A new report by professional services firm Deloitte is throwing the spotlight on a long-underestimated asset — the non-oil sector.

According to the firm’s Macroeconomic Outlook, the non-oil sector is fast emerging as Ghana’s most reliable driver of long-term growth and macroeconomic stability, especially in light of recurring oil output volatility and global commodity price fluctuations.

The report underscores the risks Ghana faces due to its exposure to the highly volatile oil and gas market, which is increasingly affected by global geopolitical tensions, especially in the Middle East. Supply chain disruptions, rising transportation costs, and falling domestic oil output have all created significant challenges for Ghana’s industry sector.

“The contraction in oil output highlights the urgency for economic diversification to mitigate exposure to commodity price shocks and production volatility,” Deloitte’s analysis stated.

Why the Non-Oil Sector Matters Now More Than Ever

While Ghana has long celebrated the role of its petroleum industry in spurring growth, Deloitte’s latest findings suggest that the real safety net for the economy lies in non-oil sectors, including agriculture, services, and non-oil manufacturing. These sectors are proving to be more resilient and adaptive in the face of domestic and external shocks.

According to Deloitte, the non-oil sector is now expected to remain the cornerstone of economic expansion, contributing significantly to employment, GDP growth, and investment opportunities.

In particular, digitalisation and mobile financial services have powered the services sector, while emerging investments in non-oil manufacturing and agribusiness are setting the stage for broader economic transformation.

“The dynamic nature of the non-oil sector is paramount for Ghana’s economic stability and is expected to remain the crucial driver of Ghana’s economic growth.”

Deloitte

IMF Programme Backing the Shift

The continued implementation of Ghana’s IMF-supported economic programme is seen as a critical factor in stabilizing macroeconomic conditions and laying the groundwork for the shift toward non-oil-driven growth. The government’s adherence to reform targets has already restored some investor confidence and helped secure improved credit ratings.

Deloitte maintains that commitment to the IMF programme will be vital in ensuring policy continuity and fiscal discipline, both of which are needed to unlock the full potential of non-oil sectors.

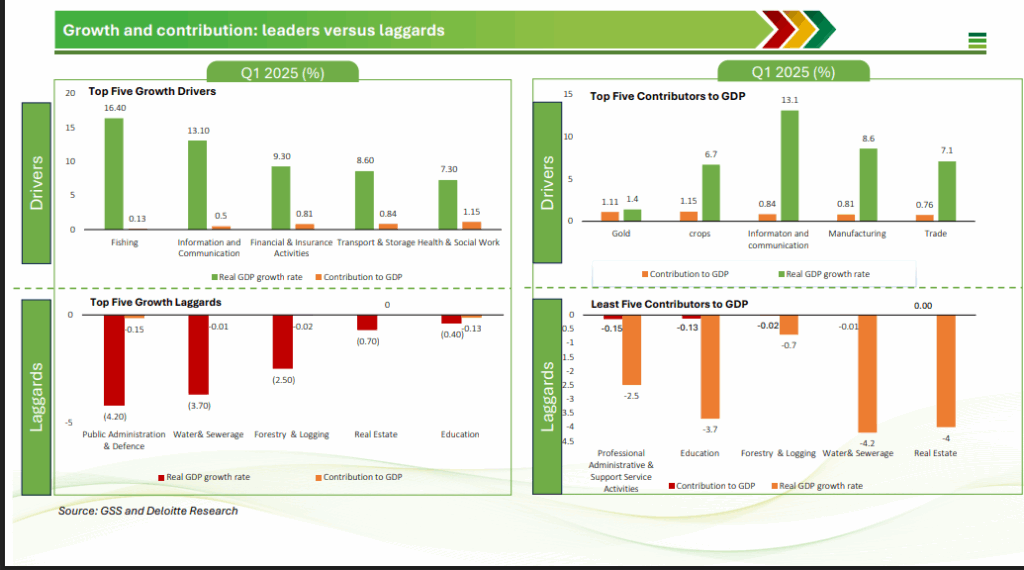

With real GDP growth hitting 5.3% in Q1 2025 — the fastest quarterly growth rate since early 2020 — Ghana is on track to achieve its 4.0% GDP growth target for the year. This growth, Deloitte asserts, is largely being fuelled by non-oil economic activities.

Sectoral Outlook

Agriculture remains a central pillar in Ghana’s non-oil strategy, though not without its challenges. While the sector stands to benefit from the government’s Feed Ghana Agenda and expanded irrigation programmes, the cocoa sub-sector is at risk from pest infestations and crop diseases. Nonetheless, high global cocoa prices could help cushion any revenue losses from lower output.

The Services sector, though still the largest contributor to GDP, may see its dominance wane slightly as government efforts to industrialize gain momentum. However, its integration with digital technologies continues to foster inclusion, innovation, and entrepreneurship, especially among Ghana’s youth.

In the industrial space, the focus is shifting from extractives to value-added manufacturing, food processing, and construction — all of which are less prone to the boom-bust cycles of oil prices.

Deloitte’s report positions the non-oil sector not only as a buffer against volatility but as a foundation for sustainable, inclusive growth. By investing in non-oil value chains, strengthening infrastructure, and ensuring macroeconomic stability, Ghana can insulate itself from future external shocks.

As global demand patterns shift and traditional commodity markets face increasing instability, the ability of Ghana to lean on its diversified, non-oil economic base could determine the difference between stagnation and sustained prosperity.

READ ALSO: GEPA Trains Palm Oil Producers in Agona Nkwanta to Meet Global Standards