Oil Prices have been bullish for a second session in a row, buoyed by s stronger-than-expected U.S. economic growth and hopes of a rapid recovery in Chinese demand as COVID-19 cases and deaths plunged from last month’s peak levels.

According to prices in the international market, Brent futures gained 18 cents, or 0.2%, to US$87.65 a barrel, while U.S. crude rose 22 cents to US$81.23 per barrel, a 0.4% gain. Meanwhile, both benchmarks gained more than 1% on Thursday.

The prices were flat compared with when last Friday’s session closed. If they end at higher levels, it would mark the third straight week of gains for crude.

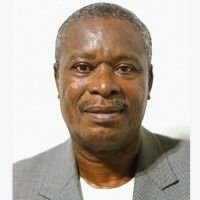

Edward Moya, Senior Market analyst at OANDA indicated that the commodity might struggle to make any substantial gain by the close of the week.

“Oil might have trouble making any substantial moves to finish the week as many traders will wait to see what happens with next week’s two massive events; the OPEC+ virtual meeting on output and the FOMC decision.”

Edward Moya

OPEC+ delegates will meet next week to review crude production levels, amid steady support for crude prices from strong demand for jet fuel and diesel. The U.S. Federal Reserve will decide on another rate hike, as inflation cools and gross domestic product improves.

Gains on U.S. crude were limited by a 4.2-million-barrel build in stocks at Cushing, the pricing hub for NYMEX oil futures, earlier this week.

Markets Boosted By Broad Optimism

Still, oil markets were boosted by broad optimism on the first day of the return of Chinese stock markets as China’s reopening still plays a main role in boosting the demand outlook, said Tina Teng, an analyst at CMC Markets.

Critically ill COVID-19 cases in China are down 72% from a peak early this month while daily deaths among COVID-19 patients in hospitals have dropped 79% from their peak, pointing to a normalisation of the Chinese economy and boosting expectations of a recovery in oil demand.

“The short-term bullish factor is that the recent outage in the U.S. refineries helped push up gasoline prices, though the U.S. crude inventories hit a 16-month high,” Teng said.

Meanwhile, some experts say oil prices won’t trade above $100 this year. After an initial dip, the oil price rally has been a steady grind upwards in the current year, with the last 12 trading days seeing 10 days of higher intraday highs and 11 days of higher intraday lows. And now commodity analysts at Standard Chartered are saying that positive speculative sentiment in the oil markets can support prices above $90/bbl.

According to experts, the proprietary crude oil money-manager positioning index increased by 23.2 w/w to -39.6, the largest w/w improvement since the price lows of April 2020. StanChart says that improving sentiment can be chalked up to trader consensus becoming less concerned about OECD recession and more convinced that the oil markets will see significant demand growth, from China and India in particular. The analysts say that the rally is likely to take Brent prices past $90/bbl, though they are not optimistic that the fundamentals are strong enough to sustain prices above USD 100/bbl.

READ ALSO: Ukraine May Boycott 2024 Olympics If Russians Take Part