The National Pensions Regulatory Authority (NPRA) has unveiled plans to introduce a non-scoring course on pensions across tertiary, secondary, and vocational institutions in Ghana. The initiative seeks to deepen financial literacy, expand pension coverage, and ensure that young Ghanaians are equipped with the knowledge necessary to prepare for retirement.

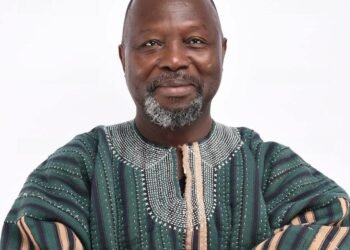

During a courtesy call on the Minister of Education, the Chief Executive Officer of NPRA, Chriss Boadi-Mensah, highlighted the gaps in pension knowledge among young graduates, explaining that entering the workforce with little or no understanding of pensions does a lot of avoidable harm to the individual.

“Many graduates leave school without basic knowledge of pensions, even though they enter the workforce shortly after,” Mr. Boadi-Mensah said, highlighting the fact that financial security in later years depends heavily on early planning. He added that for vocational and technical students, pensions education is even more “critical,” as many of them will move into self-employment soon after their training.

The NPRA boss pointed out that the Authority’s decision to roll out pension education aligns with efforts to decentralise its operations across the country.

He acknowledged the role played by the Ministry of Education in establishing NPRA’s zonal offices in Tamale and Kumasi, noting that these facilities have strengthened the Authority’s capacity to reach different parts of the country.

“As part of the programme, the NPRA will distribute 10,000 branded exercise books to selected Technical and Vocational Education and Training (TVET) schools. The books carry simplified explanations of Ghana’s 3-Tier Pension Scheme and are intended to instill a culture of savings and retirement planning among students”

Chriss Boadi-Mensah, Chief Executive Officer of NPRA

According to the NPRA, the proposed course will focus on the fundamentals of the 3-Tier Pension System, the legal responsibilities of employers and employees under Act 766, and the advantages of starting early.

It will also educate students on the opportunities available for self-employed and informal sector workers to contribute to pension schemes, thereby encouraging inclusivity in retirement planning.

Minister Commends Initiative

Minister for Education, Hon. Haruna Iddrisu, praised the Authority’s foresight in introducing pension education into the school system. He welcomed the donation of exercise books to the TVET sector.

“First, I express my profound appreciation to the National Pensions Authority for the generous donation of 10,000 branded exercise books to support Technical and Vocational Education and Training (TVET) institutions nationwide.

“This thoughtful gesture will not only enhance quality learning outcomes within the TVET sub-sector but will also equip learners with essential knowledge on pensions and retirement planning, even before they transition into the world of work”

Hon. Haruna Iddrisu, Minister for Education

He further reflected on his time as Minister for Employment and Labour Relations, noting that pension education had always been a pressing need. He observed that many workers in both the formal and informal sectors face serious challenges in retirement due to poor financial preparation.

Introducing pensions at the secondary and tertiary levels, he argued, would help address these challenges at their roots.

The Education Minister also revealed that the proposal coincides with the ongoing review of Ghana’s national curriculum from Kindergarten to Primary Six, emphasising that integrating pensions and retirement planning into basic education would nurture financial literacy in children at an early stage.

“It will help them build a sound understanding of pensions long before they transition into the world of work,” Hon. Iddrisu explained.

He stressed that the NPRA’s proposal is not only about pensions but also about securing the nation’s long-term human capital. By equipping young people with tools for financial security, the country would be creating a generation of workers prepared to “plan adequately, retire with dignity, and enjoy lasting security.”

The NPRA’s push to expand pension education reflects a wider national conversation about financial inclusion and the sustainability of Ghana’s social protection systems. The Authority’s decision to target students at multiple levels of education demonstrates a recognition that financial literacy must begin early if it is to have long-term impact.

For policymakers and regulators, the initiative underscores the importance of embedding pensions into the nation’s development agenda. For students, it provides the foundation for responsible saving and planning.

And for Ghana as a whole, it represents a step toward ensuring that the workforce of today does not become the vulnerable elderly of tomorrow.

READ ALSO: Curtains Close on 2026 Budget Hearings as Finance Ministry Sets Stage for Ghana’s Fiscal Future