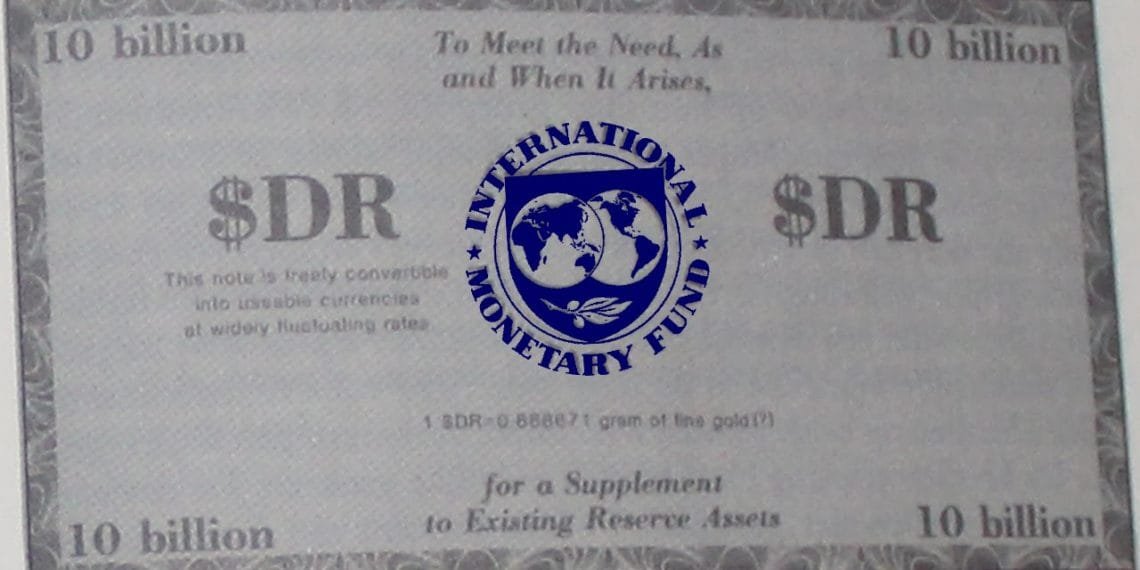

The initiative to allocate new special drawing rights (SDRs) to member countries under external financing pressure from the pandemic is helpful, albeit would not be sufficient to address sovereign debt burdens and other imbalances, Fitch notes.

The Credit Ratings Agency, Fitch Ratings observes that the $500 billion worth of special drawing rights to help emerging markets and developing countries has gained momentum. Therefore, according to Fitch, it is likely to undergo approval at the IMF springs meetings in April 2021.

The initiative to allocate special drawing rights, the IMF’s own currency, is part of a broader scheme to assist member countries. An SDR allocation of this worth is equivalent to 3.5% of world reserves and 0.5% of world GDP.

However, based on the report by Fitch, the Fund’s new SDR would only have less impact on alleviating the financial burden of emerging markets and developing countries compared to the IMF’s emergency financing that many countries received in 2020.

Implications of SDR

According to Fitch, the allocation would help countries to deal with external financing obligations that are immediate. It is also aimed at helping to increase countries’ resilience against potential tightening of emerging markets financing conditions.

However, it would be insufficient to significantly address debt burden challenges caused by the pandemic. Accordingly, Fitch expects that it would have no significant impact on ratings from the general allocations of the SDRs.

The internationally acclaimed ratings agency affirms that there are other initiatives underway. These initiatives are for rich member countries to transfer their SDR to support low-income countries. For example, under the IMF’s Poverty Reduction and Growth Trust, funds are raised for concessional loans to low-income countries.

Such an initiative is still less developed than the general allocation of SDRs. However, it could provide extra support for emerging markets and developing countries, Fitch notes.

Operations of SDRs

SDR’s serve as the IMF’s reserve assets created by the Fund, backed by a mechanism ensuring convertibility for dollars, euros, British pound, yen and Chinese renminbi. Implementation of allocated SDRs occur only with the approval of IMF members holding 85% of total votes.

The country that holds majority of votes and a major determiner of such an allocation is the United States with 16.5% of the votes.

Historically, SDR 204.2 billion (equivalent to $293 billion dollars) cover total allocations to members. This includes SDR 182.6 billion allocated by the Fund in 2009 in the wake of the global financial crisis.

Allocations of SDRs to member countries’ central banks serve as a reserve asset. That is, countries can easily exchange for hard currency from other countries. Whilst countries can voluntarily carry out the exchange, the IMF can also decide on which member countries to buy SDRs.

The value an SDR holds is against five major international currencies. These include: the U.S. dollar (41.73%), Euro (30.93%), Chinese Yuan (10.92%), Japanese Yen (8.33%), Pound Sterling (8.09%).

Allocations of SDRs are on a pro rata basis in relation to country’s IMF quota. As a result, the distribution is heavily skewed towards the bigger and richer countries that have the least need for it.

READ ALSO: Prof. Quartey backs govt’s decision to tax the gaming sector