Author: Evans Senior Owu, a Researcher, Policy Analyst, and Freelance Columnist

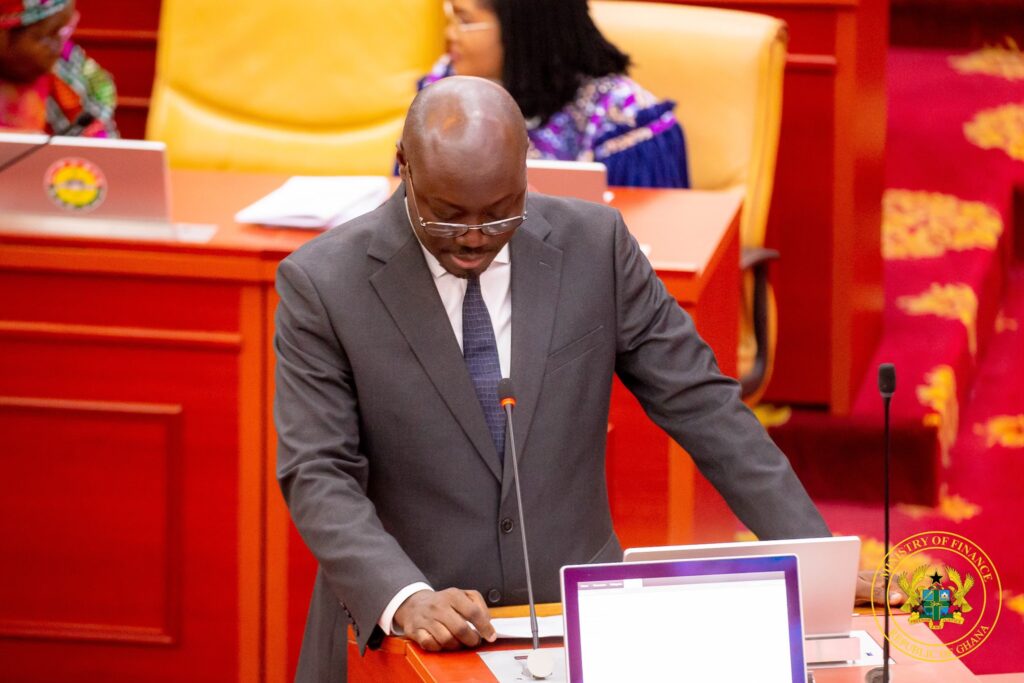

On Tuesday, 3rd June 2025, the Parliament of Ghana passed the Energy Sector Levies (Amendment) Bill, 2025, into law after laying before the House by the Minister of Finance and the Member of Parliament for Ajumako-Enyan-Esiam, Dr Casiel Ato Forson, under a certificate of urgency.

The bill, having been introduced under the certificate of urgency, allowed it to pass through the entire legislative process the same day and received the House approval at midnight of 3rd June 2025.

The President of the Republic of Ghana, John Dramani Mahama, subsequently assented to the bill on Thursday, June 5, 2025, to bring finality to the amendment process of the ESLA Act 2025.

The somewhat controversial ESLA amendment was passed without the usual drama; the Minority side of Parliament walked out of the House before its passage following vehement opposition to the proposed amendment, describing it as insensitive to the plight of the Ghanaian people.

Aside from the oral arguments that were made in support of the bill during its introduction and debate in the House by both the Finance Minister and the Energy and Green Transition Minister, the memo that accompanied the proposed amendment outlined a very compelling case in support of it.

The memorandum disclosed that the object of the bill was to increase the rate of the Energy Sector Shortfall and Debt Repayment levy in order to raise additional revenue to support the payment of energy sector shortfalls, reduce energy sector legacy debts, and stabilise power supply through the purchase of liquid fuel.

Further, the memorandum comprehensively put out the current gloomy state of the energy sector as the biggest economic and fiscal risk presently faced by Ghana’s economy, with the high potential to escalate into a major crisis if urgent resolution is not pursued.

It stated that the total energy sector debt as of March 2025 stood at USD 3.1 billion. These debts include arrears owed to independent power producers, state-owned enterprises, and fuel supplies.

Moreover, Ghana’s power sector has evolved from heavily hydroelectric sources to thermal power generation, with its consequent purchase of high-cost liquid fuel to complement the powering of the thermal plants, apart from natural gas.

According to the memorandum, the Public Utility Regulatory Commission disclosed that the cost of the liquid fuel to power the thermal plant generation is not included in the current electricity tariff build-up, resulting in a significant revenue shortfall for the procurement of liquid fuel.

The Utility Commission further indicated that the inclusion of the cost of the liquid fuel in the tariff build-up will lead to an increase in electricity tariffs by 50%.

According to the Finance Minister, the government’s policy position is that such a tariff adjustment would have a higher negative impact on industry and household income; therefore the need to take advantage of the windfall in the decrease of petroleum prices from average of ¢16 per litre to ¢12 following the strong performance of the Ghana cedi to its counterpart trading currency like the US dollar.

The government estimates that it will require about USD 1.2 billion annually to procure liquid fuel for power generation alone; therefore, the opportunity forgone of not adjusting the electricity tariff by 50% is the imposition of GHS 1 per litre on petroleum products.

