Ghana’s economy has suffered another devastating setback as Moody’s Investors Service has downgraded it deeper into junk territory on the likelihood that private creditors will incur steep losses during the government’s planned debt restructuring.

In a statement issued by the rating agency, Moody’s slashed the country’s credit rating by two levels to Ca, the second-lowest score at Moody’s. Meanwhile, the latest score puts Ghana on par with Sri Lanka, which is in default.

The downgrade follows plans in Ghana’s proposed 2023 government budget to restructure both local and foreign debts. However, the statement signed by analysts Lucie Villa and Marie Diron, indicated that the outlook changed to stable.

“The Ca rating reflects Moody’s expectation that private creditors will likely incur substantial losses in the restructuring of both local and foreign currencies debts planned by the government as part of its 2023 budget proposed to Parliament on 24 November 2022. Given Ghana’s high government debt burden and the debt structure, it is likely there will be substantial losses on both categories of debt in order for the government to meaningfully improve debt sustainability.

“At the same time, Ghana’s outlook was changed to stable as the restructuring will likely happen in coordination with creditors and under a program with the International Monetary Fund.”

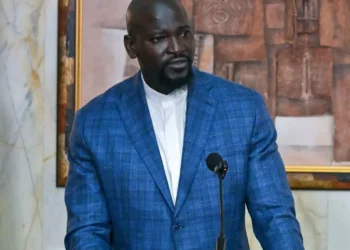

Lucie Villa and Marie Diron

The analysts explained that the stable outlook balances Moody’s assumption that the debt restructuring will happen in coordination with creditors and under the umbrella of a funding program with the IMF against the potential for a less orderly form of default that could result in higher losses for private-sector creditors.

Just last month, Ghana formed a committee to start talks with domestic bondholders to restructure its local-currency debt. Currently, Ghana’s Eurobonds have been among the worst performers in emerging markets since Bloomberg reported the plans for the local debt recast in September, handing investors losses of almost 12% in that period, according to data compiled from a Bloomberg index.

The nation’s debt-exchange program will replace existing terms and exchange debts with longer tenors at cheaper rates, said Abena Osei Asare, a deputy minister of finance. The plans come after an analysis of debt sustainability showed the nation faces a high risk of distress.

Ghana suffered a streak of downgrades from the beginning of 2022. Fitch Ratings scored the nation at CC, two notches above default. S&P Global Ratings also assigned it CCC+, seven levels into junk.

Finance Minister Ken Ofori-Atta, in his recent budget statement, blamed the downgrades on disagreements in parliament over revenue mobilisation measures.

READ ALSO: I Admire You From A Distance – Obrafour To Kweku Flick