An energy economist, Dr. Theo Acheampong, has suggested that fuel prices could ultimately be reduced by as much as 20-25% if the government significantly reduces or scraps just three taxes/levies in the price-build up; Petroleum Stabilisation and Recovery Levy, Special Petroleum Tax (SPT) and the Sanitation and Pollution Levy.

Despite the free fall in international crude prices from $130.00 per barrel to as low as $100 at current prices, prices at the pump continued to spiral upward. Specifically, oil market companies (OMCs) adjusted ex-pump prices, selling within the ranges of GHS9.00 to as high as GHS11.00, on March 16, 2022.

Prior to the recent increase in fuel prices, industry experts have long-called for a reduction or removal of some of the taxes on petroleum taxes/levies as well as using the windfall gains from high crude prices to cool down the rise in prices at the pumps.

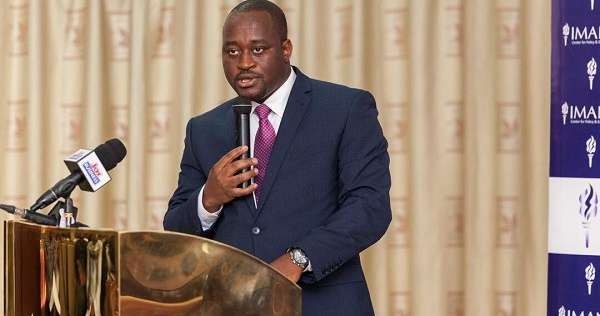

While the energy expert did not think it as “optimal” should the windfall gains be used to cushion consumption, since “the petroleum revenue management law circumscribes how that money can be spent,” he said:

“There is a possibility that if oil prices stay above $80 per barrel, we’ll get anything between $300 and $500 million extra… We can, if not, attain the same level or the same effect just by significantly reducing or scrapping some of the taxes…

“If we work on these three line items, we can get anything up to 20-25 per cent reduction overnight on these line items without having to tap into the windfall that we are getting on the upstream side of things.”

Dr Theo Acheampong

That notwithstanding, in the wake of the eye-watering rise in prices, and the resultant burden on Ghanaians, the government has risen to the occasion, initiating steps to look into a number of propositions available to cushion consumers of petroleum products.

Gov’t is Considering Some Proposals

Currently, a proposal from the NPA has been relayed to the Ministry of Energy, which has subsequently been endorsed, Hon. Andrew Egyapa Mercer said. He added that these line of items being considered are “the special petroleum tax (SPT), the Price Stabilization and Recovery Levy (PSRL) and then also the Sanitation and Pollution Levy that they expressed some desire for the government through the Ministry of Finance to look at what they could… accommodate.”

Taking into consideration, this action by the government, Mr Alex Mould, former CEO of GNPC, said:

“Those are things under their [government] control. I think the challenge government has is, it’s always just looking at the revenue that it will lose if it removes these levies and taxes from the petroleum price. The government should also be looking at the extra revenue that they are making from the crude oil sales and from royalties and taxes that they get from the oil companies.

“[This is] because, our benchmark price was about $61/bbl, and the average price that is projected by all the research companies in the world is showing that our crude oil prices is going to be no less than $85… so if you look at the windfall, and we should understand government will be getting a windfall because government has only budgeted for $61/bbl.”

Alex Mould

Another proposal under consideration by the Ministry of Energy has to do with the effect of the depreciation of the cedi on fuel prices. The proposal suggests that the Bank of Ghana will create some FX market for petroleum products and guarantee a certain FX rate for a minimum period of two months, the deputy minister said.

“So, that is something we are also going to push as a Ministry to the Finance Ministry to see to what extent that the FX market can be created purely for the petroleum sector, so that, that in itself will assure some stability in the price for us all to benefit…”

Hon. Andrew Egyapa Mercer

On this note, the volatilities in the exchange rate is “based on what is happening in the international market, Mr Alex Mould said, adding that “our bond prices are trading around 70 cents to the dollar.

“This means that anybody who bought the bonds when it was issued has lost 30 per cent of his value and this is why a lot of investors are selling their bonds and also those of them who have invested in our local bonds… are trying to get out of these local bonds and that is why there is a lot of pressure on the foreign exchange.”

Alex Mould

In solving this challenge, Mr. Mould iterated that, “if we can get Bank of Ghana… Ministry of Finance and Ministry of Energy to come to some compromise to know exactly how much foreign exchange is required by these BDCs and ensure that these BDCs… [buy the forex] at the Bank of Ghana rate to pay for petroleum products… it will reduce the volatility of the foreign exchange prices that the BDCs use.”

Based on these considerations by the government, consumers of petroleum products should begin to see some of the burden of the constant rise in prices being lifted in the coming days. Hopefully, should crude prices on the world market continue to ease, consumers would very likely, benefit in reduced prices at the pump.

READ ALSO: Tuna Sector’s Contribution to Ghana’s GDP on the Decline