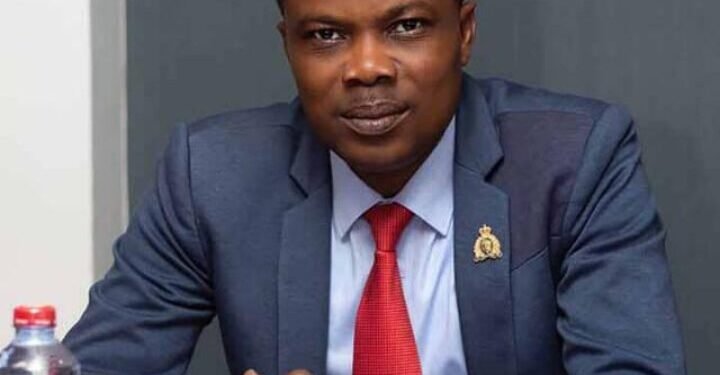

Dr. John Kofi Mensah, Managing Director of the Agricultural Development Bank(ADB) PLC, has hailed the introduction of the Ghana Incentive-based Risk Sharing for Agricultural Lending Scheme (GIRSAL) as game changer to agricultural lending in the country.

According to the Managing Director of ADB, GIRSAL’s introduction into the agricultural lending space will further de-risk the sector and make it more comfortable for commercial banks, which hitherto, feared to venture into agricultural financing to lend to the sector.

“As the leading Commercial Bank for agricultural lending in the country, the introduction of GIRSAL into the agricultural lending space will positively impact lending in the sector.

“I wish to commend the government, the Bank of Ghana and all other stakeholders for such a wonderful initiative aimed at de-risking agricultural lending in the country.”

Dr. John Kofi Mensah

Speaking at the re-launch of GIRSAL on the theme: ‘Re-launch of the GIRSAL Scheme and the Launch of an Agribusiness Public-Private Partnership Platform,’ Dr. Kofi Mensah noted that customers in the agricultural value chain have been constrained in their access to credit because of absence of collateral, credit history, and reliable financial accounts which would help financial institutions to better appraise their creditworthiness.

According to him, the impact of GIRSAL had been monumental in these few years of operation and had eased the constraints and bottlenecks associated with giving loans to customers in the sector by absorbing part of the default risk of commercial banks.

“GIRSAL has provided commercial banks with appreciable level of comfort to stimulate them to increase credit supply to the credit-constrained players in the agricultural sector.

“We at ADB are happy to note that the start of operations of GIRSAL has stimulated competition in agricultural lending in Ghana. While the Agricultural Development Bank remains the main player in agricultural lending, we have in the last few years observed interest shown by other commercial Banks in lending to the sector.”

Dr. John Kofi Mensah

Dr. Mensah was hopeful the renewed enthusiasm in some commercial banks to lend to the agricultural sector, hitherto considered risky was underpinned by the risk sharing activities of GIRSAL which had enabled the Commercial Banks to expand their risk appetite for agricultural and agro allied projects.

Dr. Mensah added that one major additional functionality of GIRSAL which would help the agricultural sector is its ability to negotiate better lending conditions such as lower interest rates, longer loan terms, and less burdensome collateral requirements.

“They have always argued that once their interventions reduce the risk of lending, it is important for customers to benefit from the reduced risk profiles.”

Dr. John Kofi Mensah

Dr. Mensah was hopeful that the operations of GIRSAL would be financially sustainable in the long run to enable them play their role in the agricultural lending space. He urged players in the agricultural value chain especially Customers who were the ultimate beneficiaries of credit risk guarantees provided by GIRSAL not to renege on their loan repayment obligations in order not to actualize the biggest fear associated with such credit risk guarantee schemes.

Dr. Mensah also urged commercial banks not to let the credit risk guarantee by GIRSAL affect effective appraisal, monitoring and recovery of loans and more importantly not to view GIRSAL’s credit risk guarantee as an absolute substitute for collateral.

The MD indicated the preparedness of ADB and other partner financial institutions to work with GIRSAL to consolidate gains made even as they prioritized selected agricultural value chains to achieve import substitution and export objectives.

From their start of operations in July 2019 to June 24, 2022, GIRSAL has provided Credit Risk Guarantees totaling about GHS301.30 million covering loans totaling GHS629.60 million granted by Ghanaian Commercial Banks to players in the agricultural value chain and the Agricultural Development Bank PLC remains the single largest partner financial institution

READ ALSO: Prudential Ghana Gets New Female CEO