As Ghana’s national currency, the cedi, marks its 60th anniversary this month, the Bank of Ghana (BoG) is seizing the occasion to renew a powerful campaign against dollarization, a persistent challenge that has long undermined the country’s monetary stability.

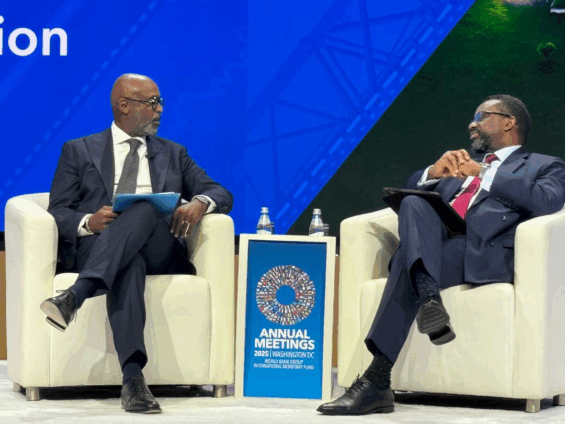

Governor of the Bank of Ghana, Dr. Johnson Asiama, made the declaration at the IMF/World Bank Governor Talk Series in Washington, D.C., where he reaffirmed the central bank’s commitment to ensuring the exclusive use of the cedi for domestic transactions.

He described dollarisation as one of Ghana’s most entrenched economic hurdles, one that continues to weaken the effectiveness of monetary policy.

“A couple of things bother me. First of all is the issue of dollarisation. I have seen this for many years. I started central banking 30 years ago. The phenomenon has been there. So, we are tackling it.”

Dr. Johnson Asiama

The Cedi at 60: A Symbol of Renewal and Sovereignty

The “Cedi at 60” celebration, scheduled for October 28, will not only mark six decades of Ghana’s national currency but also serve as a rallying call for economic independence. According to Dr. Asiama, the milestone presents an opportunity to redefine the cedi’s place in Ghana’s financial ecosystem and to inspire a cultural and institutional shift toward full currency sovereignty.

“What can we do to make the local currency the sole legal tender? So on the 28th of this month, we are having a celebration. We call it the Cedi at 60. The local currency will be 60 years this year, and we want that to mark a new beginning.”

Dr. Johnson Asiama

The Bank of Ghana plans to use the anniversary to highlight the cedi’s evolution — from its inception in 1965, through various redenominations and economic cycles, to its current role in a digitized financial environment. The event is expected to draw participation from financial institutions, policy makers, and businesses, all converging around one central theme: restoring pride in the cedi.

Ending Dollarisation

Dollarisation, the practice of pricing or conducting transactions in foreign currencies, especially the US dollar, has become a common feature in parts of Ghana’s economy. From real estate and automobile sales to tuition fees and rent payments, the tendency to demand or quote prices in dollars has persisted despite clear legal prohibitions.

Economists argue that the phenomenon reflects not only the strength of the dollar but also deep-seated perceptions of volatility in the cedi. Dr. Asiama, however, believes that ending this trend is both possible and necessary for economic resilience.

“When we use the local currency in all transactions, that enhances the efficiency of monetary policy. It is at the core of most of our problems. It is one of the things I would want to be remembered for—that I came, I solved that problem, and I made the local currency the currency of choice.”

Dr. Johnson Asiama

Dollarisation weakens the transmission of monetary policy, limiting the central bank’s ability to control inflation, stabilize prices, and manage liquidity effectively. When foreign currencies dominate local trade, the BoG’s policy rate adjustments have less impact on lending, borrowing, and consumer behavior.

The Governor’s renewed campaign, therefore, is not merely symbolic. It is aimed at ensuring that the BoG’s policy tools regain their full potency. The end goal is a stable, credible, and trusted cedi that serves as both a medium of exchange and a store of value.

Experts suggest that restoring confidence in the cedi will require more than enforcement; it will demand consistent policy discipline, macroeconomic stability, and public education. The BoG is expected to roll out new initiatives to deepen cedi use in digital transactions, expand financial inclusion, and strengthen regulatory oversight against illegal foreign currency dealings.

A Vision for Legacy and Stability

Dr. Asiama’s remarks in Washington revealed not only a technical agenda but also a personal mission. Having witnessed decades of fluctuating confidence in Ghana’s currency, he expressed a deep commitment to making the cedi a symbol of national strength and monetary independence.

“I have seen this for many years,” he reflected. “So, we are tackling it.” His vision is to ensure that future generations inherit a financial system where the cedi reigns supreme — both in the markets and in the minds of Ghanaians.

With renewed political will, regulatory measures, and public cooperation, the Bank of Ghana aims to make the cedi not only a legal tender by law but a currency of choice by confidence.

READ ALSO: Ghana Saves $300M from Renegotiated IPP Power Deals