The Treasury could hit a snag in managing its deficit as commercial banks, which own more than 35 percent of Treasury bills, are likely to start selling them off to finance more loans. This insight comes from a report by GCB Capital.

This move follows the Bank of Ghana’s introduction of a tiered Cash Reserve Ratio (CRR) system. The aim is to encourage banks to lend more and free up money to fuel economic expansion.

“The Ministry of Finance will have to re-think deficit financing, and yield compression could buck the trend as banks focus on new ways to deploy deposits,” GCB Capital stated in a note to investors.

In the past, banks tended to invest in low-risk options such as Treasury bills because of a cautious atmosphere and worsening asset quality. This cautious approach meant that despite having ample deposits, the growth of loans was slow.

However, with the recent change in policy taking effect this week, approximately GH¢16.2 billion (equivalent to US$1.2 billion) could move from banks to the Bank of Ghana.

This shift could tighten the availability of Ghanaian cedi and potentially lead to a short-term increase in its value.

The Treasury bill auction conducted last week experienced a 43 percent under-subscription. This was the first time in 17 weeks that such under-subscription occurred, indicating a shift from the strong demand from investors that had been typical throughout the first quarter of 2024.

“While all banks hold healthy cash balances on their books, we believe these are largely optimal cash balances required for smooth operations,” GCB Capital added.

The low subscription to treasury bills is due to the recent change in the CRR policy. To comply with the new CRR levels, banks give priority to increasing their liquidity rather than investing in treasury bills.

GCB Capital warned, “The pronounced under-subscription at the last T-bill auction could persist beyond the current week, with the pace of yield compression potentially softening or may even buck the trend through Q2 2024, all things equal.”

In March 2024, the Treasury successfully raised GH¢19.9 billion through Treasury bills, marking a 17 percent decrease compared to the previous month. These funds were allocated towards supporting the budget and refinancing maturing bills, totaling approximately GH¢14.47 billion in face value.

The recent under-subscription of Treasury bill auctions signals a potential hurdle in the short term. However, the ongoing decrease in yields provides a glimmer of cautious optimism within the market.

With banks directing their attention towards extending credit, the Treasury is confronted with the task of reassessing its approach to financing deficits. This involves carefully navigating the potential consequences of efforts to compress yields.

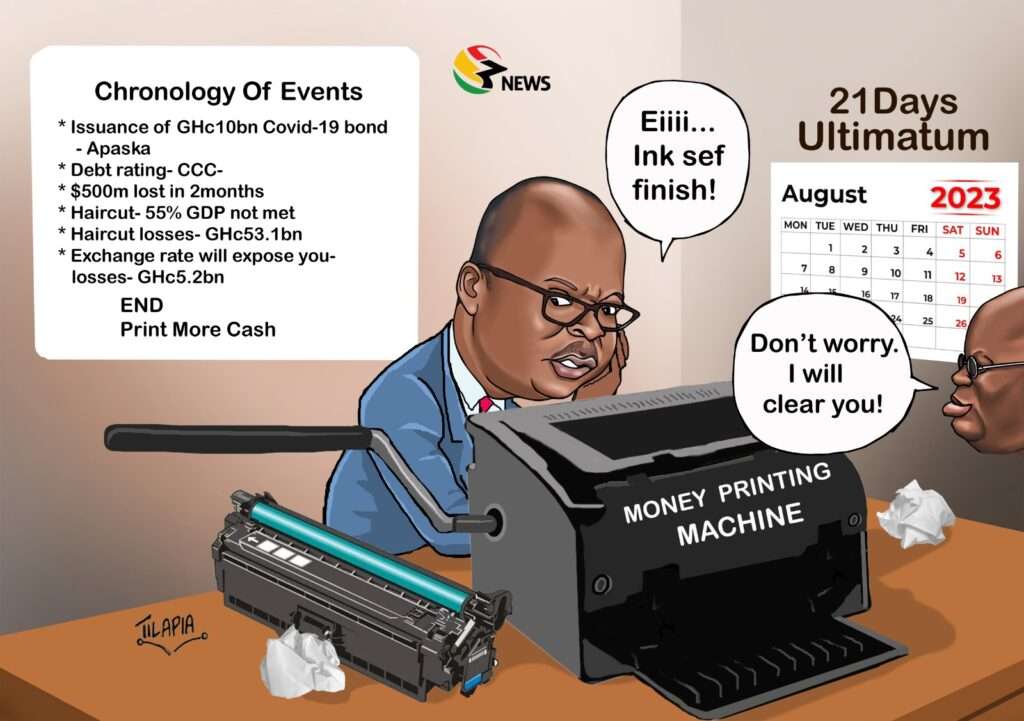

Consequences of Excessive Liquidity Injection

Moreover, it is worth noting that the country’s current economic distress is partly because the BoG printed GH¢35 billion in 2021 and GH¢42 billion in 2022 to finance the government.

This decision of the BoG was against the Fiscal Responsibility Act which capped the country’s fiscal deficit to Gross Domestic Product (GDP) at 5.0%.

A World Bank report revealed that the inflation caused by the Bank of Ghana’s excessive liquidity injection plunged nearly 850,000 Ghanaians into poverty by the end of 2022.

This alarming statistic highlighted the failure of the government’s supposed policy to improve the lives of the average Ghanaian. Instead, ill-advised economic policy-making and implementation have resulted in more people becoming poorer.

The government should focus on fiscal discipline to reduce the need for excessive borrowing. By controlling government spending and prioritizing fiscal responsibility, the government can lessen the reliance on central bank financing and mitigate inflationary risks.

READ ALSO: Online Music Streaming A Cashcow