Oil prices recovered on Monday, climbing more than $1 per barrel, as traders reacted to OPEC+’s latest output decision and growing concerns over potential new U.S. sanctions on Russian crude. The rebound followed steep declines last week, when weaker U.S. economic data rattled markets.

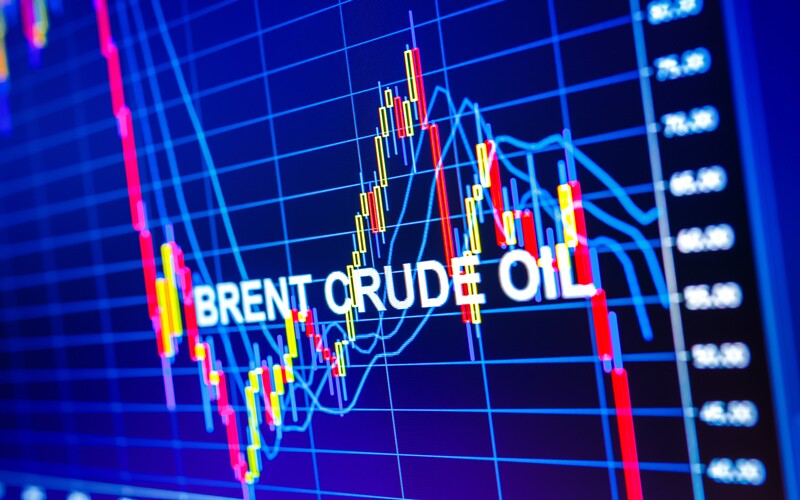

By 10:31 GMT, Brent crude had risen $1.28, or 1.95%, to $66.78 per barrel, while U.S. West Texas Intermediate (WTI) crude climbed $1.20, or 1.94%, to $63.07 per barrel.

The gains helped offset some of the more than 3% losses recorded last week, including a sharp drop of over 2% on Friday after disappointing U.S. jobs data cast doubt on future fuel demand.

Market reacts to modest OPEC+ decision

The recovery in prices came after OPEC+, the alliance of the Organization of the Petroleum Exporting Countries and its partners, including Russia – confirmed on Sunday that it would raise production from October.

The group said it would add 137,000 barrels per day (bpd), far less than the hikes seen in recent months.

In August and September, OPEC+ increased output by around 555,000 bpd, while July and June saw rises of about 411,000 bpd.

The smaller increase for October suggests the bloc is treading carefully amid concerns about a looming oil surplus during the Northern Hemisphere’s winter months.

Analysts said the modest hike eased fears of a supply flood. Ole Hansen, head of commodity strategy at Saxo Bank, described the market reaction as predictable:

“The market had run ahead of itself in regards to this OPEC+ increase.

“Today we’re seeing a classic sell the rumour, buy the fact reaction.”

Ole Hansen, head of commodity strategy at Saxo Bank

Some traders believe the impact of the new quota will be muted, since several OPEC+ members have been exceeding their assigned limits in recent months. That means the additional barrels are already effectively in circulation.

Sanctions fears add further support

Beyond OPEC+, markets are also pricing in the potential disruption of global crude flows if Washington escalates sanctions against Moscow.

Over the weekend, U.S. President Donald Trump signaled he was prepared to move into a second phase of sanctions on Russia, including possible measures targeting buyers of Russian crude.

It was the strongest indication yet that the United States could intensify pressure on Moscow over the war in Ukraine.

“Expectations of tighter supply from potential new U.S. sanctions on Russia are also lending support.”

Toshitaka Tazawa, analyst at Fujitomi Securities

The warning comes after Russia launched its largest air attack of the war, hitting central Kyiv and killing at least four people, according to Ukrainian officials. The assault set the main government building ablaze, further intensifying the conflict.

Traders worry that new U.S. restrictions on Russian oil exports or its buyers could remove significant volumes from the market.

Frederic Lasserre, head of research and analysis at energy trader Gunvor, said on Monday that such sanctions could “seriously disrupt crude flows” depending on their scope and enforcement.

Diplomatic efforts continue alongside the threat of sanctions. President Trump confirmed on Sunday that several European leaders would visit Washington this week to discuss strategies for ending the war in Ukraine.

Still, the prospect of tighter sanctions and ongoing instability in Eastern Europe has added a risk premium to crude markets, offsetting otherwise bearish signals such as weak U.S. macroeconomic data.

Adding to the bearish picture, the U.S. Department of Energy (DoE) recently reported a build of 500,000 barrels in the Strategic Petroleum Reserve (SPR), bringing total reserves to 404.7 million barrels.

Despite short-term volatility, investment banks maintain a cautious view on future prices. In a weekend note, Goldman Sachs projected a slightly larger oil surplus in 2026 as rising supply from the Americas outweighs a downgrade to Russian production.

The bank left its Brent and WTI forecasts for 2025 unchanged, but forecast average prices of $56 per barrel for Brent and $52 for WTI in 2026.

For now, however, market sentiment remains focused on the interplay between OPEC+ supply decisions and the risk of geopolitical shocks. If U.S. sanctions on Russia expand, they could counteract the impact of additional OPEC+ barrels and keep prices supported.

READ ALSO: Investors Snub T-Bills As Government Struggles to Raise GH¢6.7bn, Settles for GH¢3.2bn