In an exclusive interview with Vaultz News, Ms. Gifty Annor-Sika Asantewah, a seasoned financial market analyst and President of Women in Forex Ghana, has projected a sustained decline in treasury bill (T-bill) yields over the coming quarters, driven by improving macroeconomic indicators and investor sentiment.

According to Ms. Asantewah, the fixed income market is entering a new phase of stability, with expectations that yields across the local currency (LCY) yield curve will gradually trend downward from the second quarter of 2025 through to the end of the year.

“We’re seeing a shift toward more constructive fiscal and monetary dynamics. These improvements are laying the groundwork for broad-based yield compression, especially at the front and belly of the curve.”

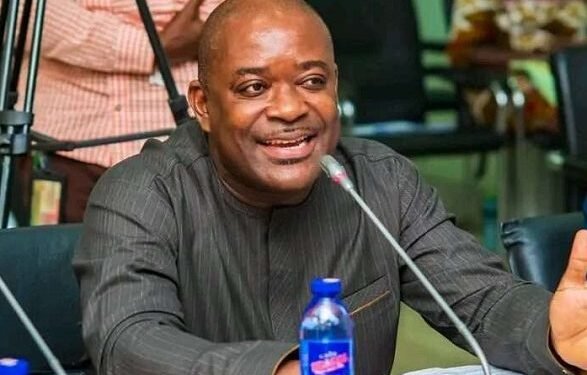

Ms. Gifty Annor-Sika Asantewah

She emphasized that this outlook is supported by the government’s renewed commitment to fiscal discipline, a trend highlighted in the 2025 national budget. The budget outlines a significant GHS10 billion cut in expenditure and an ambitious GHS37 billion boost in revenue, which she described as “the clearest sign yet of a turning tide in fiscal consolidation.”

Persistent Disinflation and Investor Confidence

Ms. Asantewah also pointed to persistent disinflation, favorable commodity price movements, and a relatively stable cedi as further anchors for investor optimism. “Disinflation isn’t just about falling prices—it’s about restoring investor confidence in the country’s long-term stability,” she asserted. “As inflation expectations recede and macroeconomic fundamentals firm up, yields will naturally adjust downward.”

She added that these developments are poised to reshape investment behaviors.

“We’re seeing a pivot from the frantic hunt for short-term gains toward a more nuanced strategy centered around value and security. Investor psychology is changing, and that alone will influence the direction of yields.”

Ms. Gifty Annor-Sika Asantewah

However, the high interest rates on Open Market Operations (OMO) remain a potential risk. According to Ms. Asantewah, OMO rates provide a competitive alternative for commercial banks, which are key players in the T-bill market. “OMO tools, if not properly coordinated with treasury operations, could distort the yield curve by creating artificial demand pressures,” she warned.

Q1 Treasury Performance: A Sign of Confidence

Touching on recent market activity, Ms. Asantewah highlighted the strong performance of treasury auctions in the first quarter of 2025. The government recorded total bids worth GHS136.87 billion across the 91-day to 364-day bills, exceeding the original target of GHS83.74 billion by over 60%. The Treasury accepted GHS95.01 billion in bids, reflecting investor confidence despite declining interest rates.

The 364-day bill was the standout performer, attracting GHS19.77 billion in bids—a 171% increase quarter-on-quarter. “This surge in demand for longer-dated bills shows that investors are still positioning to lock in yields before the broader market reprices downward,” Ms. Asantewah explained.

Yet, she cautioned that while the appetite remains strong, the current negative real returns and elevated maturities could exert downward pressure on yields, potentially holding them within the 15.00% to 16.50% range in the second quarter of 2025.

Outlook on the Bond Market

On the outlook for the bond market, Ms. Asantewah remains cautiously optimistic. While the 2025 budget hints at potential bond issuance later in the year, she does not anticipate any activity in Q2. “At the moment, yields at the front end of the curve are simply too high to make long-tenor issuance cost-effective,” she stated.

She explained that investors are likely to demand steep risk premiums for longer-dated bonds due to lingering fiscal risks and the relatively short time horizon since the last round of debt restructuring.

“There is still some healing to do in the market. Issuing long-term bonds now would not only be expensive but also send mixed signals about the government’s confidence in its current fiscal path.”

Ms. Gifty Annor-Sika Asantewah

As such, she expects the Treasury to continue focusing on short-term instruments while aggressively trimming T-bill yields to reduce borrowing costs. “In this climate, the strategy should be to build credibility with short-term wins, then leverage that for longer-term capital market re-engagement later in the year.”

Final Thoughts

Ms. Gifty Annor-Sika Asantewah underscored the importance of policy consistency and market communication.

“Markets respond to confidence, and confidence is built through predictability and discipline. If government maintains this trajectory—fiscal responsibility, inflation management, and strategic issuance—we will not only see lower yields but also a more resilient investment climate in Ghana.”

Ms. Gifty Annor-Sika Asantewah

Meanwhile, her insights paint a cautiously optimistic picture for the second half of 2025, with market watchers advised to keep a close eye on macro trends, policy reforms, and investor behavior in the fixed income space.

READ ALSO: Cedi Projected To Outperform Fitch’s 2025 Forecast