In its latest Africa Pulse Report released in April 2024, the World Bank has shed light on Ghana’s borrowing trends in comparison to other African nations like Zambia and Ethiopia.

Unlike Zambia, which has borrowed up to 36% of its external debt from China, and Ethiopia, which stands at 25%, Ghana’s exposure to Chinese loans is relatively lower.

Ghana’s reliance on Chinese loans constitutes only 7.0% of its Public and Publicly Guaranteed (PPG) external debt, as per the World Bank’s findings. This has allowed Ghana and other heavily indebted nations to reach or be close to reaching agreements with their external creditors.

“In January 2024, the Official Creditor Committee (OCC) reached an agreement in principle with the Government of Ghana on the terms of the treatment of official bilateral debt. Debt restructuring negotiations allowed the International Monetary Fund to conclude financing programs and the World Bank to provide large positive net flows at highly concessional or grant terms.”

World Bank’s Africa Pulse Report, 2024

The report continued that many low-income and lower-middle-income countries in Sub-Saharan Africa have accumulated debt burdens — as reflected by their high levels of public debt and increased debt service.

Over the past decade, there has been a rapid escalation in public debt. What’s more, the types of creditors they owe money to have changed. Before, most of the debt was owed to governments of other countries. Now, a larger chunk is owed to private creditors and governments not part of the Paris Club.

This shift has made it harder for these countries to negotiate new terms for their debts. It has also made their debt payments even more burdensome. To make matters worse, interest rates in wealthy countries have gone up, which means these countries now have to pay even more to service their debts.

The China Debt Dilemma

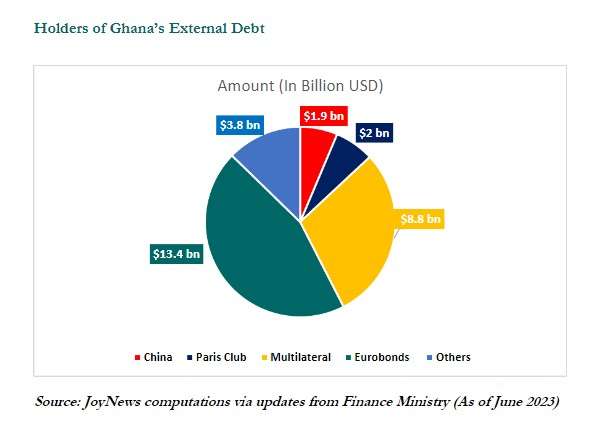

As of June 2023, holders of Ghana’s external debt include China ($1.9 billion), Eurobonds (13.4 billion), Paris Club ($2 billion), Multilateral ($8.8 billion), and Others ($3.8 billion).

Before the current debt restructuring talks between the government of Ghana and its external creditors, China had been the most reluctant to come to the negotiation table, and for a reason.

China has played a pivotal role in financing major projects in Ghana since the turn of the millennium, contributing nearly $5 billion through at least 41 Chinese project loans.

As of the end of 2022, all of Ghana’s collateralized debt was held by China, involving four loan agreements signed between 2007 and 2018, totaling $619 million for infrastructure projects.

These loans were secured against Ghana’s commodity production (including cocoa, bauxite, and oil) and electricity sales. In the event of default, China can utilize proceeds from Ghana’s resources and energy sales to settle the debt.

China therefore would prefer using proceeds from Ghana’s resources rather than restructuring because of its hunger for raw materials back home to feed its industries and boost growth.

Furthermore, historical data reveals that China is generally willing to cooperate with debtor nations during restructuring talks, particularly when the loans are interest-free. Between 2000 and 2019, China forgave 23 interest-free loans to 17 African countries, including Ghana.

Notably, interest-free loans constitute less than 5% of China’s $843 billion in loan commitments to 165 governments worldwide between 2000 and 2017. In essence, China is more likely to grant debt relief when the loans do not accrue interest.

An illustrative case is that of the Republic of Congo in 2019 when it attempted to restructure a debt of $1.3 billion owed to China. Chinese creditors agreed to extend the repayment period and raised interest rates.

However, rather than reducing the debt burden, this restructuring actually increased Congo’s debt to China to $1.6 billion, marking a substantial 23.07% increase.

Also, Zambia’s debt restructuring process encountered a similar challenge as China opposed a write-down, preferring an extension of the maturity period.

As such, since Ghana’s loans with China are currently not interest-free, it is highly unlikely China will write them off. Negotiations will likely take the trajectory of Congo and Zambia or China will opt to use Ghana’s collateralized resources.