The Federal Reserve (Fed) is of the view to push rates higher than previously expected, keep them for an extended period with the aim of cutting down inflation.

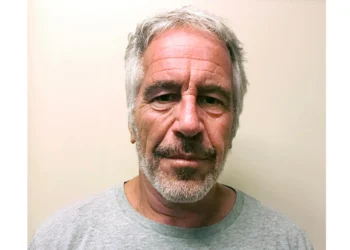

Mr. Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, during an interview disclosed that, the Federal Reserve may increase its key interest rate by a half-point at its December meeting, a smaller boost after four straight three-quarter point hikes. Rate increases could then fall to a more traditional quarter-point size at its February and March meetings, based on previous Fed forecast, he added.

Mr. Powell in his speech also revealed that, the Fed is seeking to increase its benchmark rate by enough to slow the economy, hiring, and wage growth, but not so much as to send the U.S. into recession.

According to him, Fed has lifted the rate six times this year to a range of 3.75% to 4%, the highest in 15 years. Those increases have sharply boosted mortgage rates, causing home sales to plunge, while also raising costs for most other consumer and business loans.

“We think that slowing down at this point is a good way to balance the risks. The time for moderating the pace of rate increases may come as soon as the December meeting takes place.”

Mr. Chair Jerome Powell

Mr. Powell also stressed on the fact that, smaller hikes shouldn’t be taken as a sign that the Fed will let up on its inflation fight anytime soon.

“It is likely that restoring price stability will require holding (interest rates) at a restrictive level for some time. History cautions strongly against prematurely loosening policy.”

Mr. Chair Jerome Powell

Employees Will Not Be Laid Off

Powell acknowledged there has been some good news on the inflation front, with the cost of goods such as cars, furniture, and appliances in retreat. Rents and other housing costs which make up about a third of the consumer price index were likely to decline next year.

But the cost of services, which includes dining out, traveling, and health care, are still rising at a fast clip and will likely be much harder to rein in, he added.

According to Powell, the Fed chair has singled out strong hiring and wage gains as the main driver keeping services costs high. Paychecks, on average, have jumped about 5% in the past year, before inflation, the fastest pace in four decades.

“We want wages to go up strongly, but they’ve got to go up at a level that is consistent with 2% inflation over time. Wage growth at about 3.5% a year would fit that criterion.”

Mr. Chair Jerome Powell

In concluding Powell disclosed that, Economists generally expect a rising layoffs and a higher unemployment rate, with the economy potentially falling into recession.

But employers could cut the near record-high number of job openings they have posted, rather than lay off large numbers of workers, he said.

Read Also : Recycling Waste Should Be Done More Than Resorting To Landfill Method- STRANEK Africa