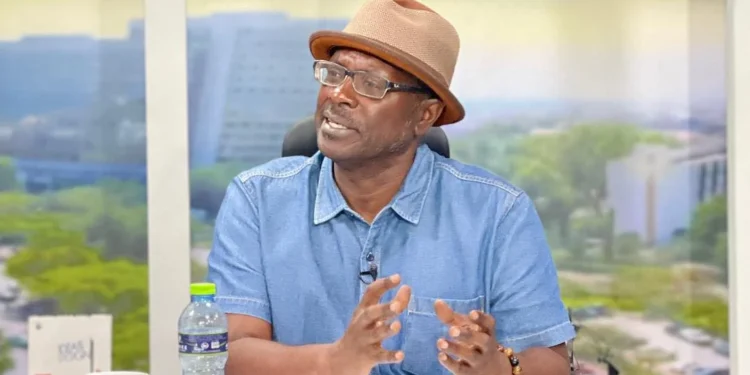

Mr. Seth Terkper, a former Finance Minister under former President John Dramani Mahama, has offered insights into the complexities of Ghana’s tax system and proposed reforms aimed at fostering efficiency and transparency.

Mr. Terkper highlighted the need for a more streamlined and effective tax structure to enhance revenue generation and promote sustainable economic growth.

Ghana’s tax system comprises four main regimes: Income Tax, Excise Duty, Petroleum Tax, and Import Duties. Mr. Terkper emphasized the significance of focusing on the core taxes, particularly income tax, which includes personal and corporate income taxes, as well as Value Added Tax (VAT). These taxes, he asserted, form the pillars of the country’s revenue regime due to their broad tax base and revenue-generating potential.

However, Mr. Terkper raised concerns about the proliferation of levies, noting that they contribute less than 6% to overall revenue and distort the primary tax system. He therefore, called for transparency in the introduction of new taxes and advocated a return to the fundamental tax pillars to ensure a more robust and sustainable revenue generation framework.

Moreover, Mr. Terkper highlighted the importance of embracing digitalization in the tax system to enhance efficiency and effectiveness. He emphasized the need for an efficient domestic Information Technology (IT) system for the Ghana Revenue Authority (GRA) and proposed mechanisms such as automation and integration of income tax and VAT files to improve tax collection and increase revenue.

Digitalization not only streamlines tax collection processes but also enhances transparency and reduces opportunities for corruption. By leveraging technology, Ghana can modernize its tax administration, reduce compliance costs for taxpayers, and ultimately improve revenue collection efficiency.

Addressing Challenges and Distortions

Expressing reservations about certain levies, Mr. Terkper cautioned against their adverse effects on the tax regime, including encouraging tax evasion and avoidance. He recommended eliminating unnecessary levies and focusing on strengthening the core tax pillars to foster sustainable revenue generation and economic development.

Furthermore, Mr. Terkper addressed the issue of distortions within the tax system, particularly regarding excise duties and petroleum taxes. While excise duties are typically levied on products like alcohol and cigarettes, Mr. Terkper emphasized the need for a careful balance to ensure these duties do not excessively burden consumers or lead to illicit trade practices.

Similarly, petroleum taxes play a significant role in Ghana’s revenue generation, but Mr. Terkper cautioned against overreliance on this revenue stream, particularly given the volatility of global oil prices. Diversifying revenue sources and reducing dependence on petroleum taxes can enhance fiscal resilience and mitigate risks associated with commodity price fluctuations.

In addition to tax reforms, Mr. Terkper addressed the issue of returning to the capital market, underscoring the importance of success in the ongoing IMF program and effective debt management policies. He called for a candid and realistic approach in negotiating with commercial creditors, emphasizing the need for a comprehensive debt management policy to safeguard Ghana’s financial health.

Ghana’s debt sustainability is crucial for maintaining investor confidence and ensuring access to affordable financing. Effective debt management strategies, including prudent borrowing practices and proactive debt restructuring measures, are essential for mitigating risks and maintaining fiscal stability in the long term.

Mr. Terkper advocated for holistic tax system reforms that prioritize transparency, efficiency, and the long-term financial stability of Ghana. By addressing the complexities of the tax system, embracing digitalization, and implementing prudent debt management strategies, Ghana can enhance its revenue generation capacity, promote economic growth, and achieve fiscal sustainability in the years to come.

However, realizing these reforms will require concerted efforts from policymakers, tax administrators, and other stakeholders. Collaborative action, guided by a commitment to transparency and accountability, will be essential for navigating the challenges ahead and building a tax system that supports inclusive development and prosperity for all Ghanaians.

READ ALSO: GSE Prime Index Jumps By Over 25 Points