Angola’s oil production has dropped below 1 million barrels per day (bpd) for the first time in more than two years, raising new questions about the country’s ability to reverse declining output despite its dramatic exit from the Organization of the Petroleum Exporting Countries (OPEC) in January 2024.

According to data released by the National Agency for Petroleum and Gas (ANPG), Angola pumped “a total of 30,961,452 barrels of crude in July, translating into a daily average of 998,757 bpd, well below the government’s forecast of 1,073,542 bpd.”

This marks the first time since March 2023 that production has fallen beneath the symbolic one-million-barrel threshold and the first such decline since the country left OPEC.

The drop highlights the structural challenges Angola faces in reviving its once-thriving oil industry, which peaked at around 2 million bpd in 2008 but has since been in steady decline due to underinvestment, maturing fields, and costly offshore developments.

Angola’s decision to quit OPEC after 16 years was motivated by disagreements over output quotas. At a pivotal meeting in mid-2023, both Angola and Nigeria were handed reduced production caps under the OPEC+ agreement because of persistent underperformance.

Officials in Luanda rejected the cuts, arguing they constrained the country’s ability to attract investment and boost production.

At the time, Angola’s government vowed to break free from OPEC restrictions and increase output.

Yet, more than 18 months later, output remains stagnant at levels seen before its exit, underlining the depth of structural weaknesses.

Gas Production Provides Some Relief

While crude oil output is faltering, associated gas and liquefied natural gas (LNG) production have shown stronger results.

ANPG reported that associated gas production in July averaged 2,655 million cubic feet per day (MMSCFD), with significant volumes re-injected into reservoirs, supplied to the Angola LNG (ALNG) plant, or used for power generation at oil facilities.

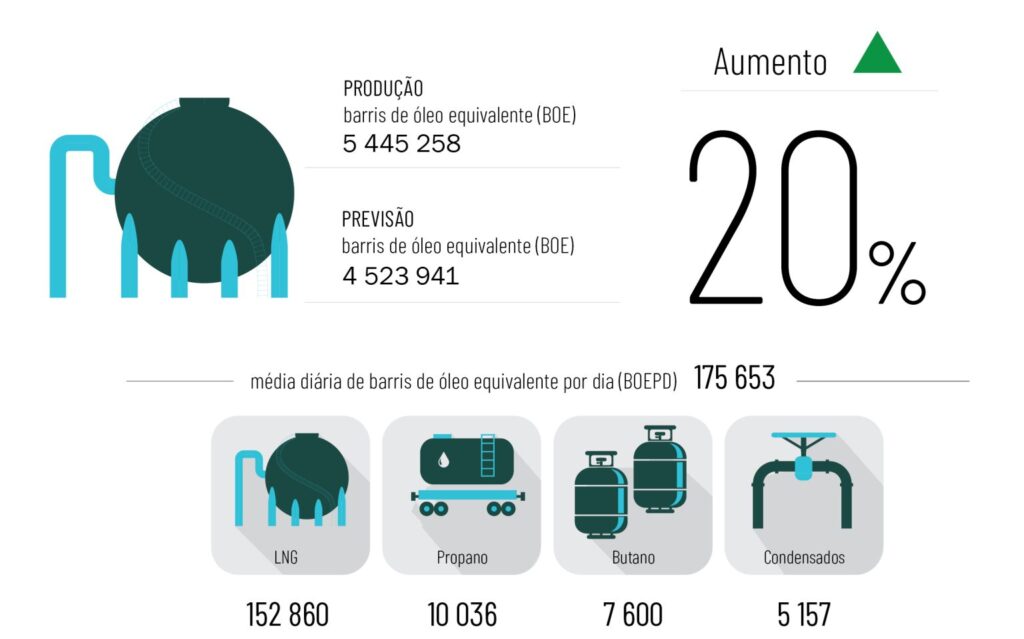

“The ALNG plant recorded a production output of 5,445,258 barrels of oil equivalent (BOE), representing a robust 20% increase over the forecast of 4,523,941 BOE.

“The plant achieved a daily average of 175,653 BOE, with liquefied natural gas accounting for the bulk of this output at 152,860 BOEPD.”

Angola National Agency for Petroleum and Gas (ANPG)

In the Cabinda Association, LPG production totaled 363,144 barrels, equating to a daily average of 11,714 barrels.

This included 6,832 barrels of propane, 4,648 barrels of butane, and 235 barrels of onshore LPG. Combined oil and LPG production for July reached 31,778,723 BOE, or a daily average of 1,025,120 barrels of oil equivalent.

Survey and withdrawal data also provide further insight into Angola’s hydrocarbon sector in July.

A total of 33,107,011 barrels were surveyed, with an average daily rate of 1,067,968 BOPD again, falling short of the predicted 1,179,048 BOPD.

The national oil company Sonangol, through its subsidiaries Sonangol E.P. and Sonangol UNEP, was responsible for 13% of the total withdrawals. ANPG, as the concessionaire, “accounted for 8,377,809 barrels, or 25% of the total.”

Of the total withdrawals, a large majority “31,481,717 barrels were earmarked for export markets, while 1,625,294 barrels were delivered domestically to the Luanda Refinery.”

This highlights Angola’s continued reliance on oil exports as a major source of revenue, even amid production shortfalls.

Declining Giant

Angola’s oil industry has long been a cornerstone of its economy, but declining output is threatening fiscal stability.

With crude accounting for around 90% of export revenues, the country is under pressure to diversify its energy base and capture more value from gas resources.

While crude production is stagnating, Angola is doubling down on natural gas as a potential lifeline.

Officials have touted gas projects as critical to unlocking new revenue streams, meeting domestic power needs, and positioning Angola as a key supplier in the LNG market.

The country’s focus on natural gas mirrors a broader shift across resource-rich African nations that are seeking to adapt to the global energy transition by diversifying beyond oil.

For now, Angola’s oil future remains uncertain, but its growing gas sector may yet provide the boost it needs to stabilize its economy and redefine its role in the global energy landscape.

READ ALSO: Ghana Set to Smash All 2025 Economic Targets – IC Research Hails Strong H1 Performance