The Ghana Association of Banks (GAB) has firmly dismissed circulating claims that commercial banks in Ghana are moving to close personal foreign currency savings accounts by July 31.

This announcement comes amidst rising concerns and confusion among customers regarding the future of their foreign currency savings.

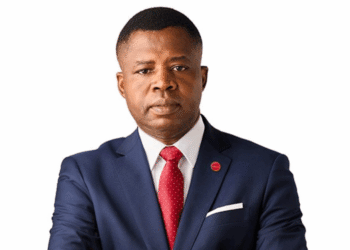

Mr John Awuah, the Chief Executive of the GAB, addressed the issue directly, emphasizing that no bank has decided to discontinue accepting deposits in foreign currencies. Instead, he highlighted that only one bank has opted to review its product offerings, resulting in the cessation of foreign currency savings accounts. This bank’s decision is not indicative of a wider trend across the banking sector.

Mr Awuah’s clarification is crucial as it dispels the misconception that the entire banking industry is collectively imposing new restrictions on foreign currency accounts. “No bank has taken any decision to discontinue deposits in foreign currencies,” he affirmed, “Rather, one bank has reviewed its product offerings and decided that they are not going to henceforth be operating using accounts in foreign currencies.”

Addressing Speculation and the Cedi’s Depreciation

The core issue, according to Mr Awuah, lies in the observed trend of customers hoarding foreign currencies in their savings accounts. This behavior, while seemingly benign, contributes significantly to currency speculation, which exacerbates the depreciation of the Ghanaian cedi. As the cedi continues to lose value, the tendency of customers to use foreign currencies as a store of value only deepens the currency’s woes.

To mitigate this, some banks are advising their clients to consider holding their foreign currencies in e-wallets or current accounts instead. This strategic shift is aimed at reducing the speculative activities that arise from the prolonged hoarding of foreign currencies in savings accounts.

From the banks’ viewpoint, the move to restrict foreign currency savings accounts is a proactive measure to stabilize the local currency. By discouraging the hoarding of foreign currencies, banks aim to curb the speculative pressures that fuel the cedi’s depreciation. This approach aligns with broader efforts to strengthen the national currency and maintain economic stability.

Mr Awuah elaborated on the banks’ stance, stating, “We observed a trend where customers hoard foreign currencies in their foreign currency savings accounts. A practice which is feeding into speculation and leading to the depreciation of the cedi, and we do not want to be part of this.” This statement underscores the banks’ commitment to addressing the root causes of currency depreciation and ensuring a more stable economic environment.

Impact on Businesses and Customers

While the decision to review foreign currency savings accounts might seem restrictive, it is important to note that businesses and individuals who engage in transactions involving foreign currencies are not left without options. According to Awuah, businesses can still utilize foreign currency current accounts or other types of accounts, such as Foreign Exchange Accounts, to facilitate their transactions.

This assurance is significant for businesses that rely on foreign currencies for their operations. By maintaining access to these accounts, banks ensure that essential economic activities can continue without disruption. This balanced approach aims to stabilize the cedi while accommodating the needs of businesses and individual customers.

Meanwhile, the decision by one bank to cease operating such accounts is a targeted measure aimed at reducing currency speculation and stabilizing the cedi. By encouraging customers to consider alternative holding options, banks are taking steps to mitigate the factors contributing to the cedi’s depreciation.

READ ALSO: Only A Matter Of Days Before Anxiety In Biden’s Party Boils Over