Leading Oil Marketing Companies (OMCs) in Ghana, TotalEnergies, GOIL, and Star Oil have increased prices of petrol and diesel at their pumps, effective today, July 16, 2025. The adjustments come in line with projections for the second pricing window of the month and the government’s implementation of a GHS 1.00 fuel levy on petrol and diesel.

TotalEnergies has taken the lead with the highest upward adjustment among the three major OMCs, now retailing petrol at GHS 13.30 per litre and diesel at GHS 14.50 per litre.

This represents a significant increase, positioning the multinational as the most expensive among the leading retailers.

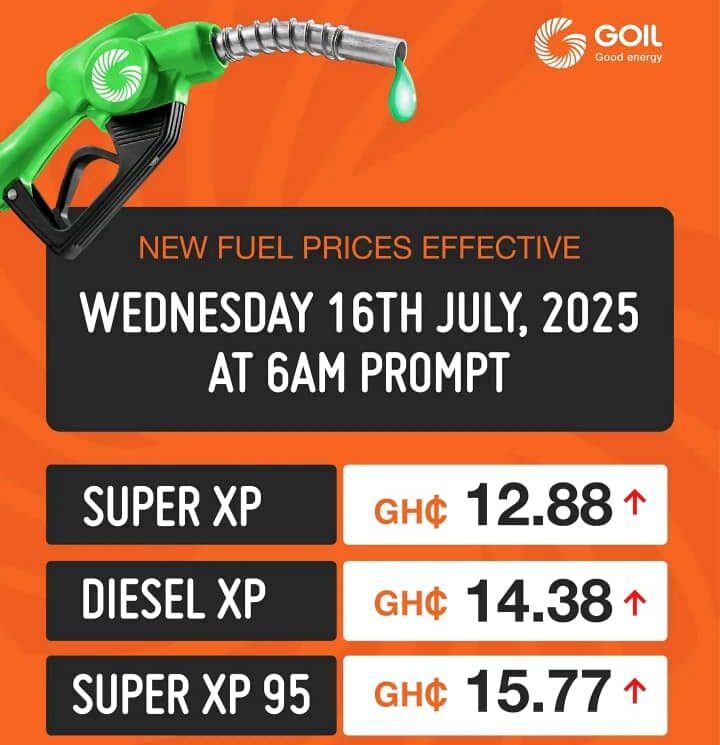

GOIL, the state-owned petroleum distributor, has pegged its petrol at GHS 12.88 and diesel at GHS 14.38 per litre.

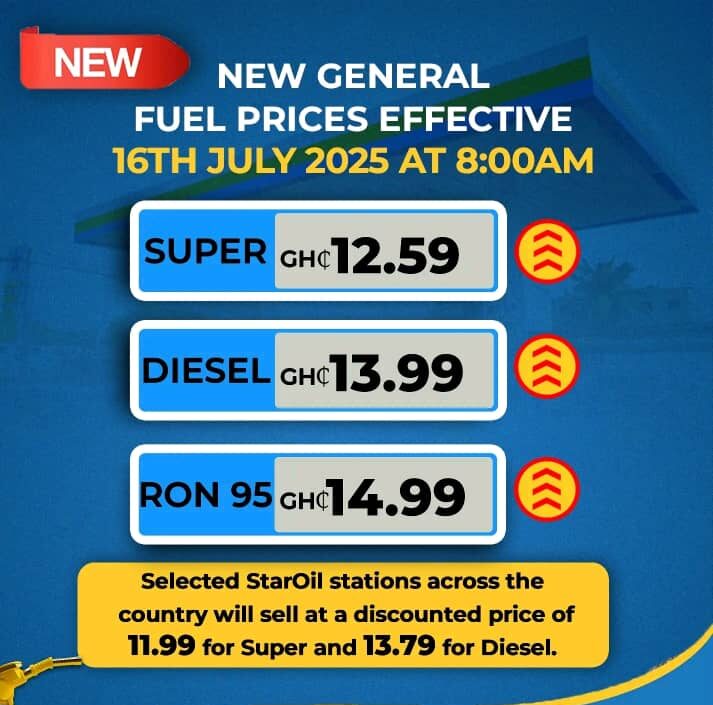

Market leader Star Oil, known for its relatively competitive pricing strategy, has raised prices as well, now selling petrol at GHS 12.59 and diesel at GHS 13.99.

However, price variability persists across Star Oil outlets. Some of its service stations are reportedly offering petrol at GHS 11.99 and diesel at GHS 13.79, reflecting regional pricing dynamics and supply considerations.

Other smaller OMCs are expected to announce their price changes later today.

Levy-Driven Surge, Not Global Alone

The price adjustments are largely attributed to the government’s newly applied GHS 1.00 per litre fuel levy, which came into effect today.

“If the levy had not taken effect, consumers could have seen a reduction in pump prices by about 2%. “Unfortunately, this levy has offset the gains from marginal global price stability and improved forex conditions.”

Dr. Riverson Oppong, Chief Executive of the Chamber of Oil Marketing Companies (COMAC)

While Ghana’s local currency, the cedi, has shown signs of stability in recent months, the effect of global crude oil prices, combined with the new tax, has tilted the scales toward higher consumer prices.

The average fuel price across the country now stands at GHS 14.44 per litre, compared to GHS 11.59 just three months ago. The development is expected to trigger a ripple effect across the economy, particularly on transportation costs, logistics, and commodity pricing.

COMAC had earlier projected 8% to 10% rise in fuel prices for July’s second pricing window, citing both international crude market pressures and internal fiscal measures like the levy.

“The price increases are consistent with market fundamentals. “However, sustained forex stability and efficient supply chain management remain critical if we are to avoid more hikes in the future.”

Dr. Riverson Oppong, Chief Executive of the Chamber of Oil Marketing Companies (COMAC)

Experts warn that while the levy helps the government in raising revenue for infrastructure and energy-sector projects, it could also stoke inflationary pressures, already a concern for many Ghanaians.

Government Regulatory Response

The National Petroleum Authority (NPA) is expected to monitor compliance with the new levy and ensure that OMCs do not exploit the adjustment window for excessive profiteering.

Meanwhile, the government has reiterated its stance that the reintroduction of the GHS 1 levy was necessary to stabilise the energy sector and address mounting arrears.

Despite opposition during initial consultations, energy officials maintain that the levy will support infrastructure development and bolster power sector reforms in the medium term.

Despite the challenges, market watchers suggest that if global oil prices hold steady and the cedi remains relatively stable, the next pricing window in August could bring some relief.

As the second pricing window of July 2025 opens with a hike in fuel prices, Ghanaians are bracing for cost increases across the board.

While some OMCs are offering slight variations in pricing, the overall market consensus points to a period of cautious monitoring, policy reassessment, and consumer adaptation.

READ ALSO: IMF Names Seasoned Economist Dr. Adrian Alter as New Country Representative in Ghana