Cameroon’s government has granted authorisation for its finance minister to secure up to 930 billion CFA francs ($1.67 billion) in domestic and external loans, a move aimed at funding key development projects and settling outstanding arrears. The presidential decree outlining this decision marks another step in the country’s efforts to bridge financing gaps while advancing infrastructure growth.

According to the directive, the funds will be raised through a mix of market instruments. These include 350 billion CFA francs sourced from domestic treasury bond issues, 250 billion CFA francs from domestic private lenders, and 330 billion CFA francs from international banking institutions.

This borrowing plan comes at a time when Cameroon is grappling with slower-than-expected disbursement of external financing and persistent shortfalls in revenue mobilisation, particularly in non-oil tax collection.

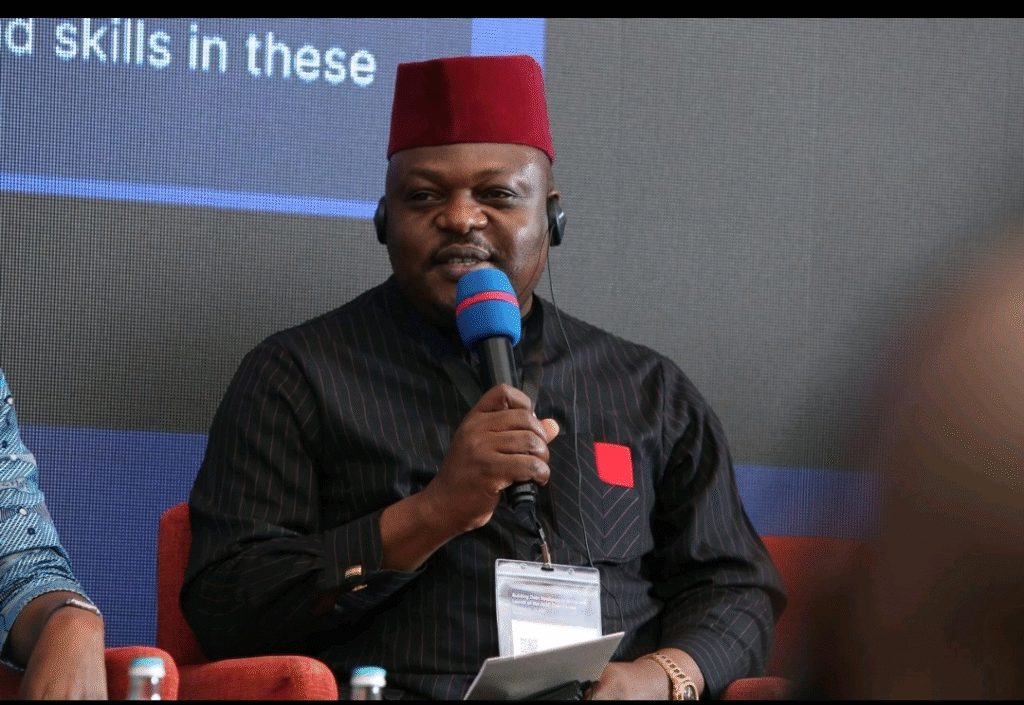

Kelly Mua Kingsly, head of finance operations at the Ministry of Finance, described the move as a strong economic signal. “The decision signals market confidence, boosts liquidity and maintains debt sustainability within CEMAC norms, reinforcing Cameroon’s commitment to macroeconomic stability and structural reform continuity,” he said.

Cameroon, Central Africa’s largest economy with strongholds in oil and gas, cocoa, and timber, has stepped up borrowing in recent years to address budget shortfalls and support national infrastructure development.

Debt Levels Remain Below Regional Threshold

Last month, the International Monetary Fund (IMF) warned that Cameroon faced a high risk of debt distress, though it emphasised that overall debt remained sustainable. As of June 2025, public debt stood at 43% of GDP, according to figures from Cameroon’s debt management body, the Autonomous Sinking Fund. This is significantly below the 70% ceiling set by the Central African Economic and Monetary Community (CEMAC).

Despite this, analysts caution that the country’s reliance on loans carries risks. Many argue that the effectiveness of Cameroon’s borrowing strategy depends heavily on how the funds are ultimately utilised.

Haiwang Djamo Ferdinand, an economic policy analyst at the Cameroon Economic Policy Institute in Yaoundé, pointed out governance concerns. “The effectiveness greatly depends on the use of borrowed funds. In the case of Cameroon, a significant envelope remains idle, a symptom of a governance or strategic planning deficit,” he explained.

The government has not yet revealed which specific projects will be financed by this latest borrowing initiative, raising questions about transparency and prioritisation.

Infrastructure Projects Drive Economic Development

Over recent years, Cameroon has pursued ambitious government-led infrastructure projects aimed at accelerating economic growth and enhancing national development. Roads, energy, and transport have been the primary focus areas, reflecting the administration’s recognition of infrastructure as a catalyst for industrialisation and regional integration.

One of the most significant undertakings is the expansion and rehabilitation of the road network, which plays a crucial role in trade facilitation. Upgrades are ongoing for major highways linking cities such as Douala, Yaoundé, and Bamenda, with funding drawn from both national resources and international development agencies. These projects are expected to cut travel times, reduce transport costs, and boost commerce within Cameroon and across borders.

In the energy sector, the government is advancing hydroelectric and solar power projects to combat chronic electricity shortages that hinder industrial capacity and limit household access. The emphasis on renewable energy aligns with broader global sustainability goals, with the ambition of ensuring affordable and reliable electricity nationwide.

Urban development has also gained attention, with water supply and sanitation upgrades underway in fast-growing cities. These projects are designed to improve the quality of life, though challenges such as funding shortfalls and logistical difficulties continue to pose obstacles.

Still, the government insists that its infrastructure drive is central to Cameroon’s long-term economic resilience. By focusing on energy, transport, and social services, authorities hope to lay the foundation for a stronger, more inclusive economy capable of withstanding future shocks.

While critics remain wary of rising debt and inefficiencies in fund allocation, the government’s borrowing spree underscores its determination to press ahead with development despite fiscal constraints. The months ahead will likely reveal whether Cameroon’s strategy can deliver the growth and stability it urgently seeks.

READ ALSO: Aboso Chiefs Clash with Local NDC Executives Over Illegal Mining