The First Deputy Governor of the Bank of Ghana (BoG), Dr. Zakari Mumuni, has issued a powerful warning about the devastating financial and social impact of cybercrime in Africa, calling for cybersecurity to be prioritized as a fundamental element of financial governance.

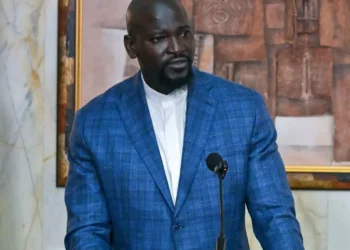

Speaking at the 14th Annual Africa Financial Inclusion Policy Initiative (AfPI) Roundtable in Accra, Dr. Mumuni revealed that the continent loses an estimated US$4 billion annually to cyber fraud.

Held under the theme “Strengthening Cyber Resilience in Digital Financial Services in Africa: The Role of Financial Regulators,” the high-level meeting was co-hosted by the BoG and the Alliance for Financial Inclusion (AFI). It brought together central bank officials, policymakers, and financial regulators from across Africa to address the growing cybersecurity risks threatening financial inclusion and digital progress.

Dr. Mumuni underscored the urgency of placing cybersecurity at the core of Africa’s digital financial ecosystem. “Cybercrime is not a distant risk. It is a present danger,” he warned. According to him, in 2022 alone, Ghana recorded over 21,000 cyber fraud attempts targeting the financial sector, with a significant number focusing on digital platforms.

He highlighted that across Africa, the annual financial loss from cybercrime now exceeds US$4 billion, referencing data from Interpol. “This reality underscores a simple truth,” Dr. Mumuni stressed. “Financial inclusion without system integrity is unsustainable. Cybersecurity is no longer an IT issue. It is a strategic imperative at the core of financial governance.”

His remarks sent a strong signal to stakeholders about the critical need for coordinated reforms, national strategies, and institutional capacity-building to counter the rising cyber threat.

Digital Financial Inclusion at a Crossroads

The AfPI Roundtable came at a pivotal moment in Africa’s digital transformation journey. Financial technology has accelerated the expansion of services to low-income and previously unbanked populations. Yet, as digital access expands, so do the threats.

CEO of the Alliance for Financial Inclusion, Dr. Alfred Hannig, echoed Dr. Mumuni’s sentiments, noting that while digitalization has made financial services more accessible, it has also introduced new layers of vulnerability. “Technologies come with risks which, as you all know, could have dramatic consequences, especially for the vulnerable. Because if we don’t get it right, poor people can lose the little they have in just one day,” Dr. Hannig warned.

He praised the growth of digital payments and transfers across Africa but insisted that inclusion must be matched with security. “The financial ecosystem is evolving fast,” he added, “and while we celebrate the gains, we must also shield the weakest participants from catastrophic losses.”

Strengthening Resilience Through Regulation and Collaboration

The AfPI forum served as a call to action for African regulators to proactively engage in cybersecurity policymaking and oversight. Experts at the event urged the need for cross-border collaboration, the sharing of intelligence, and harmonization of cyber regulations to outpace the ever-evolving tactics of cybercriminals.

The discussions focused on strategic responses such as developing real-time fraud detection systems, national cyber incident response teams, and sector-wide simulation exercises to test resilience. There was also a strong push for integrating cybersecurity into broader financial sector reforms and digital finance strategies.

Africa’s digital financial future depends not only on access and affordability but on trust and security. As countries continue to roll out digital platforms, mobile money services, and fintech innovations, the call to embed cybersecurity into every layer of financial governance is more urgent than ever.

The BoG’s leadership in hosting the AfPI Roundtable reflects Ghana’s commitment to setting high standards for digital financial security on the continent. With cybercrime evolving in sophistication, the role of financial regulators is no longer optional—it is central to protecting economic stability and safeguarding the very progress Africa has made in financial inclusion.

READ ALSO: The Market Voting With Its Wallet!– Analyst Slams Gov’t Over T-Bill Shortfall