As digital banking gathers steam in West Africa’s banking industry, digital channels have become integral to the financial ecosystems of countries like Nigeria and Ghana.

According to the 2023 KPMG West Africa Banking Industry Customer Survey, Nigeria emerges as the front-runner in the adoption and usage of digital banking platforms, showcasing a significant lead over its Ghanaian counterpart.

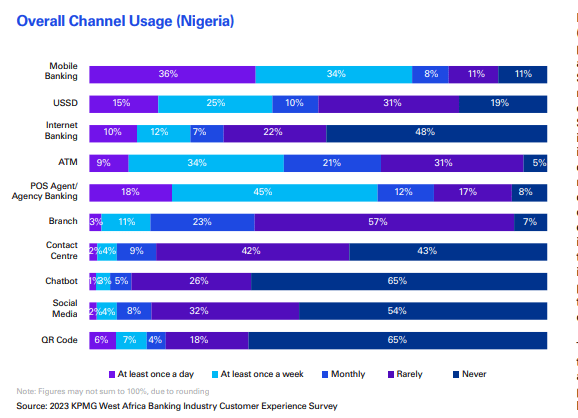

The survey revealed a notable contrast in the frequency of mobile banking app usage between Nigeria and Ghana. A substantial 70% of Nigerian customers utilize their mobile banking apps weekly, whereas in Ghana, the figure stands at 53%. This discrepancy indicates a higher degree of reliance on digital channels among Nigerian consumers.

Further emphasizing Nigeria’s digital prowess, the survey demonstrates disparities in Automated Teller Machine (ATM) usage. Approximately 43% of Nigerian customers use ATMs on a weekly basis, surpassing the 32% observed among Ghanaian customers. This trend reflects Nigeria’s more extensive integration of digital solutions into everyday banking practices.

In the realm of Unstructured Supplementary Service Data (USSD), Nigeria again leads with 40% of customers engaging in banking transactions through this medium, compared to 28% in Ghana. This suggests a higher level of comfort and acceptance of innovative banking methods among Nigerian consumers.

Corporate Perspectives on Online Banking

The survey delved into the perspectives of corporates and Small and Medium Enterprises (SMEs) regarding online banking importance. In Nigeria, 78% of corporates and 52% of SMEs emphasize the significance of the ease of use and variety of features in their bank’s online platform.

In Ghana, the corresponding figures are 61% for corporates and 44% for SMEs. This discrepancy underscores the varying demands and expectations of businesses in the two countries.

KPMG highlighted that the evolving digital landscape in West Africa, with mobile connectivity exceeding 100% in both Ghana and Nigeria, is reshaping financial ecosystems. This surge in mobile connectivity has initiated a profound shift in the payments sector, reinforcing the importance of digital solutions in the region’s financial activities.

As Ghana embraces the digital era, the KPMG survey unveils a promising trajectory in the adoption of digital banking channels. While Nigeria may lead in certain aspects, Ghana’s distinctive digital banking trends showcase a nation on the cusp of a significant transformation.

The Increasing reliance on mobile banking, acceptance of innovative channels, and the recognition of online banking’s importance among businesses collectively depict Ghana’s journey towards a more digitally inclusive financial future.

In nutshell, as digital banking continues to reshape the financial sector of West African nations, Nigeria emerges as a frontrunner in the adoption and utilization of digital channels, as highlighted by the KPMG survey. The disparities in mobile banking, ATM usage, USSD transactions, and corporate perspectives on online banking emphasize the evolving nature of consumer behavior and preferences in the dynamic digital era.

READ ALSO: Bond Market Faces Decline in Trading Activity Amidst Festive Season