Former Chief Executive at the Ghana National Petroleum Corporation (GNPC), Alex Mould, has expressed his misgivings about government’s gold for oil policy (G40), which seeks to barter gold for petroleum products.

He believes that the gold for oil policy is simply a cunning ploy by government to enrich certain players within the sector. He revealed that these players will invariably capitalize on the major elements of the policy which are gold and petroleum products for their benefits.

“What is this Gold for Oil (G4O) really all about? Key players that control government, have devised a cunning ploy to take a share of both markets [which includes] the export of Ghana’s gold [and] the import of petroleum products.”

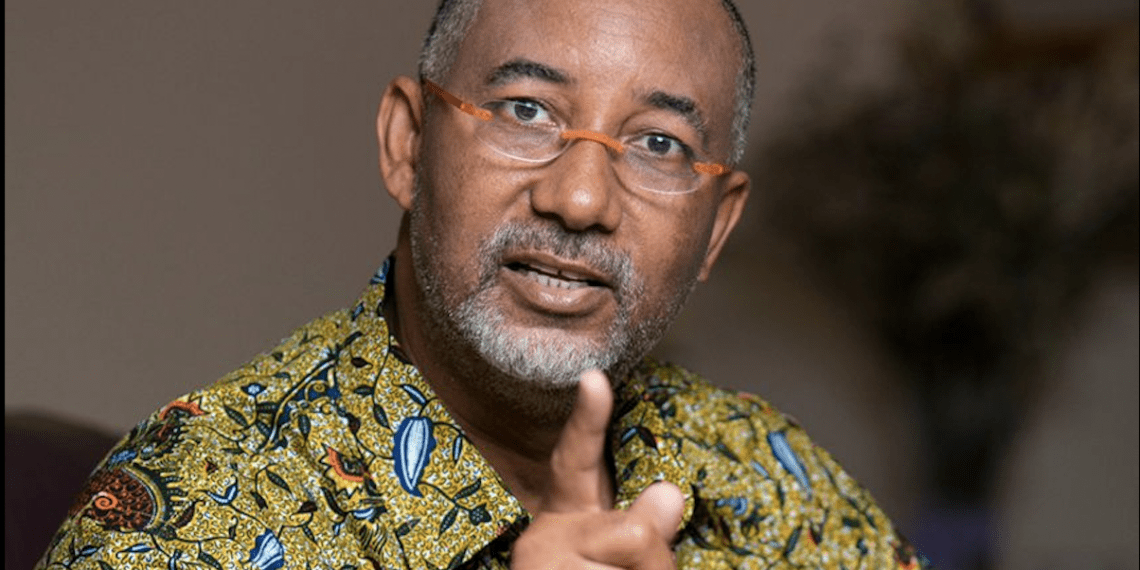

Alex Mould

Mr Mould indicated that these beneficial players who are soon to be identified, are taking market share in both gold exports and petroleum products imports under the guise of government policy using government institutions and even the regulators of these sectors.

In essence, he questioned whether the oil import programme under the Gold for Oil deal is going to be a long-term contract with only one International Oil-Trading Company (IOTC), or there will be bidding for each cargo. More importantly, he emphasized the need for the bidding process for the barter to be open and transparent.

“The first 41,000 metric tonnes of petroleum products imported was brought in by LITASCO. On this first G4O cargo contract, did it go through a public procurement bidding process? Was it open and transparent ? Who represents LITASCO in Ghana? And who is the beneficial representative?”

Alex Mould

Highlighting the risks exposure of the Bank of Ghana in the transaction of the gold for oil policy, Mr Mould underscored that the Central bank is the most exposed government institution in the G4O deal.

Risk exposure for Central bank in gold for oil policy

The former GNPC CEO stated that the importer on record, which is the Bulk Oil Storage and Transportation (BOST), is directly exposed to the credit risk of the Bulk Distributing Companies (BDCs), and does not give cover to BoG via the provision of a bank letter of credit guarantee.

Mr Mould reckoned that in this G4O, BoG uses the foreign exchange obtained from the sale of gold, which would normally then flow into the banking system in Ghana, to pay for the petroleum products imports.

“BoG is taking the direct risk exposure to buy the oil on behalf of BOST who then takes delivery of the oil and then sells to GoENERGY (and, maybe, some other BDCs) who should then provide some financial guarantee to BOST to cover credit and operational risk.”

Alex Mould

While acknowledging that all the underlying transactions may be legal, Mr Mould stated that certain government players and advisors are using their “influence to direct government policy as well as government institutions including the regulator, to muscle out existing players in order to enrich themselves”. This, he noted, is the ethical problem government is confronted with.

“BoG is using gold reserves or buying the gold from small-scale/community miners using Govt money, or by giving a loan to Government (PMMC) from BoG balance sheet to buy the gold.”

Alex Mould

Meanwhile, investment banker, Kweku Adoboli, has revealed that for the gold for oil deal to be sustainable, it would be hinged on the production capacity of gold in the country.

According to him, the success of the deal will also be dependent on how much cedis is received by the gold manufacturer.

“To get gold, they have to get the gold from somewhere. So, the gold manufacturer gets cedis, because the government will not give them dollars so it depends on how much cedis the gold manufacturer can digest. If there is a productive capacity for them to spend the cedis on, then they will take the cedis up to the point that they can no longer spend the cedis.”

Kweku Adoboli

READ ALSO: NDC Leadership Shake-up: Our First Responsibility Is To Unite The Caucus- Dr Forson