The Vice Chancellor of Methodist University Ghana, Prof. William Baah-Boateng has cautioned the Bank of Ghana of the risk associated with the current sharp appreciation of the Cedi, pointing that it can hurt the totality of the economy.

He made this bold claims in an interview stressing that the sudden 20% jump of the Cedi (to the dollar) benefits a section of the public while the others lose. He further mentioned that both depreciation and appreciation of the Cedi is bad for the economy. The ideal situation is to maintain a stable Cedi.

“Stability is the best. Appreciating and depreciating are not the best. I’m concerned about the recent one. We were at GH¢12 and straight away we’re moving into the GH¢10. When you calculate the percentage, it will go around 20%, and it will hurt some aspect of the economy and benefit some aspect of the economy. But when you put them in totality, you will see that the economy will not benefit.”

Prof. William Baah-Boateng

Economic Loss of Sharp Cedi Appreciation

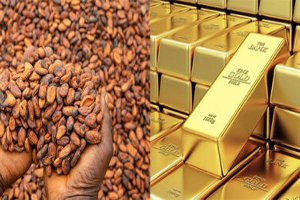

This comes on the back of basic economic understanding that export benefit outweighs import benefit. The Prof. mentioned that, though an appreciation could be a good thing, exporters will be at the losing end while importers benefit. Chunk of the revenue of the government is derived from the export of the country’s main produce, cocoa and gold.

Instead of farmers and all those involved in the value chain of export of these commodities benefiting, they don’t. This in turn, affects government revenue and subsequently its expenditure.

“Now that it [cedi] has moved from GHS12 to GHS10, expect that government revenue will take a hit. It will reduce the margin of export of cocoa. The appreciation will erode almost everything, and farmers will not benefit as they would,”

Prof. William Baah-Boateng

This significant impact on the economy made Prof. Baah-Boateng call on the Bank of Ghana to live up to its mandate by ensuring the stability of the Cedi.

The fluctuation seen recently is not healthy for the economy, he said. The Cedi recently depreciated, and then appreciated again by about a -20% and 20% respectively.

“I’m expecting that the Central Bank will not allow the cedi to go up and come down. When we got around GHS10.5, we shouldn’t have allowed it to depreciate to GHS12.5 and now come back to GHS10.5; that kind of difference is too big,”

Prof. William Baah-Boateng

The Bank of Ghana interventions

The pace of the appreciation and depreciation of the Cedi in short periods leaves some economists worried about the excessive interference of the Central Bank in the market.

According to Prof. Godfred Bokpin, there is the tendency of an increase in speculative activities as it appears the cedi’s appreciation is not backed by any structural or economic transformation.

Also, the Central bank appears to be too visible in the market, Prof. Bokpin alluded, adding that this could cause distortions.

“The Cedi jumped the gun in terms of the appreciation, within just 3 months. When it happens that way and you cannot situate that within broader structural and economic transformation, in the real sector of the economy, that is how speculative activities scales up significantly.

“We also saw that Bank of Ghana stepped in [the market] strongly. At some point you could visibly see the footprints of the Central bank in the market and that causes distortion.”

Godfred Bokpin, Professor of Finance and Economics

The Governor of the Bank of Ghana, during the IMF’s Governor Talk Series on the sideline of the IMF/World Bank Annual Meetings refuted the claims that the Central Bank is intervening in the market.

“Essentially, what we do is to smooth excessive volatilities, and that is what our framework has been about. There were allegations that we were intervening in the markets, but that was not exactly the case.”

Dr. Johnson Asiama, Governor of the Bank of Ghana

The Governor assured that the Bank’s actions are to support the market and that they are not doing it excessively. The Bank is there to monitor and deal with instabilities for the smooth running of the market.

“We do not over-support the markets at all. All we seek to do is to limit volatilities to ensure smooth market dynamics. That’s the framework we’ll maintain going forward.”

Dr. Johnson Asiama, Governor of the Bank of Ghana

READ ALSO: Ghana Medical Trust Fund Kickstarts Phase Two of Hospital Needs Assessment Tour