The World Gold Council’s (WGC’s) ‘Gold Demand Trends’ report for the second quarter has disclosed that despite some softness in some areas of the market, investment demand has shown resilience, while fabrication demand faces challenges.

The WGC’s projections for investment in the current financial year remain unchanged, thanks to robust over-the-counter (OTC) demand compensating for sluggish performances in exchange-traded funds (ETFs) and bar and coin investments, the council noted.

As the year unfolds, the WGC expects global gold ETFs and OTC demand to take precedence over traditional bar and coin demand. Meanwhile, several factors contribute to this shift. Interest rates are expected to peak at levels that do not pose restrictions for gold investors, making the yellow metal an attractive option.

Meanwhile, slower economic growth is expected to rein in lofty equity valuations, prompting investors to seek safer havens such as gold. Negative sentiment and under-allocation in certain portfolios are also fueling higher institutional involvement in gold.

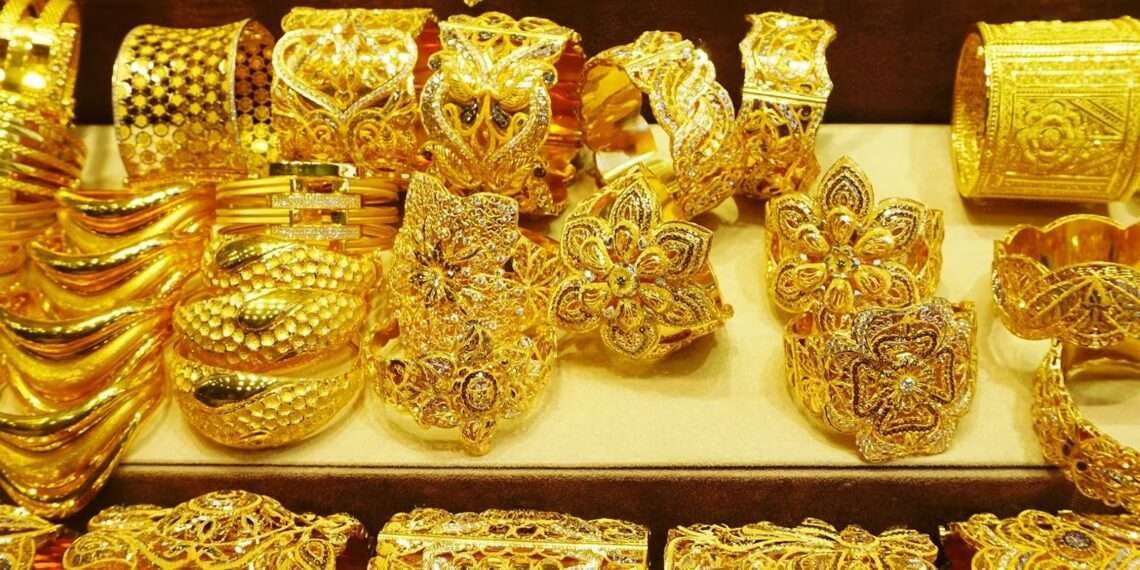

Finally, lower inflation means that retail investors are finding gold’s allure diminished compared to other periods, the WGC report outlined. Fabrication demand, however, has faced a minor downward revision owing to high gold prices and affordability concerns among consumers. The rising prices have prompted some consumers to reassess their purchases, impacting fabrication demand.

Nevertheless, the jewellery and technology sectors have maintained steady interest in gold, which partly offsets the overall softness in fabrication demand.

The positive trend of central banks adding to their gold reserves is expected to continue, bolstering the demand for the precious metal. However, the WGC has made a slight downward adjustment to its central bank estimate for the current financial year, taking into account a weak second-quarter performance.

On The Supply Front

On the supply front, the WGC report indicated that mine production is gearing up for a record high, contributing to the overall supply increase. Additionally, recycling is projected to rise as households, facing financial constraints, are expected to turn to gold recycling as a means of accessing additional income.

While there was a slight dip in gold demand, excluding OTC, by 2% year-on-year to 921 t, the total demand, inclusive of OTC and stock flows, showed strength with a 7% year-on-year increase, reaching 1,255 t.

Net central bank buying experienced a marked deceleration compared with the above-average purchases observed in the second quarter of 2022. The net official sector purchasing in the second quarter stood at 103 t, in line with the ongoing positive trend towards gold among central banks. Despite specific local market conditions in Turkey prompting some sales, overall central bank demand remained encouraging.

Jewellery consumption managed a modest 3% year-on-year improvement, with 476 t of gold being used. However, the high gold price environment impacted inventories, which increased by about 15 t in the second quarter. This was partly attributed to Chinese jewellery consumption falling short of optimistic expectations within the trade.

Bar and Coin Investment

Bar and coin investment increased by 6% year-on-year, reaching 277 t in the second quarter, with Turkey being a major driver of this growth. On the other hand, ETFs witnessed net outflows of 21 t, primarily concentrated in June. Notably, these outflows were significantly smaller than the 47 t outflow observed in the second quarter of the previous year.

OTC investment emerged as a notable bright spot in the second quarter, with demand reaching 335 t. Although somewhat opaque, the demand from this sector of the market became evident as the gold price found firm support, even amidst ETF outflows and a reduction in COMEX net longs.

Demand for gold used in technology remained soft, with just 70 t used for a second consecutive quarter. Continued weakness in consumer electronics contributed to the lacklustre performance in this segment.

Total gold supply experienced a 7% year-on-year increase, reaching 1 255 t, with growth observed across all segments. Mine production, in particular, surged to an estimated record of 1 781 t for the first half of 2023. The robust supply growth indicates the resilience of the gold mining industry and its ability to meet increasing demand.

The record-high LBMA gold price averaged an unprecedented $1,976/oz during the second quarter, surging 6% year-on-year and surpassing the previous record high set in the third quarter of 2020 by 4%. Currency fluctuations further bolstered local gold prices in several countries, with China and Turkey standing out as notable beneficiaries.

The first half gold demand, excluding OTC, experienced a 6% decline, totalling 2 062 t. The year-on-year decrease was primarily attributed to modest outflows from gold ETFs in 2023 compared to the substantial surge of inflows observed in early 2022.

However, when inclusive of OTC and stock flows, total demand in the first half rose by 5% to 2 460 t, reflecting the dynamic nature of the global gold market.

READ ALSO: Prudential Life Insurance Takes ‘Mekakrawa’ Insurance to Okaishie Market Traders