Ghana’s move to restructure its local currency and overseas debt is weighing on banks from Africa to the United Kingdom (UK).

Four of Africa’s biggest lenders — Standard Bank Group Ltd., FirstRand Ltd., Absa Group Ltd., and Nedbank Group Ltd. — has collectively set aside 4.87 billion rand ($267 million) to account for the losses, impairing as much as 57% of local and onshore dollar denominated debt holdings. In addition, Standard Chartered Plc has set aside $160 million.

As a rare move to restructure local debt, bondholders exchanged 87.8 billion cedis ($7.1 billion) of notes that paid an average of 19%, with bonds returning as little as 8.35% – which have resulted in losses for financial institutions.

Ghana is restructuring most of its public debt, estimated at 576 billion cedis to finalize a $3 billion bailout from the International Monetary Fund.

The Chief Financial Officer of Absa, Mr. Jason Quinn during an interview disclosed that the bank was ever ready to handle any unforeseen eventuality as it projected the industry to be both safe and unsafe.

“We dealt with the risk, because as we see it, while there is a potential for a better outcome, there is also potential for a worse outcome.”

Mr. Jason Quinn

Absa recognized as the third-largest lender by assets, booked 2.7 billion rand as impairment, including 2.2 billion rand for sovereign bonds, and another 500 million rand to cater for other government-related exposures. The lender maintains that its unit remains well capitalized.

Even though Standard Bank’s Ghanaian unit balance sheet is a “fortress”, the bank – which runs the fourth biggest lender in Ghana by assets, has revealed its readiness to re-capitalize the business, should the need be. The lender holds as much as 2.6 billion rand in Ghanaian bonds.

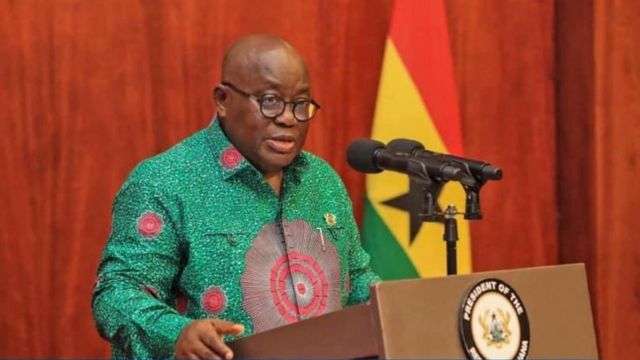

However, President Nana Akufo-Addo’s government plans to start a “substantive” discussion with international bondholders and their advisers in the coming weeks.

Finance Minister, Mr. Ken Ofori-Atta pointed out that the nation targets cutting its liabilities from an estimated 105% of gross domestic product in 2022 to 55% by 2028.

BoG Makes Available $20m In New Forex Auction

In other news, the Central Bank of Ghana’s recent forward foreign exchange auction has marked a significant shift in the country’s foreign exchange policy, with the aim of promoting stability and transparency in the downstream sector.

The auction, which took place on March 14th, saw 20 Bulk Oil Distribution Companies (BDCs) submit bids for a total of $20 million in foreign exchange, with a fixed rate of GHS 12.01 pesewas per dollar.

The Central Bank has projected a total of $200 million to be sold to BDCs during the first quarter of 2023.

This shift in the Central Bank’s foreign exchange policy is aimed at reducing uncertainty and promoting price discovery in the downstream sector.

By offering a fixed amount of foreign exchange at a fixed rate, the Central Bank aims to stabilize the market and ensure consistency in the pricing of downstream products. This is expected to improve transparency and efficiency in the foreign exchange market.