The Bank of Ghana (BoG) has reassured players in the digital financial service ecosystem that Bank of Ghana remains resolute in its commitment to the cash-lite agenda.

According to the Dr. Maxwell Opoku-Afari, First Deputy Governor of the Bank of Ghana, although much has been collectively achieved, there’s a lot that needs to be done in building the future economy. As such, he encouraged all to take advantage of the opportunities that Bank of Ghana has presented to the digital space to encourage innovation.

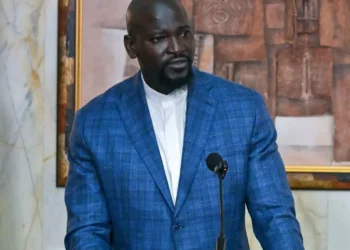

Speaking at the standard chartered digital banking, innovation and Fintech festival 2022 at the Movenpick ambassador hotel, Accra, on 26th October 2022, Dr. Opoku-Afar noted that over the last few decades, Bank of Ghana has been at the forefront of innovation, laying the foundation for an effective and efficient retail payments ecosystem that is anchored on a robust interbank infrastructure.

“A prominent mile marker was in the 2003, when the Payment Systems Act 2003 (Act 662) was passed and set in motion the promotion of electronic payments in Ghana. This law provided the mandate to establish the Ghana Interbank Payment and Settlements Systems (GhIPSS) which coupled with sustained investments in the interbank payments infrastructure, has proven to be a potent stimulant of retail payment innovation in Ghana.”

Dr. Maxwell Opoku-Afari

He further underscored that the Bank issued the Branchless Banking Guidelines to usher into Ghana, the mobile money concept. This guideline sought to anchor the emerging concept of mobile money on the resilience and safety of the banking sector.

The Bank of Ghana also developed a policy framework in concert with industry and key stakeholders to introduce the Electronic Money Issuer (EMI) Guidelines. According to him, this has provided a conducive legal and regulatory environment to promote mobile financial services, which in turn, has catalyzed the growth of an emerging ecosystem of smaller payment service providers in Ghana.

Setting the foundational digital infrastructure base of the economy

To fulfill the mandate in the National Payments Infrastructure Roadmap, the Bank of Ghana in collaboration with the Ministry of Finance, Ministry of Communications and other relevant stakeholders have been working rigorously together to set the foundational digital infrastructure base of the economy in place.

Dr. Maxwell Opoku-Afari said the ongoing sim-card registration exercise being championed by the National Communication Authority which has the bank’s full support, will ensure the centralization of KYC data to boost delivery of financial services devoid of fraud, theft and opportunities for money laundering and financing of terrorism.

“The consumer should be at the center of our collective efforts. As such, the Bank will not relent on its effort to protect them. It is in this vain that the Bank of Ghana has developed an artificial intelligence powered automated customer complaint system, I believe this community refers to it as a chatbot; dubbed ‘Akushika’.

“This customer experience solution is being deployed as an additional mechanism, to manage consumer complaints and promote consumer protection. The chatbot is currently in its pilot phase and I would like to use this opportunity to encourage you all to interact with it to ensure that it becomes fit for its purpose.”

Dr. Maxwell Opoku-Afari

In anticipation of the future role as a central bank within a digital economy, “we set out to explore the possibility of introducing a central bank digital currency called the eCedi through a comprehensive pilot testing process that has just ended”.

He disclosed that the pilot saw the testing of online and offline versions of the eCedi in Accra, Tarkwa and Sefwi Asafo. The pilot has unearthed useful insights on the impact of the initiative of the Bank which will prove instrumental in the event of a full-scale deployment of the eCedi, he added.

To build stronger collaboration and cooperation with industry, Bank of Ghana has embarked on an engagement drive through the FinTech and Innovation Office.

“In fact, the Bank has already started collaborating with FinTech Accelerators, Technology Hubs, and has facilitated various sessions on licensing requirements, corporate governance and compliance for reporting institutions. This further demonstrates the Bank’s openness and engaging attitude towards industry players.”

Dr. Maxwell Opoku-Afari

Dr. Maxwell Opoku-Afari emphasized that the Bank of Ghana encourages continual dialogue and is ready to engage all stakeholders to achieve “our shared goals to promote innovation and a safe payments ecosystem”.

READ ALSO: Restoring Fiscal And Debt Sustainability Is Not Going To Be Easy- Bawumia