The Ghanaian cedi’s steady appreciation in recent months has sparked widespread discussion among economists and market analysts, many of whom credit the improvement to the Ghana Gold Board (GoldBod) and its bold strategy of using gold to shore up the nation’s foreign exchange reserves.

Through close collaboration with the Bank of Ghana, GoldBod has transformed the country’s approach to managing gold, from a mere export commodity to a strategic tool for financial stability.

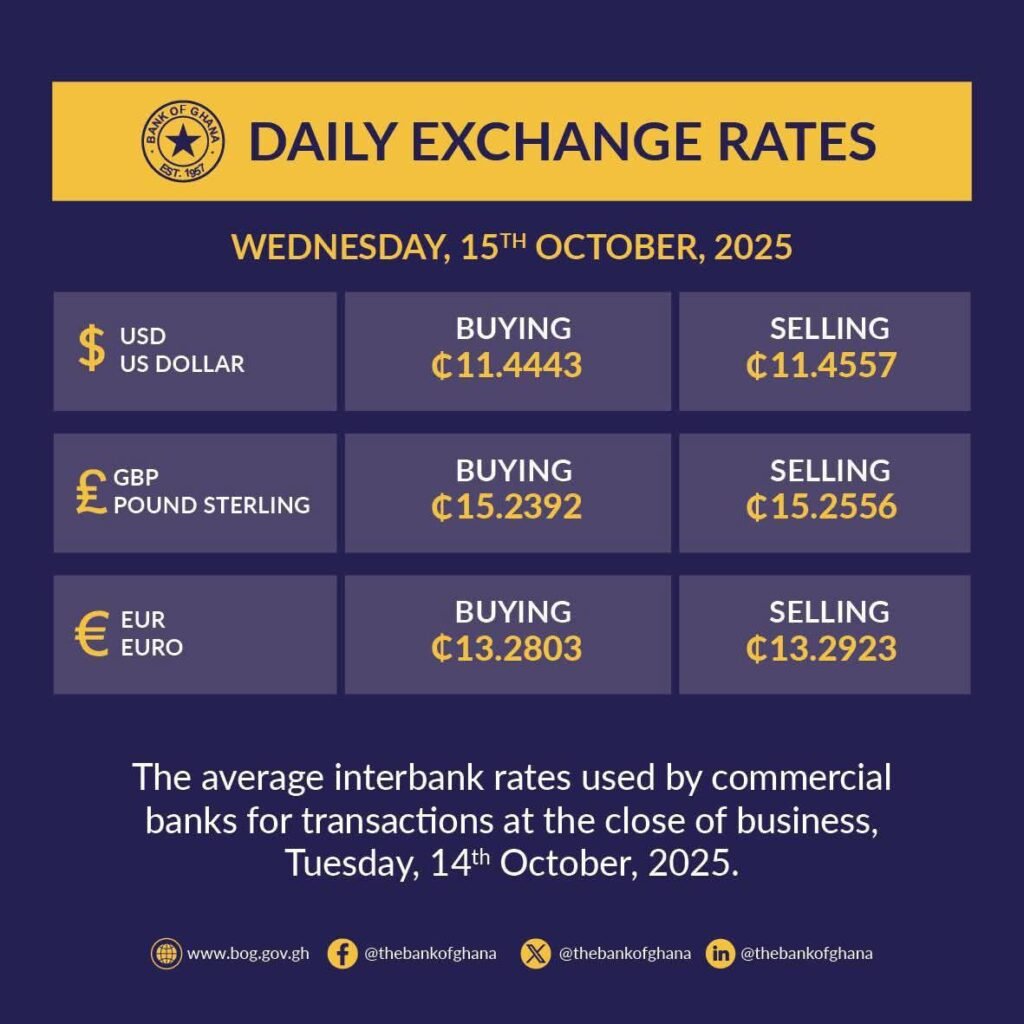

The result has been a significant increase in Ghana’s gold reserves and a surge in investor confidence, helping the cedi regain strength against major global currencies.

“GoldBod has substantially increased Ghana’s foreign exchange inflows and contributed to stabilising the cedi, with over $6 billion in annual gold export revenues.”

Sammy Gyamfi, Chief Executive Officer of GoldBod

Surge in Gold Reserves

Data from the Bank of Ghana shows that the nation’s official gold reserves rose sharply to 37.06 tonnes by the end of September 2025, up from 30.53 tonnes in January.

This represents a remarkable 21.3% increase within nine months, a growth largely attributed to GoldBod’s domestic procurement strategy.

In comparison, as recently as 2023, Ghana’s gold reserves stood at just 8.78 tonnes, offering only marginal protection for the national currency. Today, that picture has changed dramatically.

Mr. Gyamfi explained that GoldBod’s mission extends beyond stabilising the currency.

“We are dedicated to transforming Ghana’s gold trading industry to maximise national benefits through responsible sourcing, supply chain traceability, value addition, and sustainability.”

Sammy Gyamfi, Chief Executive Officer of GoldBod

The GoldBod model integrates a track-and-trace system, ensuring that every gram of gold purchased can be traced back to its source.

This innovation not only enhances transparency in the gold trade but also aligns with global standards for ethical sourcing, giving Ghanaian gold a competitive edge on the international market.

Economists have praised the approach as a practical way to leverage the country’s mineral wealth for macroeconomic stability.

Boosting Confidence and Attracting Regional Attention

GoldBod’s success has not gone unnoticed across Africa. The model has become a reference point for countries looking to strengthen their own resource management systems.

Sierra Leone’s Finance Minister is among those exploring how a similar framework could be applied to drive sustainable gold sector reforms.

At a recent high-level meeting held on the sidelines of the 2025 IMF–World Bank Annual Meetings in Washington, finance ministers from Ghana, Liberia, Sierra Leone, The Gambia, and Sudan commended Ghana’s innovative approach to natural resource governance.

The session, which also included the President of the African Development Bank (AfDB) Group, Dr. Sidi Ould Tah, focused on how gold-backed economic models could promote fiscal resilience across the continent.

According to participants, Ghana’s experience shows that natural resource wealth, when managed transparently and strategically, can anchor a nation’s development rather than undermine it.

Beyond the immediate impact on currency stability, analysts believe GoldBod’s efforts are reshaping Ghana’s long-term economic outlook.

The increased gold reserves have bolstered Ghana’s creditworthiness, attracting international investors and supporting the government’s broader economic reforms.

By building a strong reserve base, Ghana has also strengthened its resilience against external shocks such as commodity price fluctuations or global financial downturns.

This stability, in turn, is expected to create a more predictable environment for business and investment growth.

Furthermore, GoldBod’s domestic procurement policy has injected vitality into local mining communities by creating structured markets and ensuring fair pricing for artisanal and small-scale miners. This has contributed to job creation and improved livelihoods across gold-producing regions.

As Africa’s second-largest gold producer, Ghana is positioning itself as a leader in using gold as a tool for economic transformation rather than dependency.

With the Ghana Gold Board’s steady progress and the Bank of Ghana’s continued commitment to reserve accumulation, analysts expect the cedi’s outlook to remain strong in the medium term.

For Ghana, gold has evolved from being a commodity of export to a cornerstone of economic sovereignty, a golden strategy in every sense.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization