A Senior Economic Analyst at Databank Research, Courage Martey, has attributed this week’s oversubscription of Government of Ghana Treasury bills to an improvement in inter- bank liquidity.

According to him, the improvement in inter-bank liquidity led to a rise in demand for government’s securities in the past few weeks.

“Well yes, it is true that liquidity has improved remarkably on the inter-bank market over the past two weeks and that has also propelled demand for government of Ghana securities across the maturities spectrum from T-bills to bonds. And the increase in demand is one key reason why yields have actually come down in the past couple of weeks. The real driver of this demand and liquidity for that matter has been the events that have happened particularly on the monetary policy side in the past two weeks.”

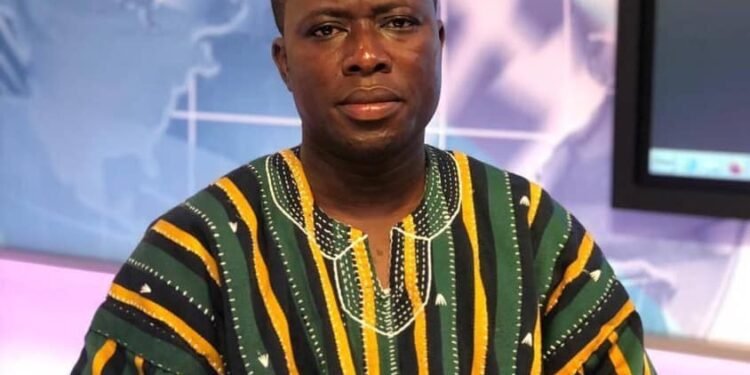

Courage Martey

The Bank of Ghana accepted GH¢1.17 billion as against GHc1.34 billion bids submitted this week, representing an oversubscription of 14 percent.

Meanwhile, Mr Martey believes that the demand for the short term securities will be sustained for few more weeks. He further opined that the high demand will trigger renewed expectation of a decline in interest rate for short term securities and subsequently present an option for the government to borrow at reduced rate.

“We expect that this demand [Treasury bills] will continue to pull down yields in the few weeks ahead and this lower yields also means that the government of Ghana can then refinance its matured papers at a lower cost compared to how much they issued the papers that are maturing currently.”

Courage Martey

How Inflation Contributed to Oversubscription

Other analysts also pointed out that, the recent decline in inflation to unexpected levels has also accounted for the high demand for Government’s short term securities. The inflation rate for the month of May declined to 7.5%, the lowest since 2013.

More so, the decline in the inflation is sign of positive market sentiment meaning the overall attitude of investors towards the financial market is boosted as evidenced by the oversubscription of the T-bills despite mixed developments in market for the last eight weeks.

They also predicted a decline in demand for short term securities, particularly Treasury bills and bonds as a result of cut in the monetary policy rate.

Treasury bills are important financial instrument that helps governments to finance their national debt. Therefore, the recent slump in the targets were major concerns because it could have thrown government’s debt management programme out of gear.

Monetary Policy Reduction

It can be recalled that, the Bank of Ghana (BoG), has recently announced a reduction in its monetary policy rate by 100 basis point from 14.5% to 13.5% in May 31st, 2021. This was the first time Since November 2019.

According to the Governor of the Bank of Ghana, Dr. Ernest Addison, the move was influenced by a pick-up in economic activities and recovery towards pre-pandemic levels.

Overall, it appears the monetary policy action by the Bank of Ghana two weeks ago followed by the decline in inflation in the subsequent week has boosted a demand on the market.

READ ALSO: Chinese Gasoline Demand Driving Oil Prices Higher