An Energy expert and Senior Oil Production Operations Specialist with Petroleum Development Oman, Dr Yusif Sulemana has hinted that ex-pump prices of petroleum products are not likely to decline within the near-to-medium term.

This is indicative of the components that determine the ex-pump prices of petroleum products: the prevailing exchange rate; global crude oil prices; and existing taxes/levies, which are all on the high side and do not favour the consumer, he highlighted.

“…All the three [components] are not going in favour of the consumer. Oil prices are still above US$70 per barrel, and so that will cascade to the pumps; [for] exchange rate, cumulatively… we are not doing so well— [cedi has been depreciating against the dollar in recent times]— and that will also have impact on the pumps; taxes/levies are already high, we have so many taxes within our price build-up which is almost closer to 50% of the entire price build-up.

“With all these three [conditions], I don’t think we are going to see prices of petroleum products dropping anytime soon in the short-to-medium term, unless something drastic happens.”

Dr Sulemana, Energy Expert

Oil Prices not reducing anytime soon

From a global perspective, he opined that while it was expected that the advent of the delta variant had surfaced, thus triggering a re-imposition of stringent restrictions among major economies, oil prices would have coiled downwards. And this would have further run prices at the pump down, but this has not happened.

This is because, “OPEC is still willing to have higher prices and shale patch from US which hitherto used to be a counterbalancing force that was able to [offset] OPEC dominance also seems to be in the same boat with OPEC— also interested in [high crude oil prices].

“…Because Covid hit hard and producers were affected. So, they just thought it wise to [adjust] global supply and get oil prices at a point where they can get maximum benefits. These are external factors but they will have cascading impact on every economy globally.”

Dr Sulemana, Energy Expert

Short term and long term factors to consider

Speaking to the Vaultz News, Dr. Sulemana suggested that what is within the government’s control to quell these factors from further worsening is to adjust the fiscal regime by reducing some of the existing taxes/levies.

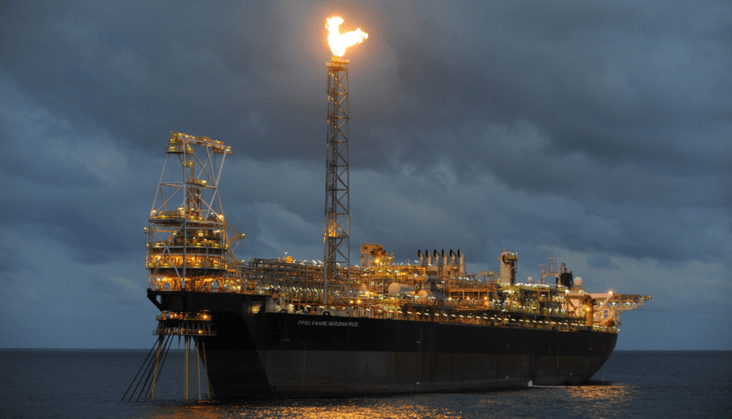

In the long-term, of primary importance is the need to minimize the country’s exposure against external pressures or shocks. This, he said could be achieved when there is commitment by the government to ensure the operation of a robust local refinery(s) as well as having a massive petroleum products storage reserves. And that would not require importing huge volumes of petroleum products as currently is the case.

These, he indicated will reduce the high prices of petroleum products which has cascading effects on rising prices of goods and services (inflation) in recent times.

That said, inflation rate for the month of August as released by the Ghana Statistical Service (GSS) in the past week has risen for the third consecutive time, now standing at 9.7 per cent.

According to the GSS, food inflation went through the roof in the past month, rising by 1.4 percentage points to reach 10.9 per cent, inflation for local and imported goods also increased (10.3% and 8.1% respectively).

Inflation rate to go up further

For instance, S&P Global Platts recently reported that rise in freight rates were likely to increase import prices. And particularly, import destinations for rice in countries such as Ghana, Benin, Senegal and Côte d’Ivoire were going to be hit.

According to the expert, “what we are seeing as inflation figure is just normal. It is just a natural response to what is happening. This is what economists are calling cost-push inflation.”

He further noted that, “if we cannot stabilize petroleum prices, then we should forget about having control of goods and services, because everything (goods and services) depends on petroleum prices.”

Indeed, the pass through effect of petroleum prices are a major contributing factor for the current inflation trajectory. The inflation rate has been inching towards the upper bound of the central bank target band (8+/-2).

According to Dr Sulemana, these cost push factors as identified are likely to send inflation rate up the more. “inflation is bound to go up because goods and services are going up and is triggered [mainly] by high fuel prices that we pay at the pumps.

“And we pay high fuel prices at the pump because all of the three things that go into the price build-up are not favouring consumers.”

Dr Sulemana, Energy Expert

READ ALSO: The Ghanaian Cedi Fights Against the Buck and Prevails by 0.33%