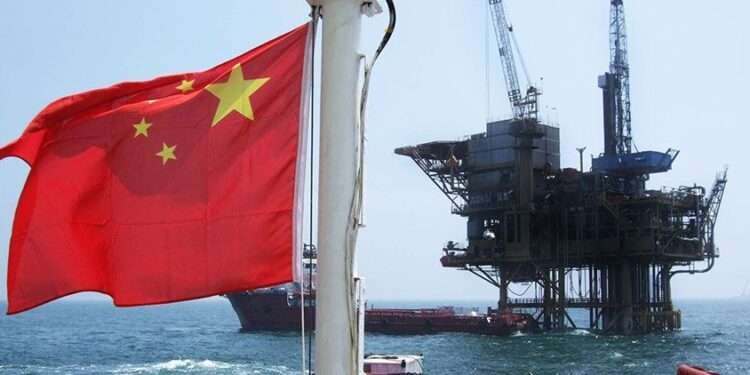

Oil price has pulled back after hitting an all year high in the early hours of Monday as investors await the outcome of this week’s talks between Iran and world powers over a nuclear deal that is expected to boost crude supplies.

Tehran’s nuclear program is expected to reduce Iran’s oil supply. This is likely to affect the price of crude oil on the market.

BRENT CRUDE FUTURES

Brent crude futures for August, 2021 fell 26 cents, or 0.4%, to $71.63 a barrel in the early hours of Monday 0218 GMT, after earlier hitting $72.27, their highest since May 2019. U.S. West Texas Intermediate (WTI) crude for July, 2021 touched $70 for the first time since October 2018 but retreated to $69.43 a barrel, down 19 cents, or 0.3%.

“After much dilly-dallying, Brent appears to have found a new home above $70,” said Stephen Brennock of oil broker PVM. “Summer and the reopening of the global economy is bullish for oil demand in the second half of the year.”

Brent is on track for a gain on the week of more than 3.2% and U.S. crude is heading for a 5% rise. It is the second week of gains for both contracts.

Meanwhile, a senior commodities manager at Phillips Futures in Singapore stated that investors may have sold off some contracts to take profit when WTI hit $70 per barrel on Monday, June 7, 2021.

“The primary concern is about Iranian barrels coming back into the market but I don’t think there will be a deal before the Iranian presidential election,” he added.

Moreover, both contracts have risen for the past two weeks as fuel demand is rebounding in the United States and Europe after governments loosened COVID-19 restrictions ahead of summer travel.

GLOBAL OIL DEMAND EXPECTATIONS

However, global oil demand is expected to exceed supplies in the second half of the year despite a gradual easing of supply cuts by OPEC+ producers, analysts say.

A slowdown in talks between Iran and global powers in reviving a 2015 nuclear deal and a drop in U.S. rig count also supported oil prices.

Iran and global powers will enter a fifth round of talks on June 10 in Vienna that could include Washington lifting economic sanctions on Iranian oil exports.

Meanwhile, the European Union envoy coordinating the negotiations believed a deal would be struck at this week’s talk. However, other senior diplomats have said the most difficult decisions still lie ahead.

Analysts expect Iran, which is having its presidential election on June 18, to increase its production by 500,000 to 1 million barrels per day once sanctions are lifted.

In the United States, the number of oil and natural gas rigs operating fell for the first time in six weeks as growth in drilling slowed.

The talk will have world “super powers” meet in Vienna later on Wednesday, June 9, 2021 to deliberate on the nuclear deal. However, the United States is not expected to be part of the negotiation as they quit under President Trump. Investors are hoping for a favorable outcome from the deal.

READ ALSO: Economist expects marginal rise in Inflation soon