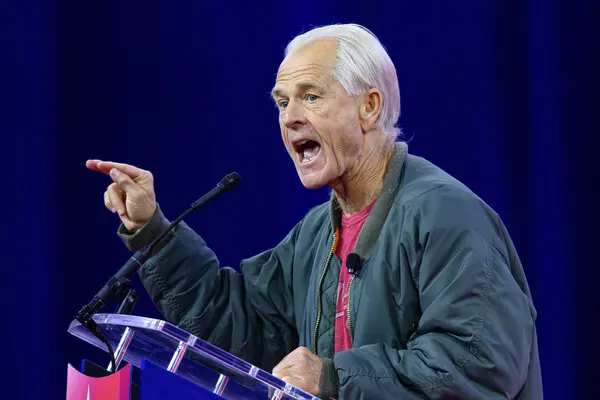

A sharp warning has been issued to India over its deepening trade ties with Russia, with U.S. trade adviser Peter Navarro urging New Delhi to halt crude oil imports from Moscow.

Writing in the Financial Times, Navarro argued that India’s reliance on discounted Russian crude undermines international efforts to isolate the Kremlin and bankrolls Russia’s war economy.

“India’s dependence on Russian crude is opportunistic and deeply corrosive of the world’s efforts to isolate Putin’s war economy.”

Peter Navarro, White House Trade Adviser

Navarro accused New Delhi of playing a pivotal role in keeping Russia’s oil flowing, describing India as acting like “a global clearinghouse for Russian oil, converting embargoed crude into high-value exports while giving Moscow the dollars it needs.”

India, the world’s third-largest importer of crude oil, has dramatically expanded its purchases from Russia since 2022, when Western sanctions largely blocked Moscow’s oil from global markets.

Russian supplies now account for roughly one-third of India’s total oil imports, making it the single largest source of crude for the South Asian nation.

Navarro’s critique comes just days after U.S. President Donald Trump signed an executive order imposing an additional 25 percent tariff on Indian goods, citing India’s ongoing Russian crude purchases as a key factor.

With the new measures, Indian goods face a total tariff of 50 percent in the U.S. market, among the steepest trade penalties Washington has levied on a major partner in recent years. The tariffs are set to take effect on August 27, three weeks after the order was signed.

The decision threatens to inflame trade tensions between Washington and New Delhi, which had been working towards a long-awaited trade deal.

Sources told Reuters that a planned negotiation session scheduled for next week has already been cancelled, raising fears that the tariff standoff could drag on and delay prospects of a compromise.

Navarro Targets India’s Trade Policies

Beyond oil, Navarro used the op-ed to deliver a scathing assessment of India’s trade practices, accusing New Delhi of imposing “a dense web of non-tariff barriers that punish American workers and businesses.”

He claimed these policies have fueled a large trade imbalance, worsening the U.S. deficit with India.

He charged, “And here’s the kicker: India is using those U.S. trade dollars to buy Russian oil,” tying India’s energy strategy directly to Washington’s trade grievances.

Navarro’s remarks underscore the growing frustration in U.S. policy circles that India has not aligned more closely with Western sanctions against Moscow, despite its strategic partnership with Washington.

The warning places India in a difficult position. On one hand, Russian crude has provided New Delhi with affordable energy at a time of high global prices, helping shield its economy from inflationary shocks.

On the other, mounting U.S. pressure now threatens to strain its access to American markets, a critical destination for Indian exports.

Indian state-owned refiners are reportedly waiting for government instructions on how to respond to the escalating dispute.

Industry sources suggest some refiners have already begun seeking alternative supplies from the Middle East and Africa in anticipation of disruptions.

The U.S. tariffs and oil dispute risk complicating broader U.S.–India relations, which have grown significantly over the past decade, particularly in defense and technology cooperation.

Washington has long sought New Delhi as a key partner in counterbalancing China’s influence in the Indo-Pacific region.

However, Navarro’s direct accusations highlight the friction between strategic alignment and economic policy.

The collapse of the upcoming trade talks adds another layer of uncertainty. Without progress, Indian exporters face the risk of losing competitiveness in the U.S. market, while American companies dependent on Indian supply chains may also feel the pinch of tariffs.

READ ALSO: Ghana Set to Smash All 2025 Economic Targets – IC Research Hails Strong H1 Performance