Gold prices have climbed on Friday, rallying on the back of heightened expectations of a September interest rate cut from the U.S. Federal Reserve.

The rebound followed Fed Chair Jerome Powell’s remarks at the central bank’s Jackson Hole symposium, where he struck a cautious yet dovish tone that markets interpreted as opening the door to policy easing.

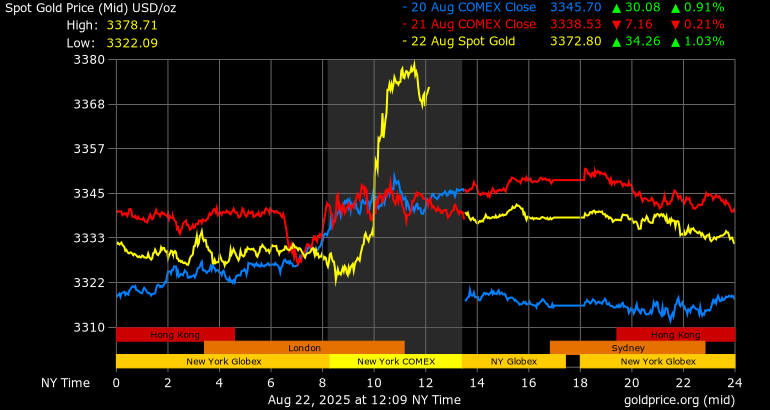

At the time of writing, gold was up 0.96%, trading at $3,370.53 per ounce. U.S. gold futures, meanwhile, stood at $3,408.20 per ounce, down 0.8% but still reflecting strength compared to earlier in the week.

The rebound followed Fed Chair Jerome Powell’s remarks at the central bank’s Jackson Hole symposium, where he struck a cautious yet dovish tone that markets interpreted as opening the door to policy easing.

In what was his eighth and final Jackson Hole address, Powell walked a fine line between acknowledging persistent inflationary pressures and recognizing growing risks to the labor market.

Powell said, “The shifting balance of risks may warrant adjusting the Fed’s policy stance,” while stopping short of making a firm commitment to a rate cut.

His remarks left markets with the impression that the central bank was preparing to act if upcoming jobs and inflation data confirm a slowdown.

For gold, that message was enough to ignite bullish momentum. Tai Wong, an independent metals trader, summed up the market’s reaction succinctly:

“In his eighth and final Jackson Hole speech, Powell surprised a worried market, opening the express lanes to a September rate cut, which has boosted every single asset, including gold.”

Tai Wong, an independent metals trader

Wong added that the next hurdle for gold would be to “break and hold above $3,400 in the coming days,” a level that could reinforce investor confidence in the rally.

Markets Price in a September Cut

Powell’s carefully worded comments shifted market expectations significantly. According to CME’s FedWatch tool, traders now assign a 90% probability of a 25 basis-point cut at the Fed’s September 16–17 policy meeting, up from 75% before the speech.

That expectation has provided a tailwind not just for gold but for risk assets across the board, from equities to emerging-market currencies.

Analysts noted, however, that much depends on the trajectory of U.S. jobs and consumer price data in the coming weeks.

Gold does not yield interest, which means it typically loses some of its appeal when rates are high and competing assets like bonds offer attractive returns.

Conversely, when rates fall, bullion becomes more desirable as a store of value, often benefiting from safe-haven demand as well.

Broader Precious Metals Market

The bullish sentiment extended beyond gold to other precious metals. Spot silver advanced 2.2% to $38.97 per ounce, platinum edged up 0.5% to $1,359.75, and palladium gained 1.4% to $1,126.25.

Analysts said the performance underscored broad investor interest in hard assets as uncertainty over the global economy and monetary policy persists.

Attention now turns to the release of U.S. non-farm payrolls and consumer price inflation data in the coming weeks. Both will serve as critical inputs for the Fed’s September decision.

For gold investors, the stakes are clear: confirmation of slowing growth and easing inflation would likely push bullion higher, potentially testing the $3,400 threshold mentioned by traders.

“Markets are bracing for a volatile few weeks.

“But with Powell signaling flexibility, gold has regained its footing as one of the most reliable hedges against uncertainty.”

Tai Wong, an independent metals trader

For now, the metal’s rebound caps a week that has seen shifting sentiment in global markets, with traders recalibrating their expectations for U.S. monetary policy.

If the Fed follows through with a September rate cut, analysts say gold could be poised for another leg higher, reaffirming its status as a safe-haven asset in turbulent times.

READ ALSO: Ghana Set to Smash All 2025 Economic Targets – IC Research Hails Strong H1 Performance