index, it was found that sugar prices inched up mainly due to fears that Thailand’s crop could shrink in 2021 following a drought as well as lingering expectations of firm import demand from China.

Furthermore, the impact of the weaker US dollar on dollar-denominated commodities was also supportive. Also, cocoa futures (futures are exchange traded derivatives contracts that lock in future delivery of a commodity or security at a price set today) managed a pre-election premium in Ghana and Cote d’Ivoire, despite the imminent risk of a bumper harvest in the 2020/21 season and the fall in price of cocoa butter.

The cocoa market was also kept afloat by the introduction of a US$400/tonne living income differential (LID) in Ghana and Cote d’Ivoire, for the purpose of improving the income of farmers. Again, both countries which are a major power house in cocoa production worldwide and which jointly contribute 60% of global cocoa output, raised their farmgate prices by 28 percent in Ghana and 21 percent in Cote d’Ivoire.

Whilst the coffee index rose by 10 percent as the producers of Robusta coffee in Vietnam hinted of a shortage in exports and the cotton index also improved as the world’s major exporter of cotton, US raised concerns of poor field challenges as well as the threat of hurricane Sally on cotton harvest in September.

Base metal prices continued its steep recovery, after performing strongly in the second quarter. The precious metals sub-index has been the best performer year-to-date and in the third quarter it consolidated gains recorded since the start of the year. This is partly attributed to the boost in gold inflows into gold-backed exchange traded funds, ETFS (ETF is a basket of securities that trade on an exchange, just like a stock) which offsets major weaknesses in jewelry demand.

Despite the improvements in some sub-indices, on a composite level, the performance of the AACI fell as compared to that of the second quarter, as earlier indicated.

Therefore, it is important to note that the frequent adverse shocks in commodity trade has been the biggest challenge of African economies. Hence, it is crucial for businesses and policy makers alike to consistently monitor trends in the region’s key commodity markets in order to make informed policy decisions and actions.

“Commodity prices in Q3 of 2020 have largely been impacted by COVID-19. The pandemic has exposed global demand shifts that have seen the oil industry incur backlogs and agricultural commodity prices dwindle in the first half of the year,” says Dr. Hippolyte Fofack, Chief Economist, Afreximbank

He further said that, “the outlook for 2021 is positive, however conservative the markets still are. We hope to see an increase in global demand within Q1 and Q2 of 2021 buoyed by the relaxation of most COVID-19 disruptions and restrictions.’’