CalBank PLC, one of Ghana’s prominent financial institutions, has announced an impressive turnaround in its financial performance for the first half of 2024.

The bank reported a staggering 49.4% increase in Profit After Tax (PAT), reaching GHS 151.9 million, a significant rise from GHS 105.7 million during the same period last year.

This remarkable recovery is highlighted in the bank’s unaudited results, showcasing substantial improvements across key financial metrics.

The primary driver of this growth was a substantial surge in Net Fees and Commissions income, which soared by 130.1% to GHS 113.4 million, up from GHS 49.3 million in the first half of 2023. This impressive increase underscores the bank’s enhanced ability to generate fee-based income, a critical component of its revenue stream.

CalBank’s balance sheet also reflected positive trends, with Total Assets growing by 14.4% to GHS 10.9 billion. Concurrently, Customer Deposits increased by 9.6% to GHS 8.0 billion, indicating growing customer confidence and the bank’s effectiveness in attracting and retaining deposits despite recent challenges.

A significant milestone in CalBank’s recovery journey was the successful completion of a capital raise in June 2024, which brought in GHS 145.8 million. This initiative not only strengthened the bank’s capital position but also resulted in a positive equity of GHS 112.9 million, a marked improvement from the negative GHS 184.9 million reported at the end of 2023.

The turnaround is particularly noteworthy given the headwinds faced by CalBank in recent years. The bank had been grappling with the aftermath of the Domestic Debt Exchange Program (DDEP) in 2022 and significant impairment charges in 2023.

In response, management implemented a comprehensive review of operational tactics and enhanced the risk management framework to improve loan portfolio quality.

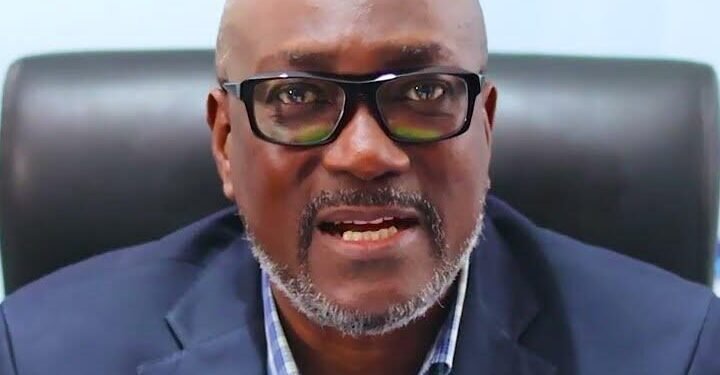

Carl Asem, Acting Managing Director of CalBank PLC, commented on the results saying “Our journey over the past two years has been one of the most challenging in the history of CalBank”.

“We have now emerged stronger and entirely focused on delivering value to our stakeholders. Our return to profitability and positive equity are significant milestones that reflect our dedication to the continued financial stability and sustainable growth of CalBank.”

Carl Asem

Return on Average Assets Improves

The bank’s performance indicators reflect this positive trajectory. Return on Average Assets (ROAA) improved to 5.8% from 2.3% in the first half of 2023, while Return on Average Equity (ROAE) saw a dramatic increase to 389.8% from 23.7%.

However, the Cost-to-Income Ratio rose to 83.1% from 64.0%, indicating higher operational costs relative to income. While this increase in operational costs might seem concerning, it is often a part of the growth process, especially when investments are made in critical areas like technology and risk management.

Analysts view CalBank’s return to profitability as a positive sign for Ghana’s banking sector, which has been grappling with the fallout from the government’s debt restructuring programme. However, given the persisting macroeconomic headwinds, they caution that the road to full recovery remains challenging. The banking sector in Ghana, while showing signs of resilience, must navigate through ongoing economic pressures and regulatory changes to sustain growth.

In the near future, CalBank has outlined strategies to sustain this growth momentum. These include enhancing product and service offerings, optimizing technology investments to improve operational efficiency, expanding the retail franchise, and maintaining rigorous risk management practices. These strategies are aimed at not only maintaining the current positive trajectory but also at building a resilient framework to weather future challenges.

As CalBank moves forward from this turnaround, all eyes will be on its ability to maintain this positive trajectory and address remaining challenges. The bank’s leadership expresses confidence in building on this momentum to further strengthen their capital position and drive sustainable growth in 2024 and beyond. The focus will be on consolidating gains and ensuring that the foundations laid during this recovery phase support long-term growth and stability.

CalBank’s financial performance in the first half of 2024 is a testament to effective management and strategic foresight, positioning the bank as a resilient player in Ghana’s banking sector.

READ ALSO: Rebound of Ghanaian Bond Market, A Positive Signal for Investors- Analyst