Following the National Democratic Congress (NDC) betting tax policy, Francis Timore Boi Esq. Tax Analyst has disagreed with the NDC’s removal of the betting tax policy.

Francis Timore Boi pointed out the global perspective of betting as a form of investment and the importance of maintaining a fair and balanced taxation system that encourages participation while ensuring revenue generation for the state. Timore Boi began by revisiting the history of betting taxation in Ghana. He pointed out that in 2015, the country passed an income tax law that imposed a 5% tax on winnings from betting. This tax applied only to winnings, and not to losses, with the rationale that “each event is seen as a separate activity.”

According to Timore Boi the approach is to recognize the nature of betting as a series of independent transactions, with each win considered a taxable event.

Timore Boi emphasized that by 2016, it became apparent that frequent bettors who often lost needed some form of cushioning. In response, the government introduced a threshold of GHS 2,592. However, Under this new rule, the 5% tax would only be applied to winnings above this threshold, thereby providing some relief to bettors who won small amounts. This move was intended to strike a balance between generating revenue and not overly burdening individuals who frequently lost money in betting activities.

Meanwhile, Policy Reversal and Industry Impact In 2017, the government decided to scrap the betting tax altogether. This decision was heavily influenced by concerns raised by the National Lottery Authority (NLA), which argued that the tax was negatively impacting the betting industry.

However, Timore Boi questioned this decision, pointing out that the global betting industry was experiencing significant growth.

“Globally, betting has been estimated to be at a growth rate very high, between 2016 and 2022 alone. It’s moved from $70 billion to $90 billion.”

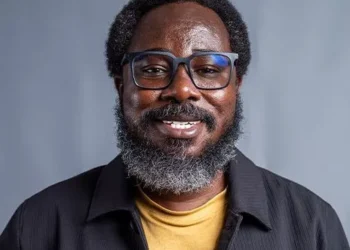

Francis Timore Boi Esq. Tax Analyst

He further projected that by 2030, the industry could reach a value of $200 billion.

Timore Boi’s emphasized that betting should be viewed as an investment, given its substantial growth and the involvement of significant capital.

Timore Boi argued that instead of scrapping the betting tax, the government should consider modifying it.

“I think that what [the government] should do is to rather make changes to it. The 10% [proposed tax] I think is too high. Let’s bring it back to the 5% and then let’s leave it as an investment income.”

Francis Timore Boi Esq. Tax Analyst

This perspective aligns with the idea that betting, like any other form of investment, should contribute to national revenue.

Timore Boi’s argued that to revert to the 5% tax rate while maintaining it as an investment income tax suggests a middle ground that could satisfy both the government’s revenue needs and the industry’s concerns about the impact of high taxation on participation.

Challenges and Alternatives

Timore Boi emphasized that tax removal would be a challenge for the country as he pointed out the potential loss of revenue. He highlighted the difficulty in finding alternative sources of revenue if the betting tax were to be removed, especially given the significant growth in the betting industry.

“There’s no other way. If you are looking at it at the national level, what other revenue measure do we have to, bring in if we are dropping this betting tax?”

“Let’s not scrap it. Let’s rather make changes to it. And then by that, we can widen the base for anybody who participates in betting or investment income, and then they also contribute to the coffers.”

Francis Timore Boi Esq. Tax Analyst

Francis Timore Boi analysis of the NDC betting tax policy underscored the importance of maintaining a balanced approach to taxation in the betting industry.

READ ALSO: Minister OJ Urges for Deeper and Richer Gospel Music Content