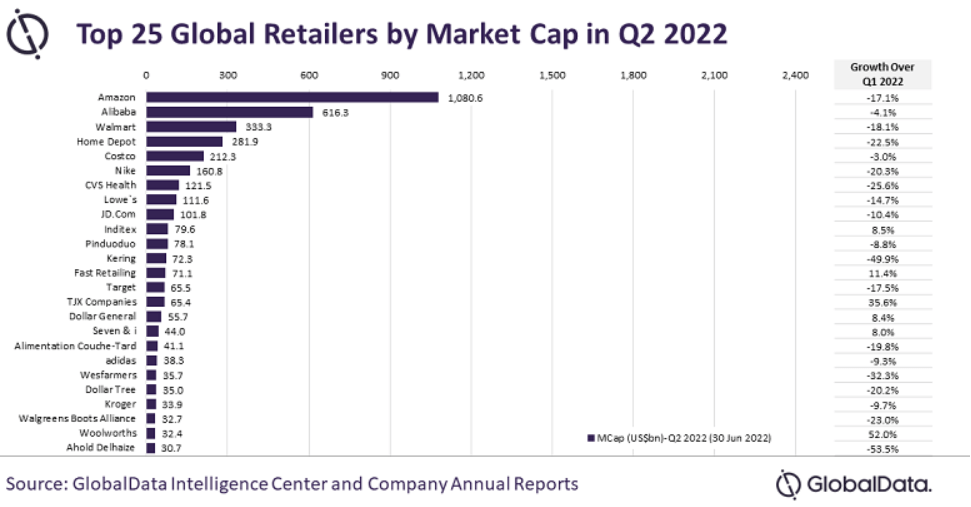

The top 25 global retailers by market capitalization reported a 14 per cent decline, representing a loss of $535 billion in their cumulative valuation in Q2 2022, according to GlobalData.

The leading data and analytics company also noted that the top six US companies– Amazon, Walmart, Home Depot, NIKE, Costco and Target– each lost over $25 billion in valuation.

Ragupathy Jayaraman, Business Fundamentals Analyst at GlobalData, said:

“As a result of the stringent lockdowns resulting from the COVID-19 pandemic, retail firms were able to enhance their e-commerce options. Additionally, home improvement and pharmaceutical retailers also benefitted from the pandemic. However, normalcy is returning to markets as more consumers are visiting physical stores.”

Ragupathy Jayaraman

Additionally, surging inflationary pressures and a hike in interest rates by the Federal Reserve resulted in a broad selloff in stocks in Q2.

Retailers are vulnerable to the volatile economic environment as the increasing prices directly impact consumers’ shopping habits. The ongoing Russia-Ukraine conflict has also had an immense impact on their positions, due to the increasing energy prices.

Amazon was the only organization among the top 25 retailers that lost over $100 billion in its Q2 valuation.

Despite the fact that the company gained substantially from the pandemic, which improved its stocks’ performance enormously, “inflationary pressures and the market dip brought the company’s stocks back to its pre-pandemic levels.”

“The company also posted its first quarterly loss in seven years. Walmart, Lowe’s, Nike, and Costco each reported more than a 20% decline in their valuation during the same comparison period.”

Ragupathy Jayaraman

In contrast, Chinese retail giants Alibaba, Pinduoduo and JD.com reported market cap growth in the present cycle, with Alibaba and Pinduoduo recording more than 35% growth in valuation.

Alibaba was the biggest gainer among the retail giants as its valuation improved from $296 billion in Q1 2022 to $616 billion in Q2 2022. However, the Chinese government’s regulatory crackdown on organizations continues to raise concerns for investors.

Market Capitalisation of Tech Giants Fall

Similarly, the ongoing geopolitical tensions and inflationary pressures continue to impact the technology sector with 24 of the top 25 technology companies reporting a combined loss of $3.3 trillion in their market capitalization in Q2 2022,

Ragupathy Jayaraman, Business Fundamentals Analyst at GlobalData, said: “Surging inflationary pressures and a hike in interest rates by the Federal Reserve resulted in a broad selloff in technology stocks in Q2.”

Meta, Apple, Amazon, Microsoft and Google (FAAMG) stocks, along with Taiwan Semiconductor and Nvidia were the seven companies that lost over $100 billion in valuation each, with Apple losing the most with $636.7 billion.

Apple started the year by becoming the first company to reach the milestone of $3 trillion in valuation. However, within the next two quarters the company’s valuation dropped to $2.2 trillion, primarily due to various factors such as Fed rate hikes, increasing inflationary pressures, weakening consumer confidence and global supply chain challenges.

This also reflected in a drop in Microsoft’s valuation by $390.5 billion in Q2 2022 compared to Q1 2021, although the company is expected to bounce back to its previous quarter levels due to its full year results this month, GlobalData noted.

READ ALSO: Israeli Green Innovation Competition Opens Application for 2022