The sector minister, whose sub-sector threatening affairs has necessitated the petroleum levy increase of GHS 1 per litre, says the levy proceeds (of about GHS 5.7 billion annually) would be used to support the procurement of liquid fuel needed to complement the powering of the thermal plant.

President John Mahama has added his voice in defense of the additional GHS 1 fuel levy imposition, describing it as a difficult but necessary measure to rescue Ghana’s heavily indebted energy sector and prevent further power crises.

He further assured that the estimated GHS 5.7 billion in annual revenue from the levy will be ring-fenced from the Consolidated Fund and used specifically for its intended objectives (i.e., payment of legacy energy sector debts, finance critical fuel purchase, etc) and will be subjected to regular audit with its report made available to the public to ensure transparency.

For all its well-intended objective, this additional fuel levy will obviously affect petroleum users’ income. While the argument that the cedi’s strong performance in the last few months against the US dollar will absorb the impact of the levy adjustment, it is sufficient to say that the levy adjustment would be seen in the petroleum prices build-up, therefore in the event of its absence would have made petroleum products much cheaper.

Yes, under the leadership of this new government that assumed office on 7th January 2025, it has managed our economy quite very well to deliver an exchange rate of averagely GHS 10.25 from GHS 15.1 (December 2024), a decreased inflation of 18.40% (as of May) the lowest point since February 2022, which has culminated in decrease in prices of goods and services especially petroleum products.

Therefore, while the government can take advantage of its output from the better management of the economy, it goes without saying that it is the very reason why it was elected into office after the Ghanaian people experienced the worst economic crisis in living memory under the erstwhile administration.

Even more importantly is the manner in which the entire amendment process was carried out with little scrutiny from the civil society organisation, key stakeholders in the petroleum sector, and the general public.

This position is evidenced by the pushback received from the Chamber of Oil Marketing Company of their inability to implement the new levy adjustment by the June 9th, 2025 schedule, which compelled the Government through the Ghana Revenue Authority to revise the date of implementation to 16th June 2025.

Yes, the John Mahama-NDC government has indeed been given a four-year mandate to govern this nation of ours and deliver on its social contract with the Ghanaian people.

The President himself has acknowledged that he was not only elected to take soft but also hard/tough decisions in line with the government’s vision of resetting and building the prosperous Ghana we all desire.

In that sense, I believe a lot of people may hold the view that the government should be allowed to decide, act, and be judged after the four-year mandate.

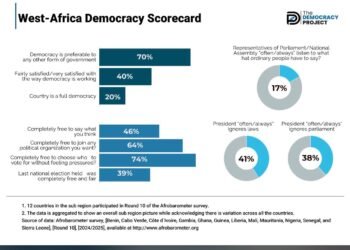

However, I differ; ours is a participatory democracy that features two main methods of participation (i.e., vote and voice).

Beyond the electorate’s endorsement through their votes of the current regime, their voice must both be sought, listened and reflected in the way this country is governed, throughout the four-year tenure, especially when it comes to the imposition of taxes that have a broader impact on all households.

I am still young in Ghana’s political happenings, but if there’s one thing that I know depletes public goodwill of a government is giving a breath to a narrative that suggests that the people in power reserve the right to decide and act without listening to the very people on whose behalf they govern.

With the abundance of verifiable public dissatisfaction with our democracy’s performance, it takes a lot to attract the kind of public endorsement and goodwill the current regime have secured from the citizens.

It is therefore too early to give room to the least suspicion of arrogance of power; a government that is committed to securing the trust of the Ghanaian people in our fragile democracy must guard itself against that tendency at all material times.

Finally, while the precarious state of the power sector, within the broader context of government fiscal responsibility and debt sustainability agenda, may necessitate urgent financial interventions such as the fuel levy adjustment, it is imperative to remind the Finance Minister of his solemn commitment to the Ghanaian people: that the inefficiencies of ECG and other power sector actors will not be passed on to consumers—whether through electricity tariffs or tax burdens.

The recent ministerial investigative report led by Professor Innocent Senyo Acquah into ECG’s operations (ECG Ghana’s Container Holdup at Tema Port and Related Procurement Issue) provides incontrovertible evidence of systemic inefficiencies that demand immediate and decisive action.

These include over-procurement driven by undue leadership pressure; management negligence that resulted in a GHS 909 million demurrage loss; failure to utilize internal capacity for container clearance in favour of costly third-party contracts worth GHS 159.65 million; and the unchecked use of non-competitive procurement practices such as single-sourcing and RFQs.

Moreover, the inability to account for over 1,346 containers valued at USD 489 million, the use of unregistered clearing agents, instances of tax evasion, blatant non-compliance with public procurement laws, and extreme procurement budget overruns of up to 790% in 2023 and 487% in 2024 all paint a grim picture.

These inefficiencies must not be masked or excused by the imposition of new levies. Instead, they must be confronted boldly and transparently.

More importantly, the government must ensure that its actions to address these inefficiencies are not communicated to the public in a piecemeal or opaque fashion.

Rather, they should be presented in a deliberate, coordinated, and tangible manner—one that earns the trust of the people and justifies any call for national sacrifice.

READ ALSO: President Mahama Ends Zoomlion ‘Waste Mines’