Uganda’s debt profile has taken a sharp turn, with government figures showing a 26.2% rise in total public debt during the 2024/2025 financial year. The finance ministry’s annual report on public debt, released Friday, revealed that the country’s debt increased from $25.6 billion in the previous year to $32.3 billion by the end of June.

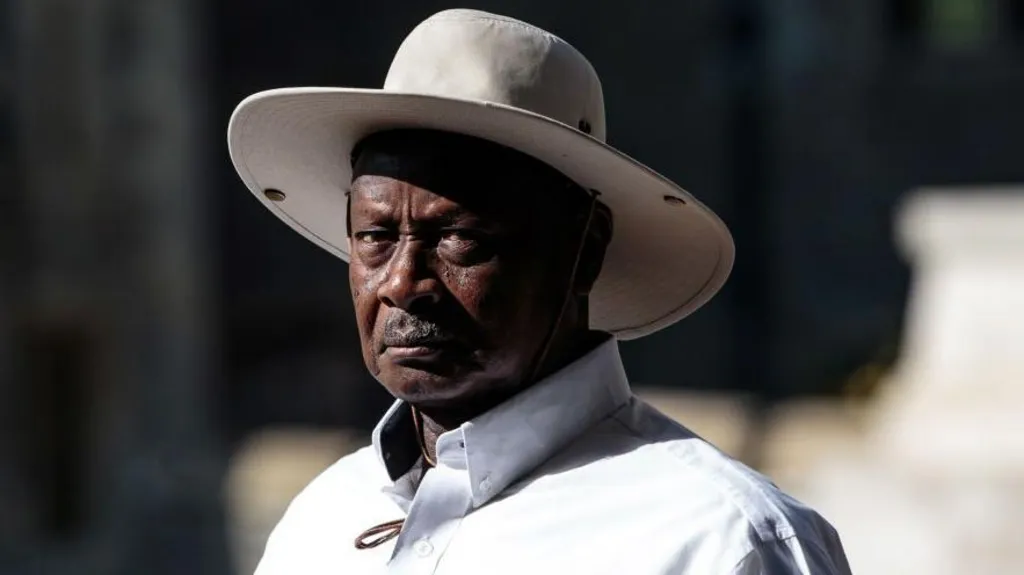

The report underscores Uganda’s growing reliance on borrowing, especially from domestic sources, to meet its financing needs. President Yoweri Museveni’s administration has poured billions into major infrastructure projects, including roads, energy, and transport, a strategy that has deepened debt exposure.

Warnings from the Bank of Uganda and other institutions have highlighted the strain repayment costs place on critical public services such as education and health. The ministry’s report stated, “The shift towards higher domestic borrowing explains the rise in both the nominal debt stock and the cost of debt.” It added that the reliance on domestic lenders “has elevated debt service costs given the higher yields demanded by the local market.”

The debt load as a percentage of GDP rose from 46.9% to 51.3% over the year to June. Domestic borrowing increased by 52.7%, compared with just 6.2% growth in external credit, magnifying repayment costs.

This shift has created new challenges for the government. In the 2025/26 budget, domestic interest payments are expected to reach $2.8 billion, surpassing obligations on external loans. With this mounting pressure, Uganda has opened negotiations with the International Monetary Fund (IMF) for a new Extended Credit Facility.

The talks come after the expiration of a $1 billion IMF program in September 2024, which had supported social spending, governance reforms, and post-COVID-19 recovery but was undermined by funding constraints.

Officials say the new bailout is likely to be finalized after the January 2026 elections and will be critical in securing concessional loans to manage the debt trajectory while maintaining reforms.

President Museveni has defended the government’s borrowing strategy, framing it as necessary to fuel long-term economic transformation. However, critics warn that the debt burden threatens fiscal space and risks crowding out private sector financing.

Growth Prospects Versus Public Pressure

Despite financial challenges, Uganda’s economy is expected to show resilience. The finance ministry projects growth of 6.3% for 2024/25, and expectations of 7% by June 2026. Investments in infrastructure, foreign direct investment inflows, and anticipated oil production are expected to propel double-digit growth in the coming years.

The government’s 2025/26 budget emphasizes structural transformation, prioritizing commercial agriculture, industrialization, services, and digital advancement. The government has allocated funds toward human capital development, regional infrastructure, and private sector growth. These reforms align with Uganda’s ambition to achieve middle-income status by 2040.

According to the finance ministry, reforms, backed by IMF support and natural resource development, will ensure sustainability. Uganda’s future, however, will depend on how effectively it balances urgent financing needs with long-term growth strategies.

As such, the nation faces a delicate balancing act of managing surging debt, sustaining growth, and proving that infrastructure-led borrowing can ultimately deliver on its promises of transformation.