United Bank for Africa (UBA) Ghana Limited has once again demonstrated its market strength, posting an impressive financial performance for the third quarter ending September 2025.

The Bank’s unaudited results reveal a surge in gross earnings to GH¢1.08 billion, up from GH¢987.2 million recorded in the same period last year — representing a remarkable 10% year-on-year growth.

This achievement is particularly noteworthy given the challenging macroeconomic environment, including rising inflation, exchange rate volatility, and liquidity pressures in Ghana’s financial sector. Despite these headwinds, UBA Ghana’s consistent growth across all key performance indicators underscores its strong operational efficiency, prudent management practices, and unwavering customer loyalty.

UBA Ghana’s profit before tax rose to GH¢430.7 million as of September 2025, reflecting a solid business performance built on sound risk management and efficient cost control. This profitability showcases the Bank’s ability to balance growth with sustainability — a key differentiator in Ghana’s increasingly competitive banking industry.

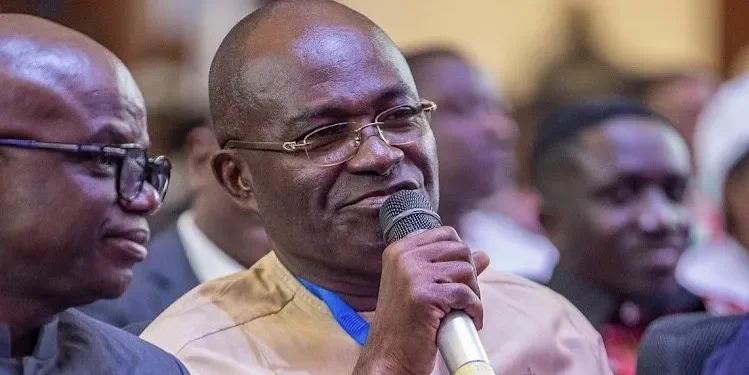

According to the Bank’s Managing Director and Chief Executive Officer, Mr. Uzoechina Molokwu, the results mirror the institution’s dedication to building long-term value for its stakeholders. “Our banking solutions continue to be the growth driver for UBA Ghana,” Mr. Molokwu noted.

“Through our customer-first philosophy and innovative solutions such as LEO, Africa’s first AI-powered virtual banker, we are democratising banking and making it more accessible to everyone.”

Mr. Uzoechina Molokwu

Expanding Balance Sheet and Strengthening Capital Base

UBA Ghana’s total assets climbed by 18%, reaching GH¢11.31 billion in September 2025, up from GH¢9.58 billion recorded a year earlier. This impressive asset growth signals the Bank’s expanding footprint and ability to deploy its resources efficiently across key sectors of the Ghanaian economy.

Furthermore, customer deposits recorded a robust 16% growth, rising from GH¢7.08 billion in 2024 to GH¢8.19 billion in 2025. This upward trajectory reflects growing public confidence in the UBA brand and its diversified product offerings that cater to individuals, SMEs, and corporate clients.

UBA Ghana also remains one of the most well-capitalised banks in the country, boasting a Capital Adequacy Ratio (CAR) of 20.46%, significantly higher than the regulatory minimum set by the Bank of Ghana. This strong capital position provides a solid buffer against market shocks and underscores the Bank’s commitment to maintaining financial soundness.

Digital Innovation at the Core of Growth

In an increasingly digital world, UBA Ghana continues to lead with innovation that simplifies banking for customers. Central to this drive is LEO, the Bank’s AI-powered virtual banker available on WhatsApp, Facebook, and other platforms. LEO has revolutionised customer engagement by enabling seamless transactions, account management, and inquiries in real time.

Between January and September 2025, UBA Ghana added over 38,800 new customers, driven by digital solutions and enhanced accessibility. Mr. Molokwu attributed this growth to the Bank’s continuous investment in technology and innovation.

“We are not just providing banking services; we are redefining how customers experience financial solutions. Through innovation, we are ensuring that every Ghanaian has access to convenient and reliable banking, whether in urban or rural communities.”

Mr. Uzoechina Molokwu

The Bank’s digital platforms, including the UBA Mobile App, Internet Banking, and PAPSS (Pan-African Payment and Settlement System), continue to enhance cross-border transactions and drive business expansion across Africa.

Empowering Families, Women, and Youth

UBA Ghana’s success also stems from its inclusive approach to financial services. Through tailor-made products such as NextGen, Kiddies, and Ruby Accounts, the Bank has strengthened its youth, family, and female banking propositions. These initiatives align with the Bank’s broader mission of promoting financial inclusion and supporting diverse customer segments.

The NextGen Account caters to young professionals and students, encouraging savings and responsible financial management. The Kiddies Account instills financial literacy among children, while the Ruby Account empowers women entrepreneurs and professionals by offering preferential rates and exclusive benefits.

These customer-focused innovations demonstrate UBA Ghana’s leadership in creating sustainable financial products that respond to real-life needs.

At the heart of UBA Ghana’s operations is its Customer First (C1st) philosophy — a commitment to placing customers at the core of every decision and service delivery process. This philosophy has shaped the Bank’s culture, ensuring responsiveness, transparency, and superior service delivery.

By embedding customer-centricity into its DNA, UBA Ghana continues to strengthen its market reputation as a trusted and dependable financial partner. The Bank’s consistent growth in deposits and earnings affirms that its clients value not just its products but also its approach to service excellence.

UBA Ghana’s outstanding Q3 2025 performance aligns with the broader strategic goals of its parent company, United Bank for Africa Plc, a leading pan-African financial institution with operations in 20 African countries and major global financial centres including London, Paris, and New York.

READ ALSO: A Brewing Debt Storm Threatens Ghana’s Recent Economic Gains