The European Union could end its reliance on Russian gas far sooner than currently planned, with the U.S. government insisting that the transition could be completed within six to twelve months if American liquefied natural gas (LNG) were used to fill the gap.

The push came during high-level energy talks in Brussels this week, where U.S. Energy Secretary Chris Wright urged the bloc to accelerate its timeline. Speaking to Reuters after meeting EU Energy Commissioner Dan Jorgensen, Wright said Washington had made clear its position.

“I think this could easily be done within 12 months, maybe within six months.

“On the U.S. side, we could do it faster, and I think it would be good if those dates were moved up even more.”

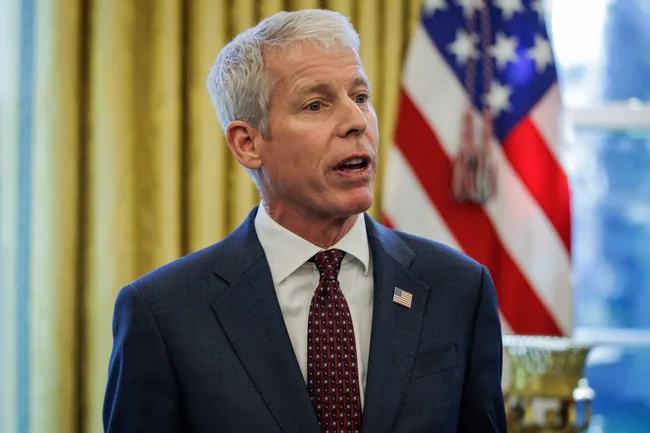

U.S. Energy Secretary Chris Wright

The comments highlight a widening gap between the EU’s cautious approach and Washington’s determination to cut off Moscow’s most lucrative export stream as part of broader efforts to end Russia’s war in Ukraine.

EU’s Current Plan

The European Commission has drafted proposals to phase out Russian oil and gas imports by January 2028, with a ban on short-term gas contracts coming into force from 2026.

Officials have argued that the lengthy phase-out period is designed to shield member states from sudden energy price spikes and supply shortages.

Commissioner Jorgensen echoed this sentiment, saying it was “unacceptable that the EU continues to import Russian energy, but the 2028 phase-out is ambitious and ensures stability for our citizens and industries in the meantime.”

European Commission President Ursula von der Leyen has also hinted at a possible acceleration, telling reporters this week that Brussels is “considering a faster phase-out of Russian fossil fuels as part of new sanctions against Moscow,” though she did not specify how the shift would be achieved.

U.S. Position

Washington, however, is pressing for a more aggressive timetable. Wright told reporters that every additional year of Russian gas imports fuels Moscow’s war chest. “The faster we phase out, the sooner you put pressure on Russia,” he said.

U.S. LNG exports to Europe have surged since Russia’s full-scale invasion of Ukraine in February 2022. Before the war, Russian pipeline gas accounted for roughly 45% of the EU’s supply; this year, that figure is expected to fall to about 13%, according to EU data.

Officials in Washington believe American LNG can more than cover the shortfall, with new export terminals in the U.S. Gulf Coast and growing shipping capacity enabling faster deliveries. Wright said he made clear to EU officials that U.S. suppliers are ready to scale up.

Despite the United States’ assurances, deep political divisions within the EU complicate any accelerated timetable. Sanctions on Russian energy require unanimous agreement among all 27 member states.

Countries such as Hungary and Slovakia, which remain heavily dependent on Russian gas, have consistently opposed immediate sanctions.

To circumvent this, Brussels has structured the 2028 phase-out plan in a way that allows approval by a reinforced majority of EU countries, sidestepping the unanimity requirement.

But even this compromise reflects the difficulty of aligning all member states on an energy strategy with profound economic and political implications.

The renewed pressure from Washington underscores the geopolitical stakes. By accelerating the shift, the U.S. hopes to deprive Russia of vital revenue that has underpinned its war in Ukraine. But European leaders remain cautious, balancing geopolitical urgency with economic realities.

A European Commission spokesperson declined to comment immediately on Wright’s remarks. However, diplomatic sources say discussions are ongoing behind closed doors about whether some member states could commit to faster individual timelines, even if the bloc’s official deadline remains 2028.

For now, the debate is set to continue. While the EU’s official position remains cautious, Wright’s comments indicate growing U.S. impatience.

The choice for Europe will be whether to push ahead with its gradual approach or embrace a more ambitious shift that could transform the continent’s energy map within a year.

READ ALSO: Investors Snub T-Bills As Government Struggles to Raise GH¢6.7bn, Settles for GH¢3.2bn

![Abronye Bail Denial, A Blow to Justice And Free Speech 10 NPP ; Kwame Baffoe [Abronye ]'s bail denial in focus](https://thevaultznews.com/wp-content/uploads/2025/09/Kwame-Baffoe-Abronye-350x250.jpg)

![NPP ; Kwame Baffoe [Abronye ]'s bail denial in focus](https://thevaultznews.com/wp-content/uploads/2025/09/Kwame-Baffoe-Abronye-706x375.jpg)

![NPP ; Kwame Baffoe [Abronye ]'s bail denial in focus](https://thevaultznews.com/wp-content/uploads/2025/09/Kwame-Baffoe-Abronye-120x86.jpg)