Mr. Richard Nunekpeku, the Vice President responsible for Legal and Strategy at Ghana Fintech and Payments Association has disclosed that Ghana’s fintech start-ups are set to remain an attractive investment opportunity for the rest of 2023.

According to Mr. Nunekpeku, despite concerns that the global economic crunch could lead to a more cautious approach to investments in less-established entities, he believes the sustained performance of Ghanaian start-ups, which raised nearly $400m in 2022, will continue as existing and emerging products address real-life issues both locally and internationally.

Estimates from McKinsey and Company – a global management consulting firm indicates that Ghanaian fintech revenues could reach $18.6bn by 2025.

Making a case for its submission, McKinsey’s in its analysis noted that the financial services industry in Africa has the potential to expand by approximately 10% annually, resulting in a market worth around $18.6bn in revenue by 2025.

“With transactional solutions provided by fintechs – potentially 80% cheaper than those offered by conventional service providers, there is significant potential for Ghanaian fintech start-ups to make a substantial contribution to this expansion.”

McKinsey and Company

More so, Mr. Nunekpeku expects the appetite of investors to continue supporting innovation across the continent to help growth materialize.

“Ghanaian firms are expanding into other markets and pushing boundaries, suggesting that the trend of investment in Ghana’s fintech industry will continue.”

Mr. Richard Nunekpeku

According to data aggregators Big Deal Africa, Ghana, in 2022, had a very successful year with 47 deals valued at relatively $400m, nearly eight times more than what the country achieved in 2021, adding that: “Ghana was ranked fifth in funding raised on the African continent in 2022.”

Regardless concerns that funding may be skewed towards emerging areas such as agrictech, regulation technology, healthtech and edutech, with fintechs bearing the brunt, Mr. Nunekpeku argued that growth in funding to other sectors will have a multiplier effect on fintechs.

“As fintech is required for the success of every industry, growth in these other areas will eventually trickle into the fintech ecosystem.”

Mr. Richard Nunekpeku

Furthermore, Mr. Nunekpeku highlighted that fintechs’ value and growth potential seeks to ensure that funding remains in the industry.

“Ghana’s fintech penetration rate is expected to reach 8% by 2025, better than the continental average of 5%.”

Mr. Richard Nunekpeku

Ghana’s fintech industry appears to be on a positive trajectory, with sustained investment expected to continue throughout 2023. The industry’s value and growth potential make it an attractive investment opportunity for investors seeking opportunities in Africa’s financial services sector.

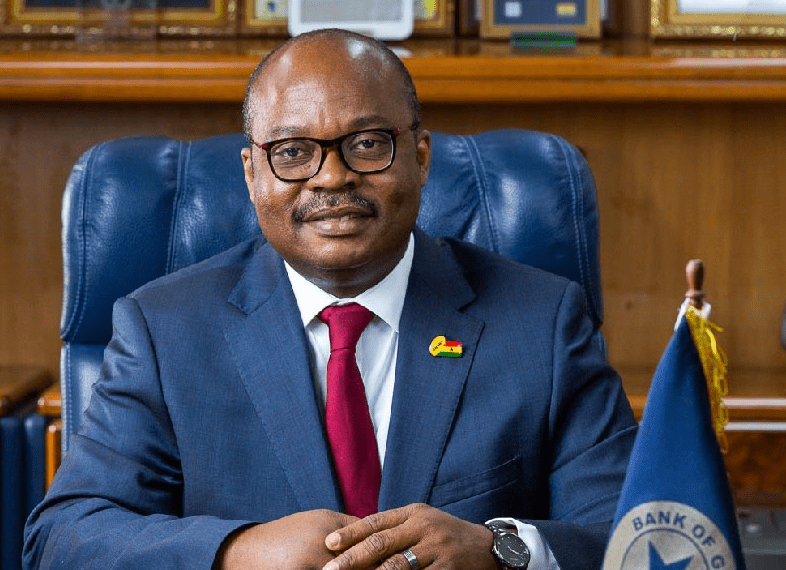

Bank of Ghana Wins Ghana Fintech Awards “Regtech of the Year”

However, it can be recalled that the Central Bank of Ghana (BoG) was recently presented with the “RegTech of the Year”.

BoG, presently and over the years have contributed immensely towards the promotion of Ghana’s FinTech competitive advantage and the journey to building a resilient FinTech space for economic growth and achieving financial inclusion.

The FinTech ecosystem and stakeholders are looking up to the regulator to offer more support to promote responsible innovation, and the Bank of Ghana is poised to deliver on that expectation.