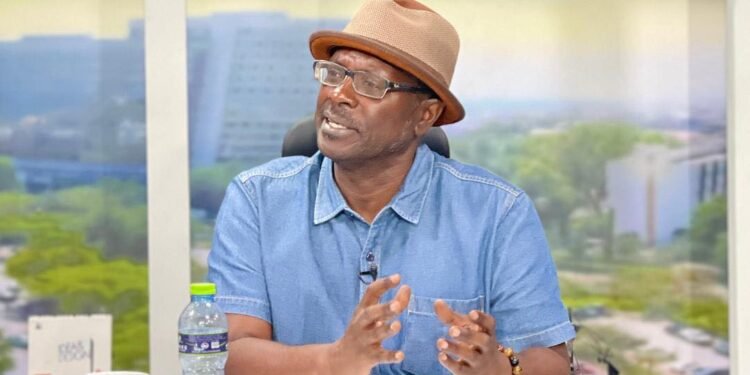

A Senior Lecturer at the University of Ghana and the Director of Ali-Nakyea and Associates, Dr. Abdallah Ali-Nakyea has expressed dissatisfaction about government’s imposition of new taxes on various sectors of the economy.

The tax expert underscored the increase in tax coverage as a better avenue. He noted that the government could have explored inter alia, the re-profiling of tax payers and the capture of hard-to-tax sectors.

He made these remarks in an interview with the Vaultz News, indicating that the time is not ripe for the imposition of new taxes since the impact of the Covid-19 pandemic still lingers.

“…Covid is still with us and like the statements always say, the experts are saying that Covid is going to be with us for the next 2 to 3 years…so attention for me should have been on how to sustain businesses so that we can get them to recover and be able to continue honouring their taxes.”

Dr. Ali-Nakyea noted that this was due to the fact that, even during Covid, the GRA exceeded its revised revenue target. Thus, it would have been helpful for the government to engage GRA to find out the things they did right. And also the assistance they would need to maintain or exceed the revenue target this year.

“…It means that with the existing taxes, there could be one or two ways by which they could still collect more. It is more or less trying to engage the player that is in charge of the sector to know how it was done. What assistance can be given for you to maintain if even you can’t increase collection and we would have all been fine.”

Other areas that could be explored

According to Dr. Ali-Nakyea, the government could have explored re-profiling of tax payers. He noted that, although certain sectors were badly hit by Covid, other sectors benefited largely. Therefore, sectors that benefited could serve as the leading contributor of taxes while those affected are given space to bounce back.

He intimated that Kasapreko, for instance, had to shut down one line of its beverage sector to produce hand sanitizers. So, in that case, they leveraged on Covid and restructured their business. Thus, they may not have recorded falling turnover. As a result, it is likely they maintained their tax contribution.

Other businesses that took advantage of the pandemic would be doing better in revenues. And these are the areas the government should be looking at, he noted.

Furthermore, he averred that the government could have explored a mop-up of sectors or people that are considered hard-to-tax.

From all indications, the ICT sector also benefited from the pandemic. Services such as restaurants utilized online services to place orders and consequently made food deliveries to that effect, e-commerce platforms also made a boom, he disclosed.

Financial Sector levy to be a challenge on the sector

Speaking on the 5% financial sector clean-up levy, Dr. Ali-Nakyea intimated that the levy is likely to affect bank charges. And then services and ultimately financial inclusion and the cost of doing business. While taking into consideration the fact that the financial sector is more elastic. Thus, such a levy would adversely affect the sector.

He maintained that, if the financial sector needs to contribute to the clean-up, the tax could be charged on the profit levels of banks and not as a levy on profit-before-tax. By that, banks that make profits at the end of a financial year should be able to contribute.

Therefore, the government should consider the dynamic analysis of the imposition of a tax, he advised.

Dynamic Analysis on financial sector levy

“…If you [government] feel that the financial sector is making gains and they need to contribute, you will take it from their profit. But immediately you come with these levies; a levy is an indirect tax.

“So, it’s going to be passed on by way of bank charge increases, by way of services increases. And then it will affect financial inclusion. I thought we [government] are trying to move into a paperless economy so people can transact.

“…when it goes as an indirect tax, that is what adds to the cost of doing business. And we [government] are trying to bring down the cost of doing business so businesses can expand and can grow and create jobs. And once they create jobs, we can get more taxes from employee taxes. They will get more profits, we [government] can get our corporate taxes.

“So, if the current corporate tax is 25% and you think financial sector corporate tax should be 30% or 28%, you could add that marginal. And in all, you should have discussions with the stakeholders.”

He further illustrated that before the fiscal stabilization levy was instituted, a few years ago, discussions were held with industry players before a 5% levy was introduced. Similar discussions should be held with stakeholders to this effect to bring about the best policy for the sector’s progress, he opined.

READ ALSO: Govt’s Financial Sector clean-up levy to stifle investment and erode gains chalked