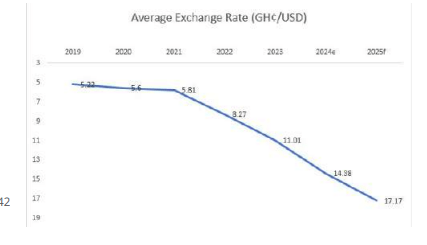

The Ghanaian cedi is projected to conclude 2024 at a rate of GH¢16.07 to one US dollar, with a slight depreciation to GH¢17.23 by the end of 2025.

This forecast, outlined in Deloitte’s report titled “Sneak Preview of 2025” and supported by insights from the Economist Intelligence Unit (EIU), sheds light on the cedi’s expected performance over the next two years.

According to the EIU, the expected depreciation of the cedi in 2024 is primarily attributed to reduced cocoa export earnings and an anticipated rise in Ghana’s import bill. These economic pressures are expected to weaken the cedi, particularly towards the latter part of 2024.

However, 2025 presents a more optimistic outlook, driven by factors such as enhanced investor confidence following a peaceful electoral process and the successful conclusion of the government’s debt restructuring negotiations.

Additional support will come from periodic International Monetary Fund (IMF) disbursements and increased gold export receipts, which are expected to bolster Ghana’s international reserves and stabilize the currency.

At present, the cedi is trading at approximately GH¢16.10 to the dollar on the retail market, demonstrating the currency’s ongoing challenges in maintaining stability against external pressures.

Implications for Ghana’s Economy

A relatively stable exchange rate is crucial for restoring investor confidence in Ghana’s economy, as highlighted by Deloitte in its analysis. Stability in the cedi can significantly impact investment decisions, especially in sectors such as manufacturing, trade, and services, which rely heavily on currency predictability for planning and operations.

Nevertheless, risks to this stability remain. Deloitte notes that increased imports in the services sub-sector, including hydrocarbons and mining projects, could exert downward pressure on the currency.

Additionally, a more pronounced decline in cocoa exports could narrow Ghana’s trade surplus, negatively affecting the current account balance. The forecasted decline in the country’s current account balance—from an estimated $1.6 billion in 2024 to $700 million in 2025—underscores the economic vulnerabilities that could undermine cedi stability.

Cocoa and gold, two of Ghana’s key export commodities, will play pivotal roles in determining the trajectory of the cedi over the forecast period.

A decrease in cocoa exports, whether due to global price fluctuations or production challenges, could limit foreign exchange inflows, exacerbating currency pressures. Conversely, higher gold export receipts, driven by favorable prices or increased production, are expected to support Ghana’s international reserves and stabilize the cedi in 2025.

Impact of IMF Disbursements and Debt Restructuring

The ongoing periodic disbursements from the IMF, coupled with successful debt restructuring negotiations, will be critical to Ghana’s economic recovery efforts. These measures not only enhance the country’s creditworthiness but also provide a cushion against external shocks, thereby contributing to a more stable currency environment.

The peaceful conclusion of Ghana’s 2024 general elections is also projected to have a significant impact on investor sentiment. Historically, political stability has been a key factor in attracting foreign direct investment and maintaining confidence in the country’s financial markets.

Despite the positive projections for 2025, the road ahead is fraught with challenges. A significant rise in imports, particularly for hydrocarbons and mining projects, could increase demand for foreign exchange, putting pressure on the cedi. Additionally, global economic uncertainties and commodity price volatility could further complicate Ghana’s efforts to stabilize its currency.

To mitigate these risks, policymakers must prioritize measures to diversify the economy, reduce dependency on imports, and enhance value addition in key export sectors. For instance, boosting domestic cocoa processing capabilities could help Ghana retain more value from its cocoa exports, while investments in renewable energy could reduce reliance on imported hydrocarbons.

Meanwhile, the EIU’s forecast of a marginal depreciation of the cedi to GH¢17.23 by the end of 2025 provides a mixed outlook for Ghana’s economy. While the anticipated stability in 2025 is a welcome development, the risks associated with declining cocoa exports and rising import bills highlight the need for proactive economic management.

The coming years will test Ghana’s resilience and ability to leverage its strengths—such as gold exports and IMF support—while addressing its vulnerabilities.

READ ALSO: IPMAN Assures Nigerians of Adequate Festive Fuel Supply