Ecobank Transnational Incorporated (ETI), the parent company of Ecobank Ghana, has announced its fiscal year 2023 results, revealing a robust performance with net revenue soaring to $2.1 billion.

This remarkable achievement marks the first time since 2015 that the bank’s net revenue has exceeded the $2 billion mark, signaling a resurgence in its financial strength and market presence.

According to the Group’s audited financial statements for 2023, ETI witnessed a substantial growth trajectory, with a profit-before-tax of $531 million, demonstrating a notable increase compared to previous years.

This upswing in profitability was propelled by a strategic focus on revenue generation, as revenue growth outpaced expenses, leading to positive operating leverage. Consequently, the pre-provision, pre-tax operating profit (PPOP) surged to $951 million in 2023, reflecting the efficacy of ETI’s operational strategies.

Furthermore, ETI’s profit-after-tax amounted to $407 million, underlining the sustainability and resilience of its earnings amid a dynamic economic landscape. The Group’s profit available (attributable) to shareholders stood at $288 million for the fiscal year 2023, slightly surpassing the figure of $286 million recorded in 2022.

This growth in profit can be attributed to solid underlying performance in both funded (net interest income) and non-funded (non-interest revenue) revenues, coupled with disciplined cost management practices and stable credit costs across all business lines.

However, it is noteworthy that while ETI experienced a commendable increase in profits, higher profits available to non-controlling shareholders partially offset this growth. Nevertheless, the overall financial outlook remains positive, bolstered by ETI’s strategic initiatives aimed at enhancing shareholder value and sustaining long-term growth.

The Group’s Gross Impairment Charges On Loans and Advances

The Group’s gross impairment charges on loans and advances for 2023 amounted to $288 million, an increase of 7% or 12% in constant currency if compared with $270 million of gross impairment charges in 2022.

The increase in impairment charges is due to a gradual reserve increase for expected credit losses in an uncertain macroeconomic environment. Loan recoveries and the release of previously booked reserves for expected credit losses amounted to $143 million, compared with $260 million in 2022.

As a result, the net impairment charge for 2023 was $145 million, which is higher than the $10 million in 2022. The higher net impairment charges on loans and advances for 2023 resulted in a higher cost-of-risk of 1.28% compared to 0.09% for 2022.

ETI’s gross loans and advances (EOP) were $11.1 billion on 31 December 2023, compared to $11.5 billion on 31 December 2022. The year-on-year (YoY) decrease of 4% was primarily driven by foreign currency translation effects resulting from significant weaknesses in the local currencies of some of our subsidiaries versus the US dollar, such as the Nigerian naira, Ghana cedi and Zimbabwe dollar.

However, gross loans and advances increased by 15% reflecting underlying loan growth across business lines and regions, particularly in trade loans within Corporate Banking in the operating markets.

CEO of ETI, Jeremy Awori, speaking on the Group’s 2023 financial results said, “2023 was a challenging year for many households, businesses, and governments across Africa due to higher inflation, higher interest rates, weakening currencies, and uncertainty in the economic outlook”.

“We have worked closely with our customers and stakeholders through this period, and managed to make progress in our new strategic agenda and grew our business. Ecobank generated a return on tangible shareholders’ equity of 24.9% despite the challenging operating environment in 2023.

“Profit before tax increased by 8% or 34%, at constant currency, to $581m. Net revenue exceeded the $2.0bn mark for the first time since 2015, increasing by 11% or 31% at constant currency to reach $2.1bn. This performance demonstrates proof of the early successes of the bank’s 5-year Growth, Transformation and Returns (GTR) strategy.”

Jeremy Awori

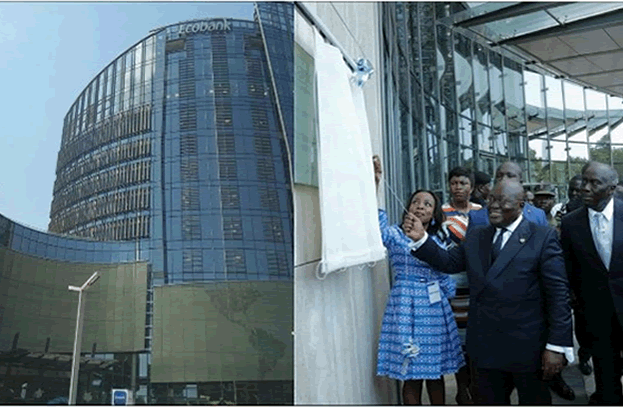

As Ecobank Ghana’s parent company continues to consolidate its position as a leading financial institution in the region, stakeholders can anticipate continued momentum and value creation in the years ahead.

READ ALSO: Amidst the Storm: Fixed Income Market Sees 10% Decline in April, Ramifications Unveiled