The European Union’s (EU) commitment to purchase $750 billion worth of American energy over three years, a central piece of a high-stakes trade deal with U.S. President Donald Trump—now appears to be more aspirational than achievable.

The agreement, announced during a summit in Scotland between Trump and European Commission President Ursula von der Leyen, is raising questions about feasibility, logistics, and market practicality.

“The number being floated is simply meaningless.

“It’s unachievable not only because EU demand cannot grow that much, but also because U.S. exporters cannot supply that much either.”

Davide Oneglia, an economist at TS Lombard

His remarks echo growing skepticism that the trade deal, though politically symbolic, may lack the technical and commercial foundations to deliver on its bold targets.

Von der Leyen characterized the commitment as a strategic pivot away from Russian fossil fuels, reinforcing the EU’s long-term energy independence by sourcing “more affordable and better” liquefied natural gas (LNG) from U.S. producers.

Observers say the promise to import an average of $250 billion in U.S. energy annually including oil, natural gas, and nuclear technology is out of step with both market capacity and existing trade flows.

Current trade data highlights the challenge. In 2024, total EU energy imports from the U.S. amounted to less than $80 billion, while U.S. energy exports globally stood at just over $330 billion.

Achieving the scale proposed would require a more than threefold increase in EU imports from the U.S., an outcome that experts consider unlikely within the short timeframe.

Despite the ambitious headline figure, the EU has not released a breakdown of how it intends to hit the $750 billion mark.

Key questions remain unanswered, including how private energy firms on both sides of the Atlantic would be incentivized to make such transactions, and whether European investment in American energy infrastructure could be counted toward the pledge.

Nuclear Trade Faces Uncertainty

One potential avenue to bolster trade volumes lies in nuclear energy, particularly small modular reactors.

The EU has hinted at new deals in this area, which could drive billions in investment. However, with commercial viability for small modular nuclear reactors not expected before 2030, this line of trade may fall short in the current three-year window.

Moreover, increasing investment in U.S. nuclear technology may clash with the EU’s own ambitions to revive its domestic nuclear industry.

Still, optimism persists in some corners of Brussels. At a press conference, EU Trade Commissioner Maros Sefcovic defended the commitment, pointing to what he called a “nuclear renaissance” and asserting that the numbers are achievable.

“That’s the offer, we are ready to go for those purchases.”

EU Trade Commissioner Maros Sefcovic

Since the onset of the war in Ukraine, Europe has been one of the largest buyers of U.S. crude oil and LNG.

At certain points, daily oil shipments from the U.S. Gulf Coast to Europe have topped 2 million barrels per day, roughly half of all American crude exports.

But analysts caution that pushing those numbers higher could complicate refinery operations in Europe, where plants depend on a blend of crude grades to meet demand for gasoline, diesel, and other fuels.

Data from energy analytics firm Kpler shows that in the first half of 2025, EU imports from the U.S. reached 1.53 million barrels of oil per day, with crude oil making up 86 percent of the total.

Those purchases amounted to approximately $19 billion, underscoring just how far the EU would have to go to reach $250 billion in annual imports.

This is not the first time energy trade promises have been used as political currency. During the 2022 energy crisis, von der Leyen and then-President Joe Biden brokered a deal to increase LNG flows from the U.S. to help Europe weather supply shocks.

LNG Deal Faces Skepticism

Energy market experts warn that such an agreement, unless backed by concrete mechanisms or government purchasing mandates, may have limited impact.

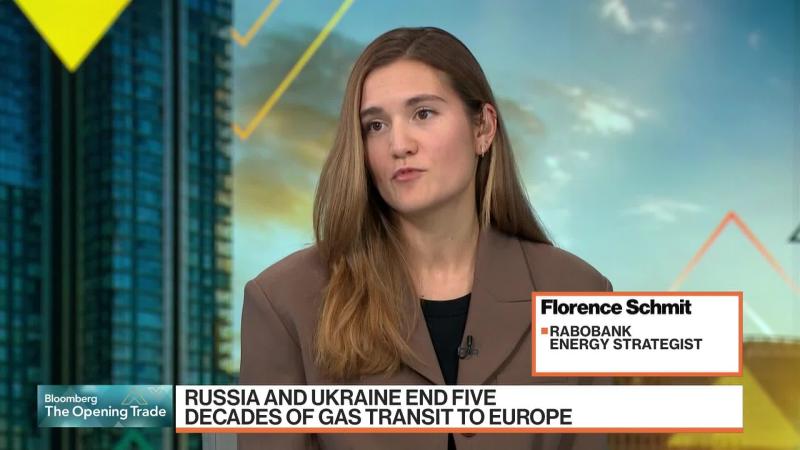

Rabobank energy strategist Florence Schmit said the market response will hinge on execution, not intent.

“The EU-U.S. agreement on higher energy purchases, especially LNG will make no difference to the market balance unless the U.S. administration decides to sell the LNG itself or unless the EU decides to purchase LNG at a higher rate than other global buyers.”

Florence Schmit, Rabobank energy strategist

Schmit added that even if the agreement leads to additional EU investment in U.S. LNG infrastructure, such projects typically take years to deliver returns, making it unlikely that any boost in flows would materialize before the end of Trump’s current term.

Meanwhile, the EU’s own climate modeling suggests natural gas demand will gradually decline throughout this decade, as member states accelerate their transition to renewables and energy efficiency. That reality makes the timing of the pledge all the more puzzling.

While the U.S. is on the verge of unleashing a new wave of LNG exports, much of that capacity still requires buyers and financing.

Trump may be positioning this trade agreement as a catalyst for domestic investment and job creation in the energy sector, even if Europe doesn’t ultimately absorb the promised volumes.

What’s clear is that, despite the fanfare surrounding the EU-U.S. trade announcement, market conditions and logistical constraints present steep hurdles.

Without more detailed planning and tangible incentives, the $750 billion pledge risks becoming yet another symbolic gesture in the complex politics of global energy trade.

READ ALSO: IMF Urges BoG to Hold Tight on Policy Rate to Cement Disinflation Gains