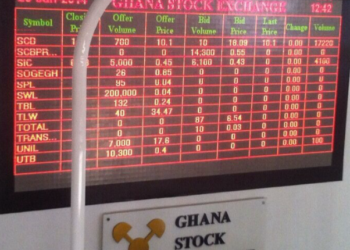

The Ghana Stock Exchange (GSE) witnessed a remarkable trading session as 16 listed equities participated, ending with four gainers and no losers.

The spotlight shone brightly on GCB Bank, which posted an impressive 9.98% appreciation in its share price, closing at GHS 12.12 per share. This surge made GCB the standout performer on the day, reinforcing investor confidence in the banking sector.

The positive movement came despite broader market challenges, with indices recording short-term losses over the past weeks. The strong gains by GCB Bank and other equities marked a welcome rebound for the market.

GCB Bank’s near 10% jump was the defining story of the day. The bank, one of Ghana’s leading financial institutions, has been steadily attracting investor interest, and the latest rally pushed its shares to a new high for the week. Analysts attribute the upward momentum to growing investor optimism in the financial sector, coupled with GCB’s robust fundamentals and market leadership.

The impressive gain underscores the resilience of GCB Bank within the financial landscape, especially at a time when investor sentiment has been mixed across various sectors.

Beyond GCB Bank, three other equities posted modest gains. NewGold ETF advanced by 1.8%, Ghana Oil Company (GOIL) rose by 0.87%, while TotalEnergies Marketing Ghana saw a marginal increase of 0.03%. Though their movements were relatively smaller, these performances collectively contributed to a positive trading outcome.

The absence of losers in the trading session was significant, highlighting a bullish tilt in investor sentiment. This trend suggests that despite reduced trading volumes, investors remain cautiously optimistic about the market’s direction.

While GCB Bank stole the show with price gains, MTN Ghana dominated trading volumes with 311,275 shares exchanged. SIC Insurance Company followed with 38,922 shares, Ecobank Transnational with 27,691, and CalBank with 11,929 shares.

MTN Ghana’s consistent dominance in trading activity reflects its position as one of the most liquid and widely held equities on the GSE. The telecom giant continues to attract investors seeking both stability and long-term growth.

Market Indices Reflect Mixed Performance

The benchmark GSE Composite Index (GSE-CI) climbed 24.20 points, representing a 0.34% increase, to close at 7,196.64. Despite the day’s gains, the index showed a one-week loss of 1.69% and a four-week decline of 3.31%. However, its year-to-date performance remained stellar, up 47.21%.

The GSE Financial Stocks Index (GSE-FSI) also recorded a healthy 0.96% increase, closing at 3,477.24 points. On a broader scale, the index marked a one-week gain of 1.02%, a four-week gain of 1.84%, and a year-to-date rise of 46.05%. These numbers emphasize the resilience of financial equities, particularly banks and insurance firms, in sustaining market momentum.

At the end of the session, the total market capitalization of the GSE rose to GHS 148 billion, a figure that underscores the overall size and strength of Ghana’s equity market.

However, trading turnover dropped significantly compared with the previous session. A total of 409,119 shares were traded, corresponding to a market value of GHS 4,403,522.47. This marked an 88% decline in trading volume and a 67% decline in turnover compared to Tuesday, September 9.

The lower activity level suggests that while investors remain confident in certain equities, overall trading enthusiasm was subdued.

The day’s performance offers an encouraging signal for investors, especially given the recent dip in market indices. With GCB Bank emerging as a clear winner, the financial sector may continue to attract fresh investor interest.

Market analysts believe the resilience of the GSE, as reflected in year-to-date gains of over 47% on the Composite Index, indicates strong underlying fundamentals despite short-term volatility. Investors will be closely monitoring upcoming sessions to see whether the bullish sentiment can be sustained.

READ ALSO: Chamber of Mines Urges Calm in Black Volta Mining Dispute