Engineers & Planners (E&P), Ghana’s leading indigenous mining and engineering company, has strongly defended its acquisition of Azumah Resources Ghana Limited, rejecting as “false and malicious” claims circulating in sections of the media about the deal’s integrity.

In a statement issued on July 8, 2025, the company described the allegations as deliberate attempts to sabotage what it calls a historic transaction for Ghana’s mining sector. “The agreement to acquire the project was signed on October 9, 2023, at our offices in Roman Ridge, Accra,” said Emmanuel Erskine, E&P’s Business Development Director.

“Every milestone in this transaction—including the offer letter for financing—was satisfied before the elections.

“Claims that the government or its appointees influenced this acquisition in any way are completely false.”

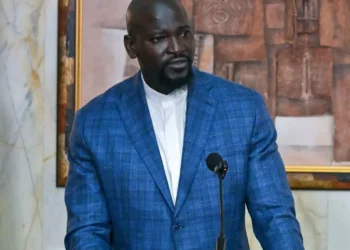

Emmanuel Erskine, E&P’s Business Development Director

The controversy revolves around E&P’s $100 million acquisition of Azumah Resources’ gold concession in the Upper West Region, a deal the company insists was lawfully negotiated and executed in October 2023—more than a year before Ghana’s 2024 general elections.

The mine, previously owned by Australian shareholders, had been underperforming for decades. Azumah Resources Ghana Limited was granted a lease in 1992 but, by 2022, had failed to undertake significant exploration activities.

Additionally, the company had accrued debts exceeding $5 million to the Ghana Revenue Authority and the Minerals Commission. A judgment by both the High Court and the Court of Appeal allowed GRA to move to liquidate Azumah’s assets.

Facing mounting liabilities and with global gold prices depressed at the time, Azumah’s shareholders approached E&P in May 2023 with an offer to sell the project for $100 million.

Despite the risks—including political instability in neighbouring Burkina Faso and the company’s financial woes—E&P agreed to the deal, even though internal assessments had valued the project at less than $80 million.

Under the agreement, E&P assumed operational control of the project, funding its operations with approximately $500,000 monthly since November 2023. By January 2024, E&P had appointed two representatives to Azumah’s board, as stipulated in the acquisition contract.

However, tensions erupted in August 2024 when Azumah director James Wallbank demanded a price increase to $300 million, citing a sharp rise in global gold prices. E&P rejected this demand, leading Azumah to attempt to unilaterally terminate the agreement in December 2024.

Act in Good Faith

In response, E&P initiated arbitration proceedings in October 2024 and secured a High Court ruling in June 2025, which upheld the validity of the original agreement and declared the purported termination null and void. “We have acted in good faith throughout this process,” Mr. Erskine explained.

“Azumah’s own directors accompanied our executives to Lomé, Togo, to meet with EBID as part of our financing arrangements.

“This isn’t politics; it’s a commercial transaction conducted at arm’s length.”

Emmanuel Erskine, E&P’s Business Development Director

On July 7, 2025, E&P signed a $100 million facility agreement with the ECOWAS Bank for Investment and Development (EBID) to finance the acquisition.

Media reports suggested Azumah’s absence from the signing ceremony cast doubt on the transaction’s legitimacy. E&P countered that Azumah’s presence was not required as the deal was between EBID and E&P as borrower.

“The resident directors of Azumah were present at the signing. Claims to the contrary are yet another attempt to distort facts.”

Emmanuel Erskine, E&P’s Business Development Director

E&P accused unnamed parties of “creating conditions that would have made it difficult for us to raise the required acquisition capital.” The company alleged there were vested interests seeking to derail the deal so that some Azumah directors could exploit surging gold prices.

Now armed with a “No Objection” letter from the Minerals Commission, E&P says it is moving forward.

The company intends to make full payment to Azumah’s shareholders and commence mine development, targeting first gold production within 36 months.

“This is a landmark achievement—the first time a wholly Ghanaian-owned company has acquired a large-scale gold mine.

“Ghanaians should support their own and not allow mercenaries to distract from this historic project.”

Emmanuel Erskine, E&P’s Business Development Director

The company reiterated its commitment to transparency and ethical practices, warning that it reserves the right to pursue legal action against any individuals or media outlets publishing defamatory claims.

“This transaction has been scrutinised at every level and meets the highest commercial standards.

“Attempts to politicise or smear it are not only unhelpful but detrimental to Ghana’s economic progress.”

Emmanuel Erskine, E&P’s Business Development Director

As E&P pushes ahead, industry observers say the dispute underscores both the opportunities and challenges for indigenous companies operating in Ghana’s high-stakes extractives sector.

READ ALSO: Ghana Edges Closer to Debt Relief as Finance Minister Hails “Monumental Step” After China Talks