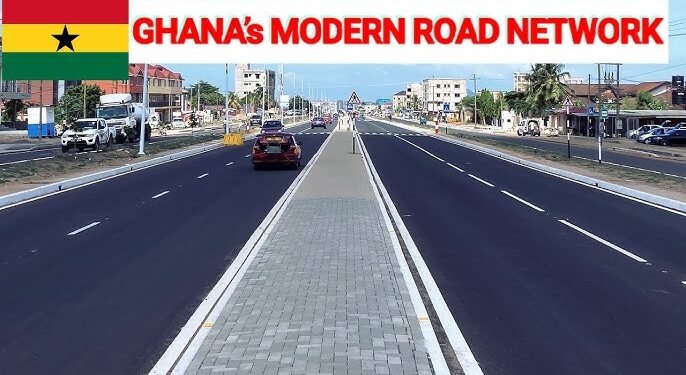

The International Monetary Fund (IMF) has thrown its weight behind Ghana’s mid-year budget review, describing the corrective measures outlined by Finance Minister Dr. Cassiel Ato Forson as being “fully in line” with the Fund-supported programme.

According to the IMF, the policy interventions mark a significant step in accelerating the country’s path to macroeconomic stability and long-term growth.

Julie Kozack, Director of Communications at the IMF, announced the endorsement during a recent briefing, highlighting that the budget review demonstrated a renewed commitment to fiscal discipline. “With respect to the budget, I can say that the IMF has welcomed the government’s corrective actions,” she stated.

A key element of the review is the government’s plan to anchor the 2025 budget on strong fiscal footing. The IMF acknowledged this approach as critical in addressing pre-election fiscal slippages that previously threatened to derail progress under the Fund programme.

Julie Kozack emphasized that “a strong 2025 budget and an audit of payables to quantify and address the pre-election fiscal slippages” were not just welcome developments but essential for the continuity of the programme. She also praised Ghana’s adherence to key governance reforms, including the enforcement of the Public Financial Management and Public Procurement Acts.

“These measures will help improve the overall fiscal responsibility framework in Ghana,” Kozack remarked, pointing to the reforms as instrumental in restoring confidence among investors and development partners.

Energy Sector Measures Also Receive IMF Backing

Beyond the budget, the IMF applauded steps taken by Ghanaian authorities in addressing long-standing challenges in the energy sector. Although Kozack did not elaborate in detail, her comments signal IMF satisfaction with recent efforts to stem financial leakages and improve operational efficiency within state-owned enterprises in the sector.

The energy sector has long been a drain on public finances, with accumulated debts and structural inefficiencies contributing to fiscal imbalances. The IMF’s recognition suggests that government actions—perhaps including tariff adjustments, payment plans, or restructuring measures—are bearing fruit.

In one of the most remarkable achievements under the programme, Ghana has managed to slash inflation from a staggering 54% at the end of 2022 to just 14% by June 2025. This sharp decline demonstrates the effectiveness of monetary policy tightening and the broader economic reforms underway.

“Ghana has made good progress since the beginning of the program in reducing inflation,” said Kozack. She underscored that the current trajectory reflects not just technical adjustments by the Bank of Ghana, but also a broader restoration of policy credibility.

The IMF stressed that this momentum must be sustained.

“Going forward, it will be important for monetary policy to remain sufficiently tight, consistent with bringing inflation down to the Bank of Ghana’s target range, which is 8.0% plus or minus 2 percentage points.”

Julie Kozack

Economic Stability on the Horizon

With inflation easing, fiscal reforms deepening, and structural challenges in sectors like energy being tackled, the IMF’s tone marks a significant vote of confidence in Ghana’s economic direction. While challenges remain—not least external vulnerabilities and debt sustainability—the Fund’s approval suggests that the country is finally regaining the stability it desperately sought when the IMF deal was first negotiated.

Dr. Cassiel Ato Forson’s stewardship of the economy, particularly in a post-debt crisis context, appears to be earning credibility not just domestically but also with Ghana’s international creditors and partners.

While the road to full recovery may be long, current indicators—fiscal correction, falling inflation, and sectoral reforms—suggest that Ghana is laying the foundation for a more stable and prosperous economic future.

If this trajectory continues, Ghana could well transition from a period of fiscal turbulence to a phase of sustained growth, debt sustainability, and economic independence.

READ ALSO: Stanbic Investment Management Services Delivers Impressive Growth for 2024