The Governor of the Bank of Ghana, Dr. Ernest Addison has revealed that the financial sector’s resilience during COVID-induced turbulent times has not been missed and continues to remain intact.

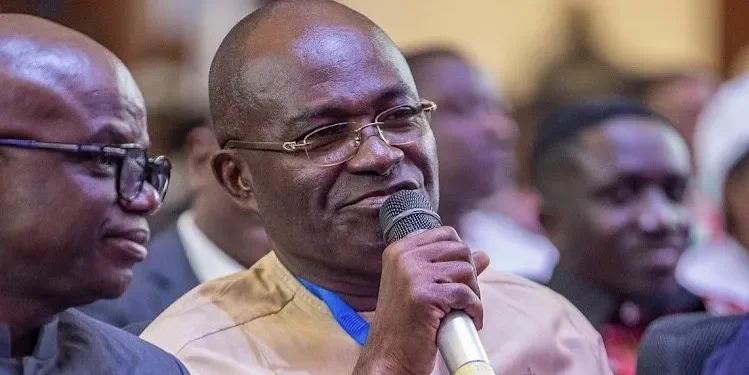

Dr. Addison made this declaration in a speech he delivered at the University of Ghana Alumni Lectures at the University’s Great Hall on December 17, 2020.

According to the governor, this trajectory has been maintained due to the policy and regulatory relief measures introduced by the Bank and have to a large extent enhanced liquidity in the banking system, preserved capital buffers, and provided relief to customers severely impacted by the pandemic.

Further, he noted that these measures have also helped banks and specialized deposit-taking institutions provide support to critical sectors of the economy to cushion the impact of the pandemic.

Notable among the measures implemented are the downward adjustment of the monetary policy rate to 14.5% from 16% as at January 2020. The average lending rate of banks also mimicked this decline from as high as 24 percent as at 2019 to 20.9 percent. Quite favourably, banks have hinted of a net easing of credit stance on loans contracted by entreprises in the coming months as more loans are being advanced, he added.

He also cited the recent banking reforms that the sector experienced as better positioning it to support growth.

“To a large extent, the policy interventions have also helped improve soundness of the banking sector and reduced the potential adverse spillback effects that the banking sector may have had on the macro-financial landscape.

“The sector remains robust as reflected by the strong Financial Soundness Indicators- Capital adequacy levels are above the regulatory limits, the NPL ratio has declined, and profitability remains strong.”

He also recounted the frequent monitoring of the banks to ascertain their resilience to the impact of the shock including gathering data on the banks and stress testing of banks. From the Bank’s findings, it was revealed that, on the whole, “the banking sector is robust and largely resilient to the pandemic-related shock,” he intimated.

Furthermore, he opined that the banking soundness index shows improvement even beyond pre-pandemic levels. Consequently, the governor noted that “prompt policy response to the COVID-19 pandemic, including the freeze on dividend pay-out, reduction in the cash reserve requirement and the reduction in policy rate supported the sector to build reserves to withstand the credit shocks.”

The resilience of the banking sector is not an isolated case within the economy. Generally, the economy has been fairly responsive to the macro-economic policies (monetary and fiscal) implemented throughout the period. According to the governor the GDP estimates released by the Ghana Statistical Service for the third quarter of 2020 indicates that the economy is on the trajectory for rebound.

Peering into the future, the governor surmised that just as the global economy seems to have a long way to go with respect to the recovery process, so is Ghana’s economy.

“…the global economy is not out of the woods yet and neither is the Ghanaian economy. The pandemic and its socio-economic impact would be felt long after we have reached herd-immunity and started seeing the full benefits of the success of the vaccines. Which means as public policy makers, we will still be faced with tough decisions that require a response function asymptotic to Pareto principles. The critical decisions that we take will be judged by posterity.”

READ MORE: Global Financial Markets Stressed by The Pandemic